Sentiment analysis is a term that most PR practitioners and communications professionals have heard of, and perhaps even a tool they use as a part of their strategy. However, many industry pros struggle to fully understand the concept and what it can do for them when implemented effectively.

The applications of sentiment analysis are wide-ranging and impactful. For instance, Brandwatch asserts that “shifts in sentiment on social media have been shown to correlate with shifts in the stock market.” British political magazine New Statesman even used the process to determine that President Joe Biden’s recent 2021 inaugural address was “the angriest ever,” based on key linguistic choices.

What is Sentiment Analysis?

Sentiment analysis is the process of identifying the tone or emotion attached to a communication. It can also be referred to as “opinion mining” or Emotion AI. Examples of the types of communication that can be analyzed for tone are nonverbal, like facial expressions and body language, and linguistic.

Analyzing the sentiment of linguistic forms of communication starts with examining a sample of text, which is then assigned a value based on the perceived attitude or tone of the communicator. Usually, the values are coded as positive, neutral, or negative so the data can be easily sorted and later visualized and studied for trends.

Why is Sentiment Analysis Important?

Sentiment analysis is important because it can provide you with a better understanding of your earned media coverage and help you reach your messaging goals. The analysis is part of an integral feedback loop that allows communicators to gauge the success of their communications tactics and identify opportunities for improvement.

Measuring the volume of media coverage by topic can only tell you so much. Without knowing the tone of that coverage, teams can’t determine whether their campaign is a success or a failure. For example, if your company experiences a spike in mentions related to product quality, how can you appropriately respond without first knowing whether that coverage is positive or a potential PR crisis, all of which comes down to sentiment?

Lexalytics explains that sentiment analysis can help companies to gauge “public opinion, conduct nuanced market research, monitor brand and product reputation, and understand customer experiences.” Once you have identified your strengths, weaknesses, and opportunities, you and your team can take advantage of all the practice has to offer.

Using AI for Sentiment Analysis

When analyzing text, computers deploy natural language processing and machine learning techniques to attach sentiment to words, phrases, topics, and themes. When an analysis program runs on an article it breaks the text down into these units. The program then identifies components that have been assigned sentiment in the program’s sentiment library (which stores the system’s human-coded values) – or the library entries they are closest to – and assigns a score to each unit. Finally, the system combines the individual scores to generate a multi-layered analysis score that represents the whole article.

As smooth as this process sounds, there are many areas where problems can arise along the way.

The Accuracy of AI Sentiment Analysis

Because AI uses natural language processing and machine learning to automate the process, it’s a useful tool for freeing up your team’s valuable time. However, fully automating your sentiment analysis can compromise its accuracy.

According to the Institute for Public Relations, no method of sentiment analysis will ever be 100% accurate. However, they argue that relying solely on a tech tool to measure sentiment “can be like flipping a coin, or only 50% accurate, since these platforms often struggle to measure more nuanced posts or are unable to filter and interpret the information through the lens of a company or brand.” Similarly, 5WPR estimates that sentiment algorithms are only about 60 percent accurate.

Linguistic Challenges for AI

Toptal has identified four major pitfalls of AI sentiment analysis: irony and sarcasm, negations, word ambiguity, and multipolarity. Some of these pitfalls can be addressed with approaches like machine learning algorithms or deep learning, but no solution is guaranteed to be fully effective.

Sarcasm is an especially deep pitfall, and its prevalence in consumer-generated content, like social media posts, makes it even more important in many sentiment analysis projects. Even humans struggle to comprehend sarcasm sometimes, so it’s no surprise that computers are often tricked by false-positive statements like, “I love the way [company’s] customer service team put me on hold for two hours.” Research shows that numerical sarcasm like in this statement is especially challenging for AI to comprehend due to its effect on a statement’s polarity.

