For quick-service restaurants (QSRs), the battle for consumer attention has never been more competitive or more price-driven. The past two years have ushered in a new normal in fast food, where value messaging dominates the media narrative and continues to shape brand strategy as we progress into 2025.

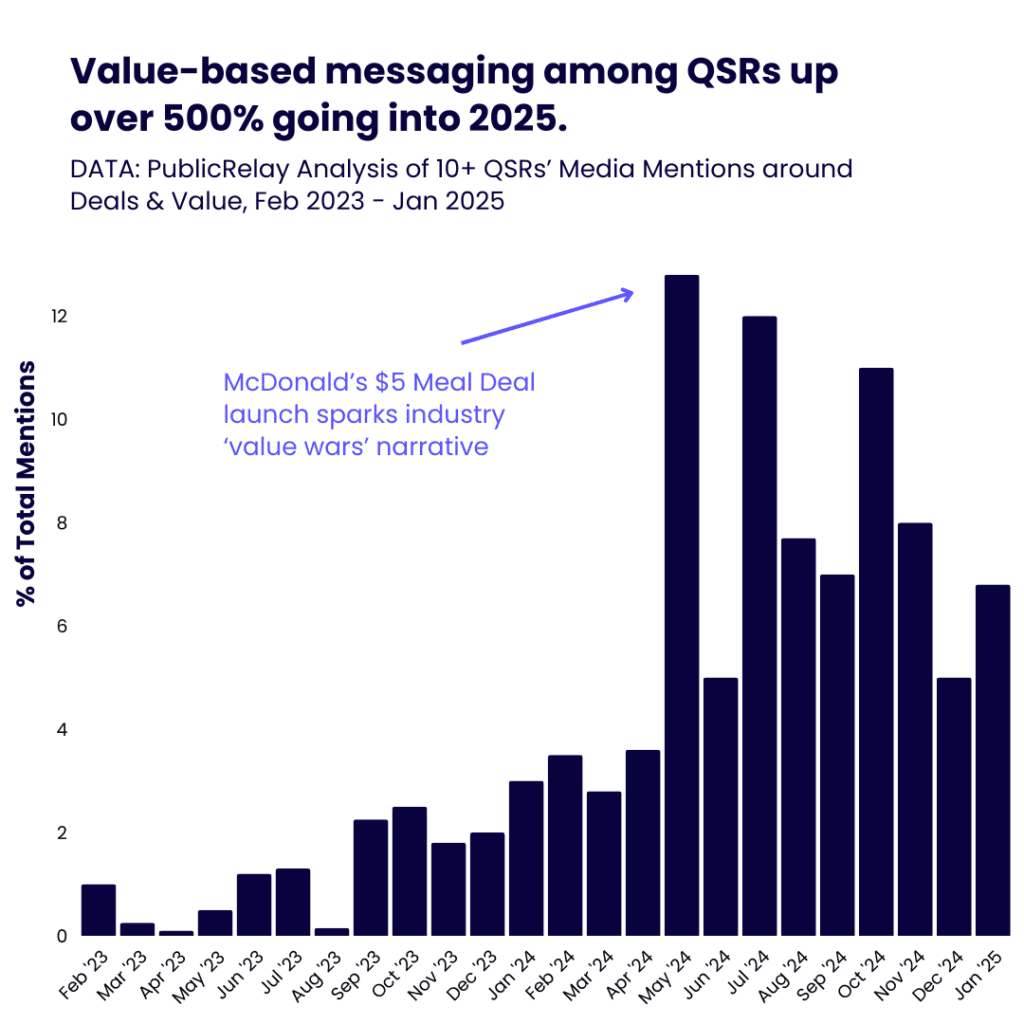

PublicRelay’s analysis of media coverage from 10+ QSRs shows a 500%+ increase in QSR messaging focused on value since early 2023. The trend isn’t just a response to inflation; it’s a fundamental shift in how brands communicate their offerings, defend their market share, and shape consumer expectations.

The Data Behind the Value War

QSRs are locked in an escalating cycle of promotional battles, as seen in recent media trends:

- May 2024 Surge: McDonald’s $5 Meal Deal launch ignited a sustained three-month media spike, forcing competitors like Burger King and Wendy’s to introduce rival promotions.

- Seasonal Fluctuations: Holiday campaigns momentarily pushed deal messaging aside in late 2023, while seasonal events (e.g., Lent specials) caused a brief dip in March 2024.

With each major promotion, competitive ripple effects extend media coverage beyond the initial campaign, proving that in today’s QSR landscape, value is a conversation that brands must continually engage in.

Why Value-Driven QSR Messaging is Non-Negotiable

Beyond media hype, economic pressures are making affordability a top priority for both consumers and brands:

- Inflation & Price Sensitivity: Fast food prices have surged 60% since 2014, far outpacing general inflation. Customers are more price-conscious than ever.

- Margin Squeeze: Labor costs have risen 22% since 2019, making cost-effective promotions essential to maintaining profitability.

- The Grocery Threat: Supermarkets now hold a 310-basis-point price advantage over QSRs, meaning fast food must prove its value beyond just price points.

In this environment, QSR messaging that reinforces value-driven storytelling is essential—not just for sales, but for sustaining brand relevance.

