Does Share of Voice = Share of Market?

The electric vehicle (EV) race is speeding along, fueled by automakers jockeying for consumers’ minds and wallets. As legacy car companies build their EV reputation, are their news headlines driving EV sales?

To answer this question, PublicRelay compared over a year’s worth of EV media coverage and sales from leading automakers. Here’s what we found:

Legacy car companies are ahead in consumers’ minds

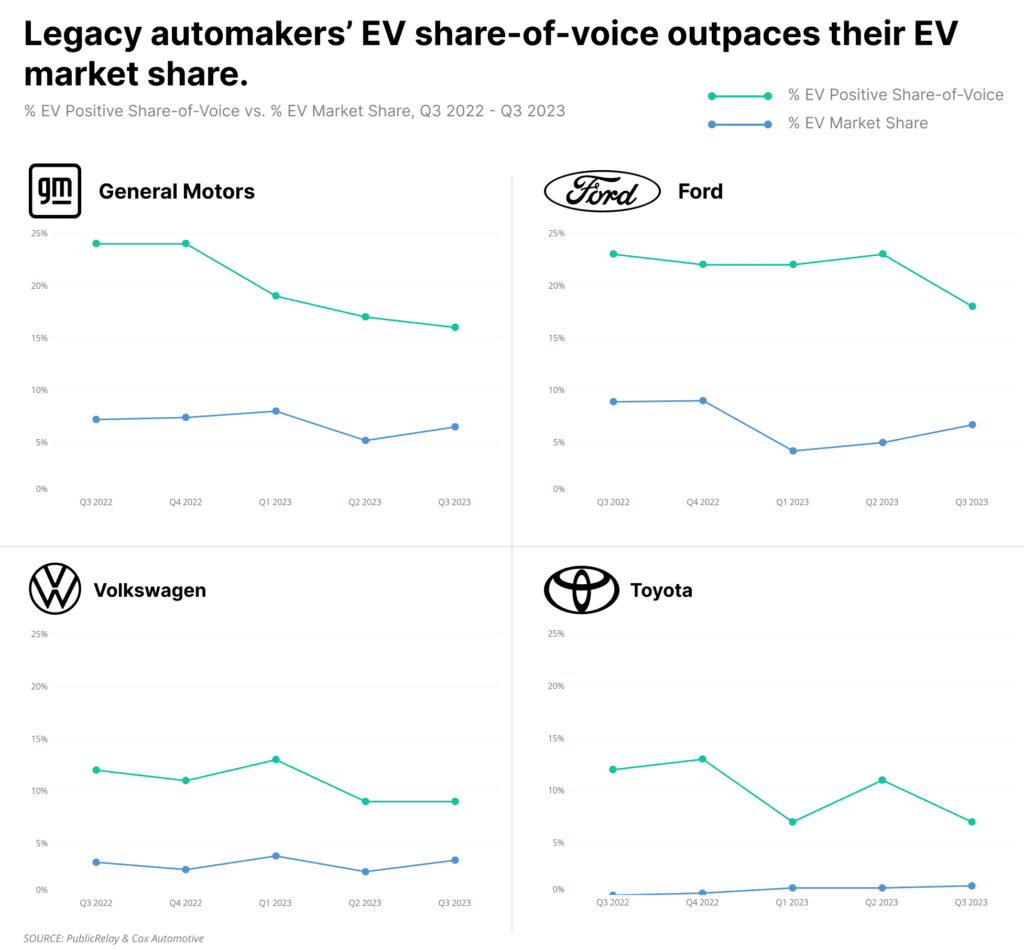

Despite their late entrance to the EV race, legacy car companies have been punching above their weight on EV communications. Over the past year, legacy automakers’ positive share-of-voice on EVs has outpaced their EV market share.

That’s a communications win for legacy car companies, especially for GM and Ford. Those two automakers have branded themselves as leading EV players. GM CEO Mary Barra has vowed to close the EV sales gap with Tesla in 2025 and pledged to end sales of gas-powered cars by 2035. Ford CEO Jim Farley has publicly committed over $50 billion in EV investments alongside partnerships with Chinese and Korean battery firms.

