With Pride Month well underway, it’s a timely moment to reflect on the state of DEI in finance. Luckily, the findings from PublicRelay’s Q1 2025 Finance Benchmark Report offer a revealing snapshot marked by both progress and pullback.

The Disconnect Between Policy and Perception

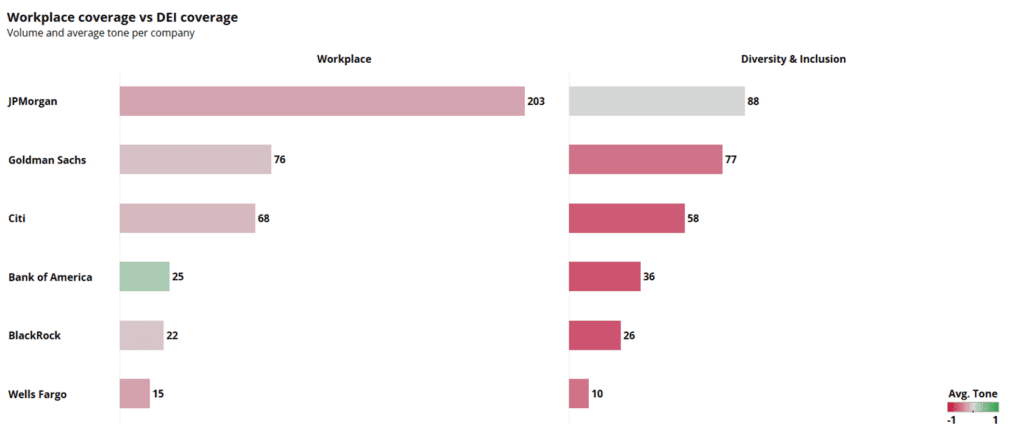

Despite strong earnings and innovation-driven headlines, many financial institutions found themselves under the media microscope for scaling back their commitments to diversity, equity, and inclusion. The report highlights that diversity and inclusion in finance remains a reputational flashpoint, with DEI rollbacks drawing significant scrutiny.

Interestingly, this scrutiny didn’t always translate into internal backlash. In many cases, workplace sentiment remained neutral or even positive, suggesting a disconnect between how DEI decisions are perceived externally versus how they are experienced internally. This gap presents an opportunity for financial institutions to better align their messaging with their values.

Symbolism vs. Substance in DEI Commitments

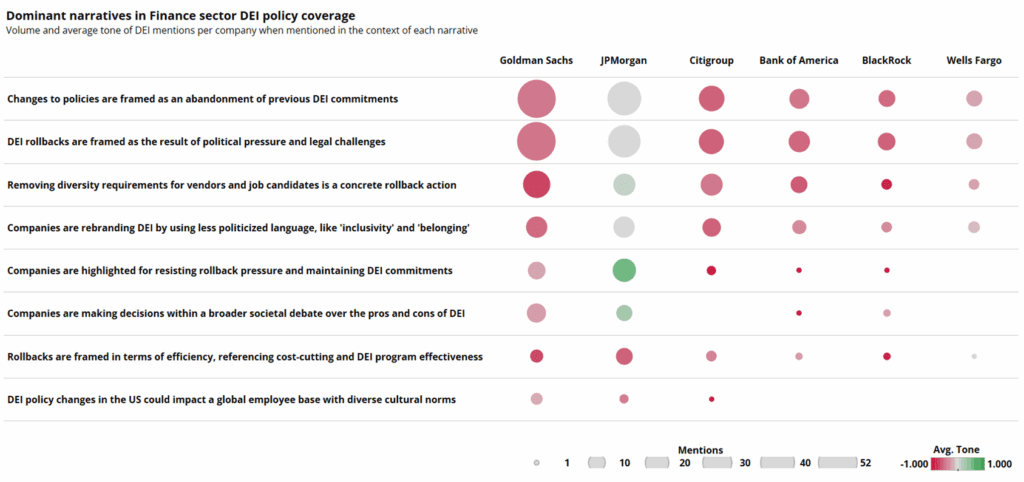

One of the most revealing takeaways from the report is how surface-level changes, such as editing DEI language or quietly removing inclusive content, are being interpreted. Rather than being seen as strategic repositioning, these actions are often viewed as capitulating to political pressure. In the eyes of the media and stakeholders, this signals a retreat from core values.

For companies looking to lead during Pride Month, this is a critical lesson. Pride Month corporate responsibility isn’t about rainbow logos or one-time donations. It’s about demonstrating a sustained, authentic commitment to equity and inclusion. Symbolic gestures, while visible, are no substitute for meaningful action.

Leadership Matters: The Case of JPMorgan

Leadership plays a pivotal role in shaping the narrative around DEI in finance. Jamie Dimon, CEO of JPMorgan, offers a compelling example. While the bank did implement significant DEI policy changes, Dimon’s vocal support for diverse communities helped mitigate negative sentiment. His public stance was framed as a refusal to cave to political and legal pressures, reinforcing the importance of executive visibility in maintaining trust.

This underscores a broader truth: in times of reputational risk, leaders who speak clearly and consistently about their values can help steer the conversation in a more positive direction.

The Path Forward: From Compliance to Culture

During Pride Month and beyond, financial institutions have an opportunity to reaffirm and act on past commitment to diversity and inclusion. According to the data, this is the most likely route to avoiding negative coverage in the media and with stakeholders. Companies that remain transparent and consistent in their DEI efforts are more likely to earn the trust of employees, customers, and investors alike, bolstering their reputations in the process. In sum, values-driven leadership is good ethics and good business.

Author: Kay Kavanagh, Director of Research