What This Means for Communications Leaders

For PR and communications teams, value messaging is a strategic necessity. Here’s what QSR communicators need to keep in mind:

- Short-Term Wins vs. Long-Term Strategy: Promotions create temporary media spikes, but brands must balance them with broader positioning that reinforces long-term brand equity.

- Echo Effects Drive Media Longevity: Competitive responses extend deal-driven media cycles. Smart brands capitalize on this momentum by keeping value narratives fresh.

- Digital Loyalty Is the New Value Play: App-exclusive deals are becoming a critical tool for reinforcing value perception while strengthening customer retention.

The Future of QSR Messaging

Expect value-driven narratives to peak in summer months and taper off during holiday seasons as brands shift focus to festive campaigns. Ensure value messaging remains compelling and sustainable beyond short-term promotions. For communicators, this is a test of agility. How will brands balance short-term promotional buzz with a long-term value platform that keeps customers engaged?

Connect with us to learn how PublicRelay can help your brand adapt to this value-first landscape.

Author: Medha Chandorkar, VP of Product Management

A company’s reputation is influenced by a diverse set of stakeholders, including employees, investors, customers, regulators, business partners, and policymakers. How does media coverage impact each of these groups? Join us for an exclusive 20-min webinar where we’ll unveil key findings from PublicRelay’s latest research on stakeholder sentiment.

Using data-driven insights from our Benchmark, we’ll explore:

- How different stakeholder groups perceive companies in the media and how their sentiment varies.

- Which stakeholders are most sensitive to media narratives and why their reactions are the most volatile.

- Why customers often remain undecided and what this means for corporate messaging.

- How sentiment shifts over time and what it reveals about reputation management strategies.

This report walkthrough will provide PR and communications leaders with actionable insights to navigate stakeholder sentiment effectively. Take this opportunity to sharpen your media strategy and better understand the audiences shaping your corporate reputation.

Host: Haley Wilson, Strategic Partnerships Lead at PublicRelay

Watch On-Demand Here

Watch On-Demand

This 25-minute webinar discussed the complex intersection of geopolitics and corporate reputation.

Using data-driven insights from PublicRelay’s benchmark, we explored when and how companies should engage in geopolitical discourse, balancing risk, reputation, and stakeholder expectations.

Watch on-demand to:

- Learn data-backed strategies for managing corporate reputation in a volatile geopolitical landscape.

- Hear insights on balancing stakeholder pressures while minimizing reputational risk.

- Gain a framework to assess whether your company should engage on a given issue.

What is Share of Voice?

Share of Voice (SOV) measures how much attention your brand receives compared to your competitors across various platforms, including social media, traditional news outlets, and other media channels. It’s a metric that PR professionals and communicators often rely on to gauge brand visibility and assess how well they are performing in the marketplace. By counting your brand’s total mentions relative to your industry, you can see what percentage of the total mentions are about your company.

At face value, SOV is a straightforward concept. It provides a snapshot of your brand’s ability to capture public and media attention, making it a valuable starting point for understanding your market presence. Communicators value this because they can see a volume related metric on how they are doing versus competitors. However, relying solely on Share of Voice can be misleading, because at its core it is simply a counting exercise.

The Limits of Share of Voice

While SOV is a useful metric, treating it as a definitive measure of success is a common pitfall. Here are some key reasons why Share of Voice, may not tell the whole story:

- Sentiment Matters: Imagine your brand commands 50% of the SOV pie. On the surface, this sounds like a win. But what if the majority of your mentions are negative? For example, if your brand is being criticized in news articles or on social media, having a high Share of Voice might highlight a reputational issue rather than a success story. Without analyzing the sentiment behind your media mentions, SOV becomes a blunt instrument, incapable of providing actionable insights.

- Context is Critical: Not all media mentions are created equal. Coverage in a respected industry journal might carry more weight than a flood of social media chatter. SOV, in isolation, doesn’t account for the context or quality of these mentions.

Turning SOV into a Strategic Tool

To extract real value from Share of Voice metrics, it’s crucial to pair them with deeper analysis. Here are some best practices for using SOV effectively:

- Prioritize Engagement Metrics: Evaluate how your mentions translate into engagement, such as social media interactions, website visits, or conversions. Pairing SOV with these metrics paints a more complete picture of your success.

- Focus on Key Message and Reputational Driver SOV: Track whether your brand’s core messages are resonating in your coverage. Are your mentions aligned with the narratives you want to promote or the reputational categories that are most important to your brand? If not, a high SOV may indicate that your message or reputational impact is being lost or misconstrued.

- Incorporate Sentiment Analysis: Measure the tone of your mentions to determine whether your Share of Voice skews positive, neutral, or negative. Sentiment analysis provides a richer understanding of how your brand is perceived and can help you address reputational challenges proactively.

Conclusion

Share of Voice is an important tool in the PR and communications arsenal, but using it simply as an article counting comparison to competitors doesn’t do anyone much good. Without deeper analysis of areas such as sentiment and context, SOV can lead you astray, masking underlying issues or providing an incomplete view of your brand’s market position. By combining SOV with more nuanced metrics and insights, communicators can turn a blunt instrument into a precision tool, driving meaningful outcomes for their brands.

Understanding Share of Voice’s limitations doesn’t diminish its value but underscores the importance of using it strategically. With the right approach, SOV becomes more than a number. It becomes a pathway to smarter, more impactful communications strategies.