As a media analyst, I often see articles that dive into complex subjects in detail. The more detailed the article, however, the higher the chances that an AI program will be tripped up by common traps like negatory statements, ambiguity surrounding entities, or articles that discuss both the pros and cons of one idea.

These issues demonstrate some of the imperfections of using AI, which can drastically change the narrative of your media analysis and your subsequent tactical decisions.

Adding a human element to your approach can be the solution to avoiding these major data hazards.

Using Humans to Detect Sentiment

Although using an AI program can help save time, its imperfections can lead to inaccurate results that can impact your communications strategy. Because of these shortcomings, it is essential to include a human perspective to analyze the more linguistically complex elements of your media coverage.

While computers need to be trained to detect subtle context clues, humans have been ‘programmed’ to find them throughout their entire socialized lives, which makes identifying common language tools like irony and negations quite simple. Using human analysts to identify these common contexts and AI to automate the basic tasks that save time can be beneficial for PR professionals as they work to improve the accuracy of their sentiment analysis insights.

The Value of a Hybrid Approach

Both AI and human analyst approaches to sentiment analysis have benefits: AI programs save time with automation, and humans decipher context and increase accuracy. Ultimately, utilizing a combined approach can offer the best of both worlds.

At PublicRelay, our human-AI hybrid approach to media monitoring makes conceptual insights possible. To learn more about using PublicRelay for accurate sentiment analysis, contact us here.

According to Business Matters, a company’s reputation is crucial to its success. When tracked effectively, it can reveal valuable insights into a brand’s current position in public opinion. This understanding provides a foundation for PR teams to make informed decisions about their communications strategy.

What Are Reputational Drivers?

Reputational drivers are the factors that contribute to a company’s overall reputation. Defining and tracking these key metrics will help public relations professionals to understand their company brand and more effectively manage their reputation.

RepTrak outlines seven drivers of reputation that can highlight an organization’s strengths, weaknesses, and areas for growth. As Reptrak points out, these categories can help you pinpoint the different aspects of your organization that are receiving press coverage.

Based on the seven drivers, PublicRelay has developed a framework for determining the essential drivers of corporate reputation that can be tailored to apply to any organization. By using this framework, your PR team can design a media monitoring strategy that effectively tracks the factors comprising your brand.

PublicRelay’s framework consists of:

- Products and Services. What are the individual elements of the products and services you offer?

- Business Strategy. What actions has your company taken to meet its business goals?

- Workplace. What is your company’s workplace culture?

- Leadership. Does your organization have a clear mission, and is there accountability among its executives?

- Corporate Social Responsibility. How does your company give back to the community or try to make the world a better place?

- Financial Performance. What is the state of your company’s financial health?

- Government Relations. Is your company in-line with industry regulations? Is your company involved in any litigation?

Each driver is connected to a specific facet of your company’s operations. Together, they help to paint a picture of the public’s perception of your brand. The final image serves as a vital tool in crafting a strong communications plan.

Why Are Reputational Drivers Important in a Communications Strategy?

Reputational drivers are important in a communications strategy because understanding the nuances of your corporate reputation will enable you to make data-driven decisions.

Reputation may feel like an intangible concept when you begin developing a communications plan. By dividing it into specific drivers, seemingly vague ideas become concrete and measurable parts of your business. Breaking it down across these seven drivers will help you to focus your messaging on the drivers that are most important to your communications objectives.

For instance, perhaps mentions of your company have been more negative than usual over the past week. By examining media content, you could uncover that negative press has largely focused on your products and services. This insight would allow you to work across teams, flagging the criticism to your product and development team for further inquiry. As a PR professional, you now have the opportunity to help shift the narrative in your brand’s favor. Once you have a firm understanding of which aspects of your brand are drawing attention, be it positive or negative, you can go to work crafting compelling content to balance the narrative.

The framework can also strengthen an organization’s external media capabilities. Once you have identified which categories are crucial to your brand’s current messaging, tracking coverage across all seven drivers can reveal further insights. In monitoring your company’s press coverage, you may begin to see which drivers are underperforming over time. Analyzing your coverage for patterns or emerging trends allows you to make intelligent and informed decisions.