The automakers’ PR strategies are borne out in PublicRelay’s analysis of the EV media landscape, featuring brands like Tesla, GM, Ford, Toyota, and Volkswagen. GM and Ford each maintain around 20% of the industry’s EV’s share-of-voice despite each having approximately 7% of the US’s EV market share. Even Volkswagen and Toyota have share-of-voices that exceed their shares of the market.

EV media wins are leading to market share gains

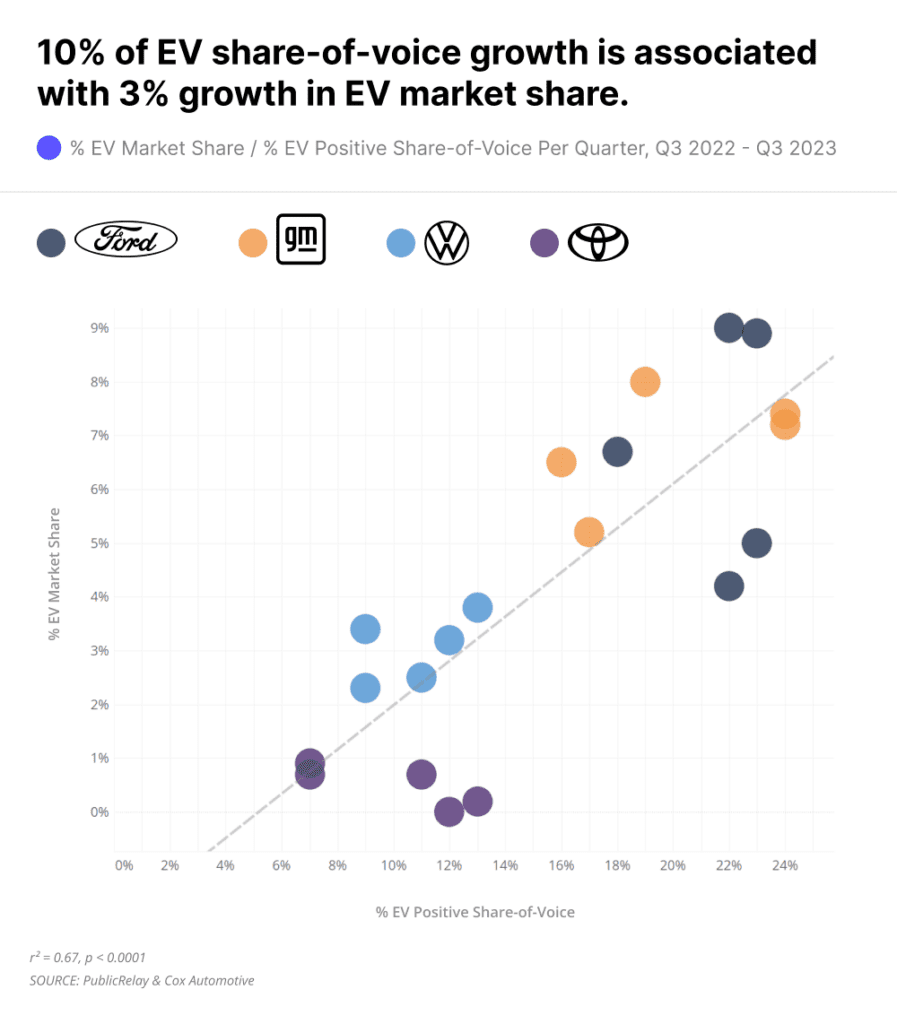

An outsized share-of-voice likely indicates future market share growth in EVs. Advertising firms like Nielsen have long highlighted the value of investing in media share-of-voice early to generate business growth later. That’s especially true when budgets are tight. Companies who build reputational strength early reap the rewards faster when market conditions mature.

That trend is already holding true for legacy automakers in the EV space. 10% more positive EV share-of-voice is generally associated with 3% growth in EV market share, quarter over quarter.