Author: Darren Sleeger, SVP of Enterprise Analytics

Climate Commitment Reversals & Energy Reputation Management

It’s never been more challenging to navigate the reputational landscape of climate commitments. PR and communications leaders in the energy industry, in particular, are managing intense public and media scrutiny. Every decision about emissions targets or clean energy initiatives can have lasting implications in energy reputation management.

Recent analysis highlights the stark contrast in media sentiment between energy companies that double down on their climate promises and those that walk them back. The data reveals valuable lessons for managing reputational risks in such a high-stakes environment.

Media Fallout According to the Data

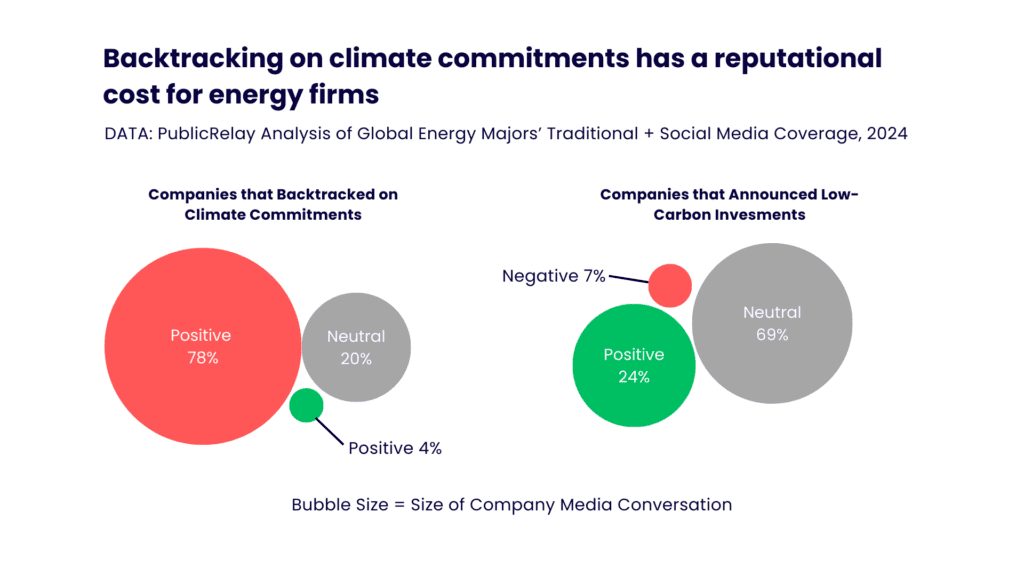

PublicRelay analyzed media coverage surrounding energy companies’ low-carbon initiatives, and the results were eye-opening:

- 78% negative media sentiment for companies that reversed their climate commitments.

- 24% positive media sentiment for companies launching new low-carbon initiatives, with only 7% negative coverage.

The disparity is clear: rolling back on climate commitments is a critical failure in energy reputation management. Companies that failed to deliver on their pledges faced significant backlash, especially on social media, where climate advocates and engaged communities amplified criticism.

In contrast, companies that took proactive steps (regardless of whether they had previous commitments) garnered more favorable media sentiment. Even when their clean energy initiatives were coupled with continued oil and gas investments, these companies benefitted from the perception that they were taking meaningful action.

The Risk of Overpromising

Backtracking on climate commitments may be worse than making no commitments at all.

Energy companies with bold climate goals but inconsistent follow-through became easy targets for criticism. The gap between promises and actions undermines trust and disrupts effective energy reputation management, leading to questions about a company’s reliability and sincerity.

Conversely, firms without ambitious commitments but actively investing in low-carbon projects avoided this backlash. Their measured approach—taking meaningful actions without overpromising—helped them stay under the radar of critics and maintain trust.

Key Implications for PR Leaders:

- Consistency is Non-Negotiable: Reversing commitments erodes credibility.

- Proactive Communication Matters: Highlight progress on sustainability initiatives, no matter how small, to build positive momentum.

- Crisis Mitigation Requires Speed: Companies that quickly address climate-related criticisms can minimize reputational damage.

Learn how PublicRelay’s data-driven insights can help communicators in the energy sector in navigate these challenges and more.

Navigating the shifting media landscape has become a critical skill for professionals in public relations and strategic communications. As the media world undergoes rapid changes, understanding and adapting to these dynamics is essential.

The media world is in flux. Traditional outlets, social platforms, and emerging formats are reshaping the communications field daily. For communicators, it’s not just a shift—it’s a seismic transformation. Yet these challenges present clear opportunities for those who can adapt. Let’s explore what we’ve heard from leading communicators about what’s happening and why it matters.

Traditional Media: Evolution, Not Extinction

Traditional media’s business model is under immense pressure. Trust in major outlets has waned, newsroom budgets have shrunk, and audiences have migrated to mobile-first and social platforms for news. There is no longer a Walter Cronkite-like, “single source of media”. “Media” is everywhere, which means organization reputation is everywhere.

Communicators are now approaching traditional media as one part of a broader strategy. By balancing relationships with reporters and editors alongside content crafted for digital and social channels, organizations can navigate this fragmented landscape with greater precision.

Think Smaller, Connect Bigger

As large national outlets feel increasingly out of reach or out of touch, the focus on local media has intensified. Community-focused stories resonate deeply, creating more meaningful engagement. Whether it’s hyper-local storytelling or partnerships with regional outlets, tapping into smaller markets can yield outsized reputational benefits.