Reputational Driver Metrics

It’s clear that drivers of corporate reputation provide invaluable insights for communications teams, but how do you tailor each to your company’s unique objectives?

Whether you decide to monitor your media in-house or use an agency, tailoring your drivers to your company and industry will ensure you are able to capture your metrics accurately.

When building your communications strategy, begin to consider the individual drivers and how each metric applies to your company and desired brand:

Products and Services

Define each aspect of the products and/or services your company offers. The distinction between the two is that products are generally tangible goods (e.g., a cheeseburger), while services are intangible activities performed by people (e.g., table service).

The benefit to tracking the elements of your products and services independently is that if you begin to see negative coverage of this driver, you can pinpoint which facet is perceived negatively.

Let’s say you work for a software company. When it comes to your products and services, you may want to monitor mentions of the various features of your software, product performance, new releases and upgrades, user experience, and customer service.

Business Strategy

Business strategy refers to the actions your company takes to reach your objectives or remain competitive in your industry. This can include partnerships, mergers and acquisitions, ad revenue, or industry innovation.

For example, strategic business partnerships are known to improve companies’ credibility, long-term stability, and access to knowledge and resources, enabling them to expand the scope and quality of their offerings.

Workplace

Workplace culture and employee experience are both important factors in measuring corporate reputation. Monitoring the workplace facet of your brand’s reputation could involve assessing coverage of employee benefits, training and advancement opportunities, and mentions of diversity and inclusion efforts.

Stakeholders often view workplace culture as an insight into the company’s alignment with its core values. If a company claims to value people over profit, but their own employees are struggling to make ends meet, then consumers may start to doubt the company’s integrity.

Leadership

A company with a clear mission and executives that align with those values is perceived as more accountable and trustworthy.

Measuring this reputational driver will likely cover mentions of company executives, spokespeople, and potential insights or thought leadership they may offer. Identify every key member of or role in your company’s leadership structure to effectively track this driver.

CEOs and other leaders are perceived as representatives of company brands. If an executive is involved in a scandal, for instance, it will reflect negatively on the company’s reputation. On the other hand, a company’s reputation can benefit from a CEO with a positive public image.

Corporate Social Responsibility

Corporate social responsibility is a powerful driving force behind a brand’s reputation. CSR encompasses charitable donations, sponsorship of local community events, or environmental initiatives.

CSR programs say more about a company’s values than the quality of its products and services, but they still impact consumer behavior. In a survey of consumers, RepTrak found that “91.4% of respondents would buy from a company with an excellent CSR program.” Another 84.3% would give a company “the benefit of the doubt” during a crisis if it had a strong CSR program.

Financial Performance

Following media coverage of your brand’s financial performance may involve examining analyst projections, quarterly earnings, or share values. Analysis of this coverage furthers your understanding of public opinion of your company’s financial health and stability.

Financial performance contributes to a company’s reputation because it is an indicator of whether the company can deliver on the other drivers. For example, if a company is doing well financially, it is more likely able to expand its product development, hire more employees, and make charitable donations to social causes.

Government Relations

When tracking government relations, consider monitoring any relevant industry legislation or regulation, and your company’s involvement in litigation. For instance, if your company is cited in an ongoing legal discussion concerning privacy standards across platforms, it could impact perceptions of and trust in your brand.

Manage Your Corporate Reputation

The insights PR teams can glean from investigating their company’s reputational drivers are essential to effectively managing corporate reputation. Analysis of these drivers will help you to craft a targeted media strategy to elevate your brand. By understanding where your brand currently stands, you will be better prepared to achieve your brand objectives.

At PublicRelay, we offer bespoke media monitoring programs designed to help your public relations team understand and reach your communications goals. Build your custom media monitoring program now!