Tesla is losing market share, but its media share-of-voice is rebounding

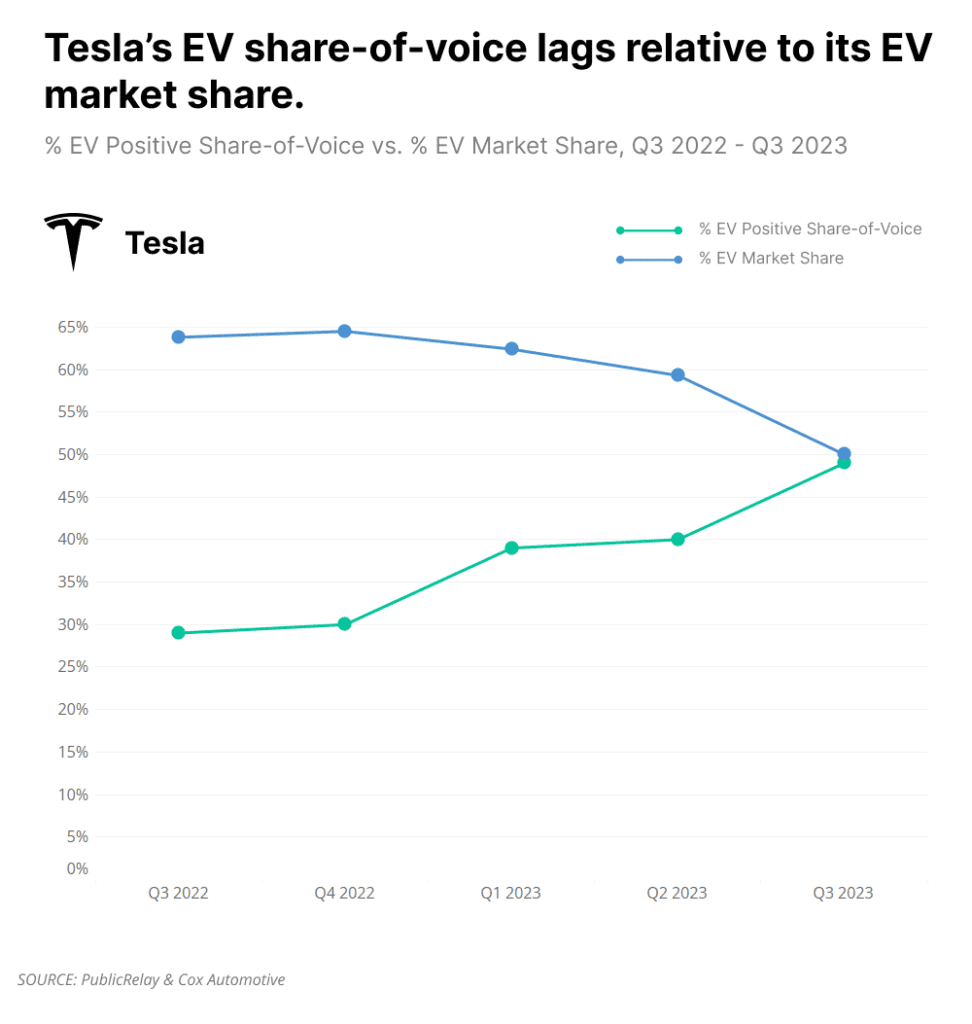

Tesla’s trajectory is also consistent with this trend. Elon Musk’s company is the clear EV market leader. But unlike legacy automakers, Tesla’s PR efforts have significantly lagged its market power. At the end of 2022, Tesla’s share-of-voice was less than half its market share.

Combined with growing competition in the EV space, Tesla’s reputation deficit has predictably led to a decrease in its market share. Tesla’s share of the EV market has decreased from 64% to 50% in the past year.

Numerous controversies surrounding Elon Musk’s takeover of Twitter have alienated potential Tesla customers. Tesla also faces ongoing product reliability issues. Without sufficient reputational capital in place, EV buyers may be more willing to look beyond Tesla towards other brands.

Tesla is far from doomed, however. The company has been rapidly increasing its EV share-of-voice in 2023. Its market leader status has enabled it to capture headlines about lowering prices and the launch of the Cybertruck. The brand has been quick to point out its insulation from chip supply constraints and UAW strikes affecting Ford and GM.

The road ahead

At the same time, legacy automakers have begun to pull back from their bold EV stances amid high interest rates, fears about inadequate EV charging infrastructure, and a surge in hybrid vehicle sales. The result has been a decline in share-of-voice among legacy car companies at the end of 2023.

Whether or not legacy automakers renew their focus on their EV businesses through 2024 remains to be seen. If they do, building their EV share-of-voice will be a necessary place to start.

Read Next: Improve Your ESG Communications Strategy