Local audiences are also more engaged—they’re reading, sharing, and reacting. Organizations that invest in grassroots storytelling often see stronger community ties and enhanced reputations in critical regions.

Ground-Up Communications

Ground-up strategies play an essential role in navigating the shifting media landscape, especially when authenticity and trust are paramount. Building on the power of local connections, the shift away from purely top-down, national PR strategies is redefining how trust is cultivated. Today, success depends on developing relationships from the ground up. Local community engagement, grassroots storytelling, and on-the-ground teams are now central to rebuilding or enhancing support in key regions.

This shift isn’t just a tactical move; it’s strategic. In a polarized and fragmented media environment, audiences crave authenticity. Investments in local communications teams are paying dividends, both in trust and long-term support.

Adapt or Fade: The Fragmentation Dilemma

The increasingly fragmented media landscape requires laser-sharp focus. Messages must be tailored for each platform and each audience. It’s no longer sufficient to “go broad”; you need to go deep where it matters most.

Geo-targeted campaigns, local influencer partnerships, and platform-specific strategies have emerged as critical components of effective communications. The challenge for communicators is to prioritize—strategic adaptation, not one-size-fits-all approaches, will win the day.

Data-Driven Decisions

Data is the compass for navigating the shifting media landscape. It transforms complexity into clarity and guides effective decision-making.

While the fragmentation of media complicates communication efforts, data offers a clear way forward. Social media platforms provide communicators with an abundance of digestible metrics. Impressions, shares, and engagement rates offer a quick glimpse into performance. Yet, these metrics only tell part of the story.

Quantifying traditional media’s ROI often requires more nuanced tools to help communicators track impact across earned and owned channels, while also surfacing actionable insights that drive strategy forward.

Preparing for Media’s New World Order

Declining traditional business models and shifting consumption habits are opportunities to innovate. Diversifying your media mix, amplifying through emerging formats, and measuring everything are no longer optional. They’re mandatory.

The evolving media landscape is daunting, but it’s also rich with potential for those ready to embrace the changes. By prioritizing hyper-local storytelling, harnessing data, and adapting communication strategies to a fragmented audience, communicators can navigate this new era with agility, creativity, and a relentless focus on what’s measurable and meaningful.

Contact us to learn more.

5 Ways to Maximize Your CEO’s Brand Impact

A CEO can influence how the media, stakeholders, and consumers perceive not only their leadership but also the brand they represent. However, recent trends show that while CEOs may be building strong personal brands, they aren’t always translating that success into a positive impact for their companies.

Understanding how to maximize your CEO’s brand impact is key to elevating both their personal standing and the reputation of the organization they lead. Let’s explore how communicators can help their CEO become an asset to their brand.

The CEO Brand Gap: Perception vs. Impact

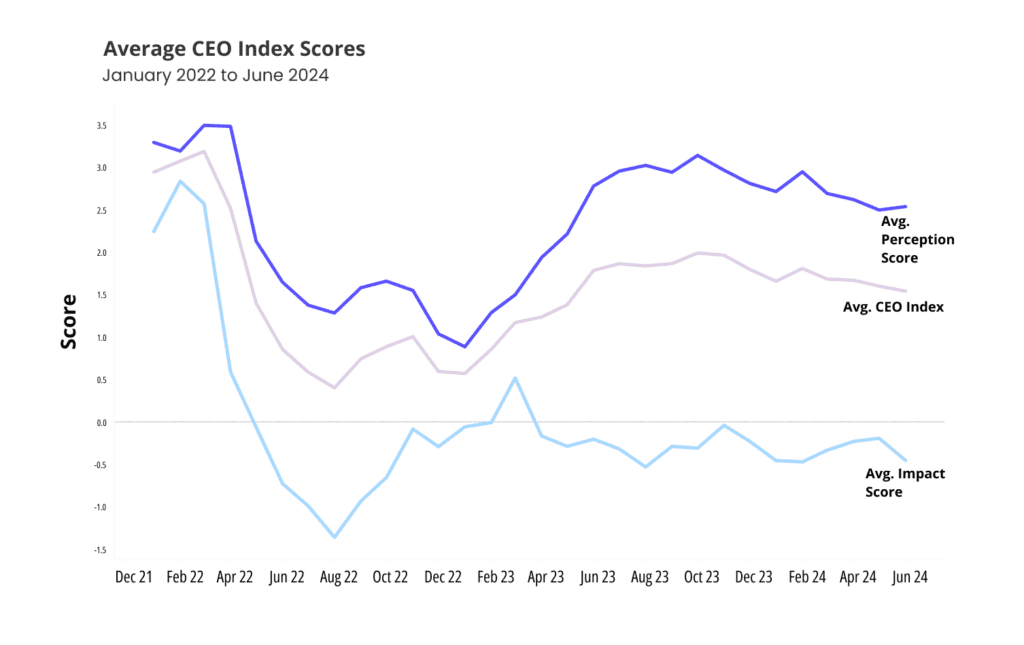

PublicRelay tracks CEO performance through our CEO Index, which rates CEOs from -10 to +10 on two essential factors:

- Perception: How well the CEO is perceived by the media. This includes the sentiment, reach, and sharing of their personal media mentions.

- Impact: How the CEO’s presence influences their company’s media reputation. This measures the sentiment, reach, and sharing of mentions where both the CEO and company are featured.