Social media is commonly viewed as a platform where companies can actively reach out to their audiences, build relationships, and manage their brand. With approximately 500 million tweets sent per day – the level of activity on one platform alone – the wealth of data available can also be used to inform and demonstrate the impact of PR teams’ communications strategies.

However, with the overwhelming volume of content, it can be difficult for PR teams to make sense of their media coverage to the extent that they can apply those insights to their communications approach.

What is the Difference Between Social Media Monitoring and Social Media Listening?

The main difference between social media monitoring and social media listening is that monitoring requires collecting and interacting with brand mentions on a granular level, while listening involves observing the “big-picture” of coverage over time. Both are approaches to measuring and analyzing a company’s media coverage.

In other words, monitoring allows you to assess engagement with your traditional media coverage on a micro-level. This is helpful when responding to potential communications crises in real-time and determining whether negative news coverage warrants a response based on its social traction.

Social media listening, on the other hand, refers to the analysis of your social media coverage over time and its interaction with your traditional media on a macro-level. During this stage, the data collected via monitoring is aggregated and analyzed based on company-specific objectives to translate them into actionable insights. This process is valuable because it enables PR teams to become predictive in their response to media coverage and to build more strategic messaging campaigns based on data.

An effective communications strategy incorporates both methods. Listening, however, stands to provide your team with data that can inform your communications approach on a larger scale.

Why is Social Media Listening Important in Communications?

Social media listening is important in communications because measuring engagement in relation to your traditional media coverage can yield valuable insights into your communications team’s effectiveness. Analyzing social media data can illuminate brand awareness and sentiment, the impact of messaging campaigns, and the industry topics that are likely to gain the most traction with target audiences.

Create a Social Media Listening Plan

To ensure your team is getting the most out of your listening process, consider the following advice for setting measurable objectives and determining the necessary metrics to track.

Setting Objectives

The communications objectives you establish will guide the design of your social media monitoring program which forms the foundation for later analysis during the social media listening stage. Begin by setting your objectives and determining the metrics that will allow you to measure them effectively from the outset.

While it’s difficult to measure social engagement’s direct impact on sales, per se, you can evaluate communications objectives such as improving brand awareness and sentiment, or increasing key message penetration, for example.

By establishing measurable objectives to assess the impact of your communications strategy, you can tailor your monitoring program to ensure you are collecting the necessary data to measure your objectives accurately and reliably.

Frequently tracked metrics include but are not limited to:

- The volume of company mentions across social platforms.

- Engagement (e.g., number of tweets, retweets, shares, comments, or likes).

- The tone of traditional coverage shared on social media.

- Influencer metrics (e.g., number of followers).

Key Message Penetration

According to CommPRO, “message penetration indicates the prevalence of [key] messages, a quantitative measure, across all possible messages.”

The listening process can help your team measure message penetration by distilling the volume of social engagement with your key messages from your total social media coverage. These metrics can work as an indicator of whether your messages are reaching and resonating with your audience.

Brand Awareness and Sentiment

Monitoring brand mentions across social media can serve as a benchmark against which you can evaluate your brand awareness relative to competitors, and the impact of your campaigns over time.

However, the frequency of your company mentions doesn’t necessarily shed a light on your overall reputation.

Dive deeper into your brand analysis by assessing the sentiment of the traditional coverage that drives engagement with your target audience. We know that when it comes to social media, coverage is seldom neutral. With sentiment analysis, you can determine whether each company mention that garners audience engagement is positive, neutral, or negative. This can be further broken down by topic and reputational driver for a more nuanced understanding of your brand.

Identify Trends

Identifying trends can inform your campaigns and enable you to invest resources in industry topics that are proven to have a higher ROI when it comes to social traction.

For this reason, tracking competitor coverage and industry topics across social platforms can be just as valuable as tracking your own.

By applying a similar measurement strategy to your competitors’ coverage, you can analyze their media campaigns to determine the topics that reliably trend across social media and garner positive engagement and brand sentiment.

Integrate Social Media Listening into Your Communications Strategy

Once you begin generating insights, there are multiple ways to apply them to your communications strategy.

Reach Target Audience

With an understanding of the topics, platforms, outlets, and influencers that have tapped your target audience, you can more effectively reach that demographic with your messaging.

Comprehensive data will answer vital questions such as:

- Does your audience demonstrate more engagement with your industry on Twitter, Facebook, LinkedIn, or Pinterest?

- On which platforms are your competitors garnering the most positive engagement?

- Which outlets or authors have positively covered your key messages and received high levels of social engagement?

- Which topics and messages are resonating most with your audience across social media platforms?

Reliable information on your target audience’s social media behavior will enable you to capitalize on the factors that drive positive engagement.

Pinpoint Key Influencers

Social media listening highlights the outlets and authors that cover your industry and gain the most traction with your target audience.

Build and leverage influencer partnerships based on proven histories of engagement and rapport with your audience to further propagate your message when promoting pickup of press releases and positive company news.

Build Data-Driven Campaigns

With social media intelligence, you can build data-driven campaigns designed to generate engagement across platforms and reach your communications objectives. A macro perspective of your social media data facilitates tailored messaging based on emerging trends, crisis response informed by historical data, and the ability to leverage industry influencers.

These insights will enable your team to evaluate the success of your existing strategies, benchmark your performance against competitors’, and adjust your strategy based on reliable data.

A Smarter Approach to Traditional Media

By using social media listening to understand your company’s traditional media coverage, you can improve the effectiveness of your communications strategies.

At PublicRelay, we can uncover the interaction between your traditional and social media coverage with our combined approach of human analysis and AI tools. Our team provides in-depth analyses of the topics, influencers, and outlets that drive social sharing to help you understand trends across multiple media channels and to leverage each for maximum impact.

Turn your social media data into social media intelligence now!

Media analytics are essential to helping public relations and communications professionals understand how well their current strategies are working and plot the path towards future success. By implementing an analytics solution, your team can more efficiently develop strategies based on data-driven insights to help you achieve your objectives.

According to the PRSA, the purpose of public relations is to forge positive relationships between organizations and their target audiences. These relationships can be developed in multiple ways: by gaining exposure to new audiences, building brand awareness among current audiences, and fostering engagement within less active audiences, to name a few. However, the various methods for building relationships with stakeholders are most effective when PR practitioners use reliable data to inform their strategies.

When explaining the importance of data utilization in the public relations industry, Keyana Corliss, Head of Global Corporate Communications at Databricks, said, “data can be the difference between assuming you’ve made a good decision and having a great data-driven strategy.” Of course, to employ this method, you must first understand what analytics are and how to use them.

What is Media Analytics?

Media analytics are observations and recommendations based on data drawn from media monitoring. Succinctly, media monitoring is the tracking of media output from various outlets and authors to gain a better understanding of a company’s brand and its communications strategies’ effectiveness.

At PublicRelay, we aggregate data collected from various media sources over time to pinpoint trends and outliers that provide key insights. These data points allow us to inform our clients of how well their communications tactics are performing and ways they may adapt their strategies to better reach their objectives.

Integrating Media Analytics into Your Public Relations Strategy

Public relations teams can be best served by incorporating media analytics into their operations strategically. You can apply an analytical lens to your own media data and make the most of the information you collect by keeping a few key principles in mind.

Be Objective-Oriented

While it is always important to keep goals in mind when making PR decisions, analyzing media requires clear, measurable objectives. Without objectives, there is nothing to differentiate a media campaign’s success from its failure. The act of establishing objectives also debunks the myth that PR efforts and outcomes cannot be measured. Further, when presenting PR outcomes in terms of accomplished objectives, PR teams can demonstrate the merit of their work, as well as prove the value of their allocated budget.