What we’ve noticed over the past two years is an interesting trend: while Perception Scores have generally increased, Impact Scores have stagnated. This means that while CEOs may be perceived more positively as individuals, they are becoming less effective at enhancing their company’s reputation.

For communications professionals, this gap is an opportunity to recalibrate. If your CEO’s personal brand is thriving, but your company isn’t seeing a parallel boost in reputation, it’s time to rethink your communication strategy.

Best Practices to Boost Brand Impact

Here are several actionable strategies to align your CEO’s personal perception with their company’s reputation, ensuring their brand impact is as strong as it should be:

1. Prioritize Company Over Self-Promotion

While building a CEO’s personal brand is important, it should never overshadow the company’s goals. Self-Promoter CEOs, those who focus too heavily on their own narratives, risk becoming disconnected from their organization. Instead, CEOs should weave company successes, values, and innovations into their personal communications. Whether it’s through interviews, social media posts, or speaking engagements, their personal brand should amplify the company’s brand story.

For example, CEOs who leverage media opportunities to highlight company initiatives and industry leadership—not just personal milestones—tend to have higher Impact Scores.

2. Align Thought Leadership with Brand Strategy

A CEO’s thought leadership can be a powerful tool to enhance the company’s reputation. However, it must be strategic. CEOs who speak on broader industry trends, corporate responsibility, or emerging technologies often boost both their Perception and Impact Scores. This is because they position themselves as experts not just on their own company but on the wider business landscape.

Encourage your CEO to engage in thought leadership that aligns with your company’s mission and values. Thoughtful commentary on relevant industry issues can help solidify both their authority and the company’s reputation, driving positive media coverage.

3. Stay Clear of Controversial Coverage

Negative media coverage can be difficult to avoid, but strategic communications can help shield your CEO from scandals that can harm both their personal and company brand. One way to manage this is by doing your best to ensure your CEO doesn’t become a scapegoat. Distance them from high-risk issues and focus on positive storytelling.

Incorporating crisis communication strategies into your CEO’s media interactions can protect their Perception while mitigating damage to your company’s Impact. For example, if a major controversy arises, quick, transparent communication that addresses the issue and highlights the company’s corrective measures can help salvage brand reputation.

4. Leverage Key Media Opportunities

Earnings calls, industry conferences, and interviews are prime opportunities for CEOs to bolster their brand impact. By participating in these high-visibility moments, CEOs can directly influence how their company is perceived. In fact, CEOs who personally engage in earnings discussions often drive positive media sentiment for their companies, as it shows hands-on leadership and transparency. See Google’s Sundar Pichai, for example, who drove positive coverage on the company’s growth after their earnings call in July.

Maximizing media moments means ensuring your CEO’s presence in coverage is both visible and favorable. Position your CEO in the right narratives—those that focus on growth, innovation, and strategic vision.

5. Be Mindful of Social Media Perception

Social media can be a double-edged sword for CEOs. While it offers a direct line to the public, it also opens the door to immediate scrutiny. CEOs with large social media followings may generate significant positive engagement, but they are equally vulnerable to backlash, especially if their posts are seen as self-serving or out of touch with current events. A quick look at Elon Musk can give a deep understanding of how that can go.

Communicators should do what they can to help their CEO craft a social media presence that reinforces the brand’s values. Their messaging should resonate with your company’s mission and connect with stakeholders in meaningful ways, avoiding the pitfalls of excessive self-promotion.

Maximizing Your CEO’s Brand Impact

Ultimately, the most successful CEOs are those who understand that their brand is an extension of their company’s identity. By balancing personal perception with corporate impact, they can drive meaningful change for their organization, not just for themselves.

For PR and Communications executives, the challenge is to guide your CEO’s messaging and media presence in a way that reflects positively on both their leadership and the business.

To effectively do so, you need comprehensive insights into how both the CEO and the company are perceived in the media. PublicRelay offers precise, human-verified insights into sentiment, reach, and sharing, ensuring you have a clear picture of how your CEO’s media presence is influencing your company’s reputation. We also track and measure the impact of your CEO’s mentions, allowing you to tailor communication strategies that elevate both personal and corporate brands.

Contact us to learn more about how PublicRelay can help you maximize your CEO’s brand impact and strengthen your company’s reputation.

The 9 CEO Archetypes that Shape (or Sink) Company Reputation

A CEO is not just the leader of a company—they’re its public face. Whether they’re boosting brand visibility or creating PR nightmares, CEOs hold significant power over how the world views their companies. Through recent analysis of our CEO Index, we’ve identified 9 distinct CEO archetypes that either enhance or erode a company’s brand reputation. Understanding which archetype your CEO aligns with can provide valuable insight into how to manage their influence on the corporate brand.

Included at the end of this blog is a quiz for communications leaders to identify which archetype their CEO falls into, helping you refine your strategy accordingly.

CEO Perception vs. Impact

First, it’s important to understand Perception versus Impact. PublicRelay tracks CEO performance through our CEO Index, which scores CEOs (from -10 to +10) on two essential factors:

- Perception: How well the CEO is perceived by the media. This includes the sentiment, reach, and sharing of their personal media mentions.

- Impact: How the CEO’s presence influences their company’s media reputation. This measures the sentiment, reach, and sharing of mentions where both the CEO and company are featured.

A CEO can have a negative Perception Score, while having a positive Impact Score, vice versa, or somewhere in between. The 9 archetypes are each defined by the types of Perception and Impact scores they have.