Setting objectives can look very different from one organization to another: a consumer-focused company may want to reposition its brand, while a non-profit organization may seek to raise awareness of a cause it supports. Both objectives are measurable using media analytics. According to Hootesuite, you can establish effective objectives using the S.M.A.R.T. goal framework, which recommends setting goals that are specific, measurable, attainable, relevant, and timely.

Without objectives, your team is at risk of reaching the end of a campaign only to find yourselves overwhelmed by too much information that you struggle to make sense of. Or worse, you may find that you have been tracking the wrong data the whole time and don’t have the necessary information to assess your PR outcomes.

Big Picture: Observe How Trends Form Over Time

While you may be able to find some noteworthy media mentions if you analyze your media coverage daily, becoming too detail-oriented can pose challenges to PR and communications teams. Without taking a step back to view your data over a longer period of time, you will most likely be faced with information-overload and struggle to identify the most significant coverage.

By allowing trends to develop over time and analyzing your data on a monthly, quarterly, or yearly basis,

you can see how patterns form and highlight the most noteworthy coverage. High-level reporting helps to cut through the noise and gives clear insights into trends as well as outlier events, putting seemingly important media coverage into perspective. Stepping back to observe the bigger picture not only saves time and energy, but it also produces better results by directing attention toward the most important data points.

Small Picture: Pay Attention to the Details

The details of your media coverage are most important during the set-up stage of your media monitoring program and later on in the analytics process when looking for a sensible narrative of your coverage.

The decisions made about the media coverage your team wants to track – like whether stock reports are relevant, or the factors that make a company mention significant or insignificant; positive or negative – may seem inconsequential and laborious, but these choices will have a big impact on the data you end up with and the story they tell when you analyze your coverage. These details determined during the planning stage will affect the narrative of your media coverage down the road. Thus, it’s important to consider these choices in the beginning when you set up your analytics strategy to minimize future changes and to make long-term observations and period-to-period comparisons more accurate.

After you’ve zoomed out to view the big picture, you can zoom in on the information behind apparent trends. By identifying factors such as authors, outlets, sentiment, and potential impressions, you can validate, explain, or negate what the numbers may appear to be telling you. For instance, a spike in a certain topic on social media may automatically signal to you that many people are discussing your brand. However, further investigation could reveal that the content is coming from one user with very few followers, perhaps even a bot, and the “trend” is not worth mentioning to your executives. In instances such as this, examining the details can help you to identify the information that is important and worth acting upon.

Media Monitoring & Analytics

It is with the perspective of analysis that your media data takes on a comprehensible narrative and becomes a more useful tool than media monitoring alone. While media monitoring can provide up-to-date coverage of all media mentions and in-depth statistical information, going one step further and analyzing this data significantly increases your return on investment. Through analysis, you can organize your data to identify the coverage and trends that are important, as well as the changes you and your team can implement to increase the success of your communications strategies.

Path to Success

A good media analytics program has the ability to both explore the nitty-gritty details and recognize patterns and significant moments within a large data set. The objectives you set to define success at the beginning of your analytics journey will guide the entire process, and a program that recognizes the value of big picture and small picture perspectives will help you to build a comprehensive understanding of your media coverage. With a strong program in place, you can recognize the key data that can provide actionable insights and inform your team’s PR and communications decisions.

At PublicRelay, we offer media monitoring and analytics programs that help our clients to identify relevant media mentions and compile informative and thorough metrics-based reports. Turn your media monitoring into media intelligence now!

Read Next: Questions to Ask Your Media Analysis Partner

The global pandemic of 2020 overtook and overwhelmed many companies’ best communications efforts. With communications teams assuming greater responsibility for effective messaging amid an influx of fake news across the media, their companies have faced tremendous pressures both in battling the pandemic and ensuring their brand stays intact.

Long-term Changes

The impact of 2020’s pandemic has become part of a seismic shift in the way companies collaborate and communicate. As we roll into a new year, many companies will find that these changes will carry forward into 2021, even as the pandemic itself fades.