The 9 CEO Archetypes

1. The Self-Promoter

- Features: Known for their strong personal brand, these CEOs often overshadow the company they lead. They blend business, entertainment, and lifestyle media, but the focus remains on them.

- Effects: While their media presence generates short-term buzz, it doesn’t translate to long-term benefits for the company. Employees may feel undervalued, as recognition is tied to the CEO rather than team achievements. Over time, the focus on self-promotion can erode trust in the company’s leadership and values.

2. The Influencer

- Features: Engaging and charismatic, the Influencer CEO is widely recognized as an expert in their field. They are frequently sought out for industry insights, but the media often emphasizes their personal achievements rather than the company’s.

- Effects: While their star power attracts media attention, it often overshadows the company’s brand. This can lead to missed opportunities where the CEO’s media presence could otherwise elevate the entire organization.

3. The Brand Ambassador

- Features: The Brand Ambassador is passionate about the company’s mission and values. They provide transparent insights into company operations and strategy, building trust and credibility.

- Effects: This archetype is highly effective as a PR asset. Their personal reputation enhances the company’s image, attracting customers, investors, and top talent. Employees take pride in their recognition, as it often includes acknowledgment of the team’s contributions.

4. The Scapegoat

- Features: The Scapegoat is often associated with controversy, stepping up to take responsibility when things go wrong. They aim to protect the company and its brand by absorbing the blame.

- Effects: While this CEO’s willingness to accept responsibility can sometimes shield the company from reputational damage, frequent association with controversy raises questions about their overall competence. Over time, this leads to skepticism and damages both the CEO’s and the company’s reputation.

5. The Steady Operator

- Features: The Steady Operator provides consistent, reliable leadership but lacks the flair to capture significant media attention. They focus on delivering factual, straightforward information.

- Effects: Stability and reliability are the hallmarks of this archetype. However, the company may miss opportunities for a dynamic reputation boost due to the CEO’s understated presence. The public sees the company as stable, but without much excitement or innovation.

6. The Reluctant Hero

- Features: Known for making rare, but highly strategic media appearances, the Reluctant Hero focuses attention on the company’s innovations and the team’s contributions.

- Effects: This CEO’s authentic and humble approach builds credibility and trust. The public and media perceive the company as genuine and mission-driven, increasing support. Employees also feel recognized and valued through the CEO’s emphasis on team successes.

7. The Villain

- Features: The Villain CEO is often criticized for poor decision-making and leading the company into controversy.

- Effects: Repairing reputational damage is an uphill battle for this CEO. Their negative perception spills over into the company, making it appear poorly managed and untrustworthy. This typically leads to financial losses and a struggle to regain legitimacy.

8. The Latent Liability

- Features: This CEO may be largely invisible until controversies surrounding their personal behavior or past scandals surface. They appear disconnected from the company’s core mission and values.

- Effects: Although the company may not immediately suffer from this CEO’s negative reputation, their continued presence can gradually erode trust, leading to long-term damage. Communications teams find it challenging to use this archetype as a PR asset, as their media presence poses more risks than benefits.

9. The Provocateur

- Features: The Provocateur is known for bold decisions and outspoken views that generate controversy. However, their vision often drives innovation and change.

- Effects: Despite the initial skepticism, this CEO’s resilience in the face of controversy can eventually shift public perception in their favor. Their ability to generate buzz and attention often puts the company in the spotlight, helping the brand stand out as innovative and forward-thinking over time.

Real-World Examples

Jamie Dimon (JPMorgan): Starting as a Scapegoat in media coverage of JPMorgan’s controversial return-to-office policy and a tough business environment, Dimon transitioned into an Influencer archetype as he distanced himself from scandals and focused on thought leadership. This pivot meant he stayed out of highly shared negative coverage around compliance controversies and more, but his personal brand may now eclipse the bank’s. If he were to leave the organization, his influence would leave with him.

Ryan Lance (ConocoPhillips): Lance is a Reluctant Hero, having managed to avoid being drawn into coverage on environmental and climate change issues companies, all the while strategically appearing in the spotlight to highlight business wins, positioning the company positively without taking much in the way of personal credit.

How CEO Archetypes Shape Brand Strategy

Each of these archetypes presents unique challenges and opportunities for communications leaders. The key to maximizing brand impact is understanding which archetype your CEO aligns with and adjusting your communications strategy accordingly.

Self-Promoters may require media strategies that balance their personal brand with the company’s message.

Brand Ambassadors can be powerful spokespersons for company values, but Villains and Latent Liabilities may require crisis management plans to mitigate their negative perception.

By identifying your CEO’s archetype, you can tailor media strategies to enhance their strengths while mitigating risks.

Understanding CEO archetypes is essential for communications professionals tasked with managing brand reputation. With the right approach, and the right media measurement support, you can leverage your CEO’s strengths to align their personal brand with the company’s goals and protect your organization from reputational risks.

Take the Quiz: Which Type of CEO Are You Working With?

Curious about where your CEO falls in the archetype spectrum? Take this brief quiz to discover their CEO style so you can tailor your communications strategy for maximum brand impact.

1. How does your CEO typically engage with the media?

A) They are the face of the company and often appear in interviews, even in non-business contexts.

B) They are sought after for their expertise and frequently share insights on industry trends.

C) They tend to be in the spotlight mainly during crises or controversies.

D) They provide calm, factual statements and avoid the limelight whenever possible.

2. How do your CEO’s media engagements affect the company’s brand?

A) The CEO’s strong personal brand often overshadows the company’s brand.

B) The company’s brand can sometimes feel secondary compared to the CEO’s personal recognition.

C) The CEO regularly shields the company brand by taking accountability during controversies.

D) The CEO generates little excitement or buzz, but the company is seen as reliable.

3. How do employees perceive your CEO’s media presence?

A) Employees often feel overlooked, as the CEO rarely mentions the efforts of the team in public.

B) They are proud that the CEO is well-respected in the media, but there’s a sense that the CEO avoids getting involved when the company faces controversies.

C) Employees appreciate that the CEO takes public accountability when things go wrong.

D) Employees see the CEO as competent and reliable, though not particularly inspiring.

4. How does your CEO handle controversies or negative publicity?

A) They tend to deflect media focus away from company scandals by drawing attention to themselves instead.

B) They continue to provide industry commentary and thought leadership in the media, but avoid publicly addressing controversies.

C) They step forward, take responsibility, and try to shield the company from further damage.

D) They address the issues calmly and factually, avoiding any dramatic statements or actions.

Results:

If you answered mostly A’s: Your CEO is The Self-Promoter.

Your CEO has a strong personal brand that often overshadows the company. They bridge the gap between business, entertainment, and lifestyle media, but this doesn’t always translate into benefits for the company.

If you answered mostly B’s: Your CEO is The Influencer.

Your CEO is charismatic and widely recognized for their expertise. While they attract a lot of attention, their strong personal brand can sometimes make the company’s brand seem secondary.

If you answered mostly C’s: Your CEO is The Scapegoat.

Your CEO often takes the blame during controversies, acting as a shield for the company. While this can mitigate reputational damage, it can also lead to skepticism about the CEO’s overall competence.

If you answered mostly D’s: Your CEO is The Steady Operator.

Your CEO delivers consistent and reliable leadership without seeking the spotlight. The company is perceived as stable, but there may be missed opportunities to enhance the company’s reputation.

Defense Sector Reputation Risks

The pandemic had substantial negative effects on the global supply chain. With the world still doing its best to adjust to post-pandemic realities, the media remains sensitive to supply chain disruptions. Despite data suggesting that supply chain pressures have eased, news stories continue to frame supply chains as fragile, leaving industries like defense vulnerable to intense media scrutiny.

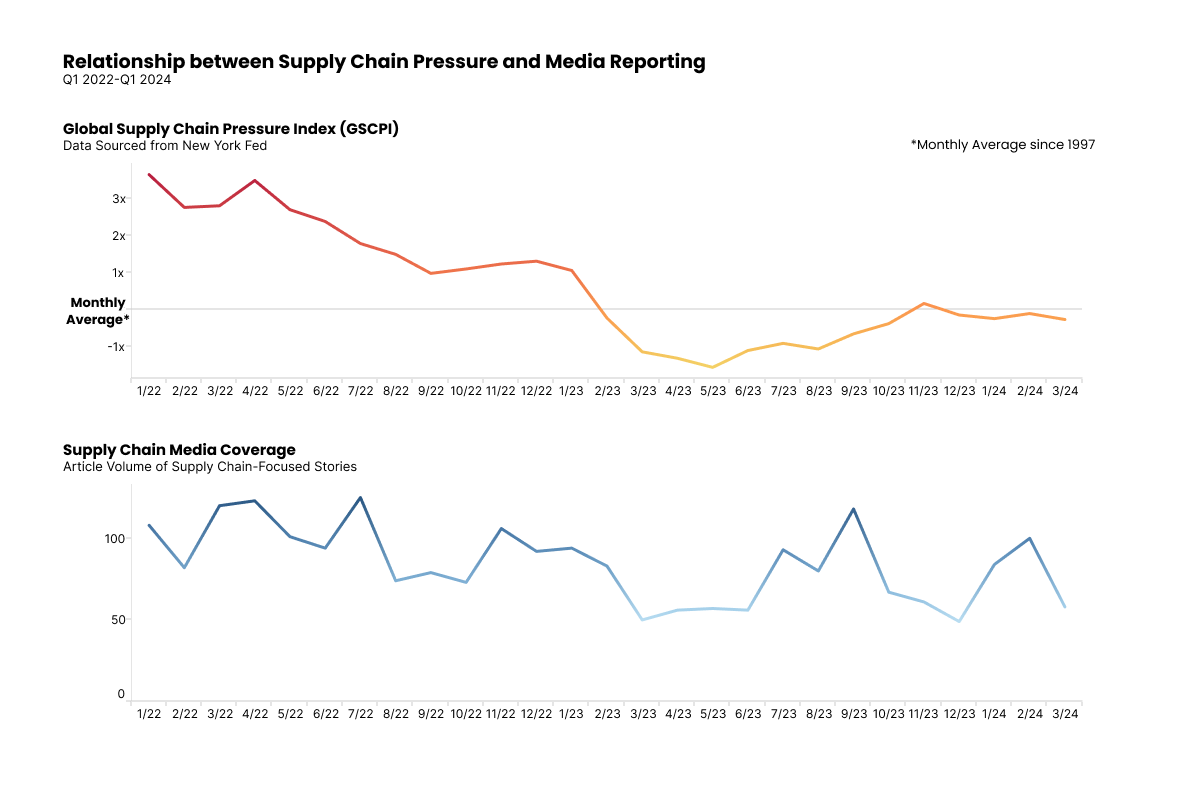

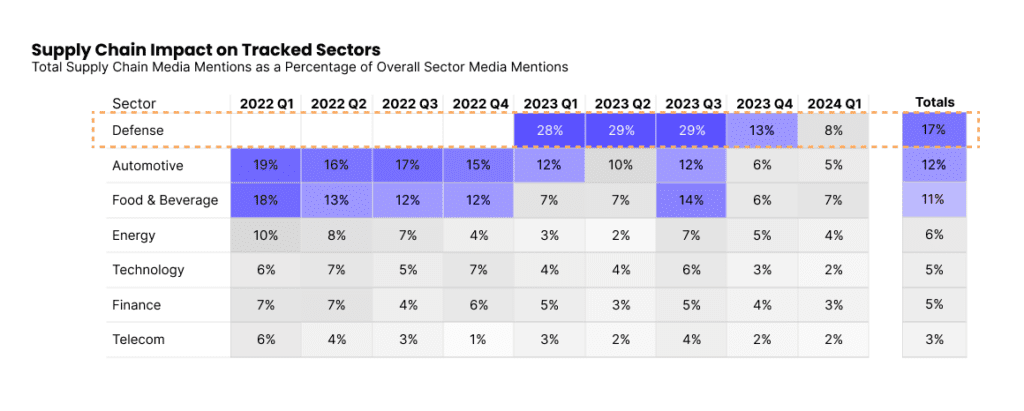

According to the Global Supply Chain Pressure Index (GSCPI), supply chain pressures have generally trended below the historical average for over a year. Yet media coverage on supply chain disruptions surged by over 100% in Q3 of 2023, reaching pandemic-era levels. This rise in coverage, despite relatively stable conditions, reveals how deep-rooted fears of supply chain instability persist, largely fueled by memories of pandemic-related disruptions.

For the defense sector, these shocks carry an even greater reputational risk. Defense is uniquely challenged by the geopolitical landscape, where global conflicts create unpredictable spikes in demand.

Global Conflicts and Outsized Demand

Throughout 2023, the defense industry faced heightened scrutiny, as supply chain issues featured prominently in nearly one-third of all defense-related media coverage. The nature of defense manufacturing—complex, highly regulated, and dependent on specialized suppliers—exposes the industry to gaps in its supply chain more visibly than in other sectors. Unlike consumer goods, where shortages might result in delayed shipments or backorders, a lapse in the defense supply chain can have far-reaching consequences that could lead to national security risks or international diplomatic repercussions.

With ongoing global conflicts driving outsized demand for items like military aircraft, technology, and more, the defense industry finds itself facing immense pressure to deliver quickly and efficiently. This demand exacerbates any existing vulnerabilities in the supply chain, from sourcing raw materials to securing manufacturing components. Any perceived or actual delays in fulfilling contracts can lead to negative media coverage. This further compounds the pressure on defense firms.

The Media’s Role in Amplifying Concerns

Even though supply chain pressures have been trending below the historical average, the media remains hyper-aware of any disruptions. Coverage tends to spike in response to real or perceived supply shocks, and the defense sector is no exception. For example, when a Boeing 737 Max panel blew out mid-flight, it triggered accusations of unrealistic production standards.

Journalists and analysts, still influenced by the pandemic, are quick to draw parallels between today’s challenges and the more severe disruptions of recent years. In fact, one-third of supply chain stories published since June 2023 (from CNN to Bloomberg to NPR) referenced the pandemic, demonstrating how much the media narrative is still shaped by past crises.

For defense communicators, this presents a significant challenge. Even when supply chain disruptions are minimal, heightened media sensitivity means that any hiccup can quickly become a headline.

The Impact on Defense Sector Reputation

Supply chain shocks are not just operational challenges for defense firms—they are reputational threats. The ability to quickly and reliably deliver products is critical to a company’s standing with stakeholders, including government clients, partners, and the general public. Delays in production or missed deadlines can lead to questions about the company’s efficiency and reliability.

The stakes are high. A damaged reputation in the defense sector can have long-term consequences, from losing critical government contracts to eroding public trust. Defense companies need to communicate effectively during times of supply chain stress, reassuring stakeholders that they are capable of managing disruptions while fulfilling their obligations.

Preparing for the Next Disruption

For PR and communications leaders in the defense sector, the key takeaway is clear: be prepared to respond quickly and strategically to any coverage of supply chain shocks. While current supply chain pressures may be near historical averages, media narratives are often shaped by past disruptions, making it crucial to anticipate how global conflicts or sudden demand spikes could reignite concerns.

PR teams must continuously monitor the media landscape, tracking coverage of supply chain issues and being ready to provide stakeholders with reassurances about the company’s operational capabilities. By staying ahead of the narrative, communicators can protect their brand from undue criticism and ensure that their organization maintains a strong reputation even in times of crisis.

Communicating the ability to meet demands, even in the face of unpredictable global pressures, will be critical to preserving trust and confidence in the defense industry as a whole. As supply chain shocks continue to make headlines, the defense sector must remain vigilant, ensuring that its reputation is as resilient as its supply chain.

Contact us here to learn how PublicRelay can support.