Here are a few ways in which the events of 2020 will affect the communications function in 2021:

- What we saw in 2020: A massive lift in the value of the Communications function.

Almost every company had to up their game in communications skills and the intensity of their outreach. 2020 saw pressures not just on external messaging, but also on internal communications. Out of nowhere, companies were forced to massively increase their conversations with employees about critical topics like workplace safety, remote work standards, and even the viability of the business itself.

What to expect in 2021: Expect this trend to continue in 2021 as companies position themselves to transition out of the pandemic.

Themes of corporate and social responsibility, including the concepts of social as well as economic justice, are likely to return to the forefront after having been sidelined by a worsening pandemic. Watch for an increase in conversations about broader shareholder responsibilities far beyond stock price.

- What we saw in 2020: A move towards putting employees first.

Finally. Many companies realized that employees were really what mattered when the chips were down. When you have to reinvent your business model in real time, you need an engaged workforce that feels like a partner in the business. In many cases, the companies that survived 2020 were those that had the most engaged and dedicated employees.

What to expect in 2021: This trend will continue as employers negotiate the terms of the post-pandemic employment relationship with employees.

Expect more employee input on work conditions, benefits, and even employers’ positions on social issues.

- What we saw in 2020: A shift to remote work.

Historically a perk for a subset of employees that was only implemented by a small number of organizations, remote work became commonplace in 2020, with many companies forced to make their entire staff remote. After some initial glitches, it was largely a successful transformation of the workplace across industries. Technologies improved, home offices were upgraded, and every function innovated to make it all work.

What to expect in 2021: Where possible, remote work or partial in-office work weeks (like 3-2-2), will become a long-term fixture for many jobs.

Expect a major impact on the size of office spaces leased by companies, and a corresponding hit to commercial real estate that will continue for many years. Secondary effects, like lower public transportation usage (a problem), and lower traffic congestion (a blessing), will have negative secondary impacts on businesses like coffee shops, gas stations, and even commercial construction.

- What we saw in 2020: True adoption of video conferencing.

Using video calls for business used to be rare, but now even basic calls have shifted over to video. Social protocols for video calls were quickly developed, and every function in the organization figured out how best to make it work. As a result, in 2020 many businesses improved their ability to build better relationships with customers and vendors across the spectrum. In addition, businesses that used to sell 100% in-person found out that video sales worked, saving them substantial time (and money), all while making sales professionals particularly efficient.

What to expect in 2021: The big unknown in the future is its impact on business travel – how much travel is truly required to build and maintain effective relationships with customers?

Will the sales function migrate back to in-person calls, or will the massive efficiencies of virtual meetings remain so compelling that the days of in-person calls are numbered? Expect the answer to be a blend: some activities will remain virtual, while high-end sales will return to travel because in-person sales work best.

- What we saw in 2020: The entrenchment of fake news as an art.

The election year (and its aftermath) showed the power of aggressively using traditional and social media to spin and control a message, even if that message was patently false. Many communications professionals (and politicians) were forced to reckon with baseless claims against their companies and brands, while countering them became more difficult as news sources and social media polarized and fragmented in 2020.

What to expect in 2021: This problem is not going away.

Fragmented sources of information will continue to allow fringe conspiracy theories and fabricated news to reach receptive ears. Business and government leadership will need to improve their communications efforts – both the accuracy and the frequency of communications – and they will need to employ trusted voices to rise above the clutter. There is no end in sight for this battle since any regulation of “facts” goes directly against the constitutionally protected concept of free speech.

The Future Has Been Thrust Upon Us

The changes driven by the global pandemic are not going away any time soon. In fact, the fundamental shifts in communications, collaboration, and messaging that were forced upon companies in 2020 will remain with us in 2021, with some of them settling in our daily lives for the long term.

Media monitoring involves tracking the output of traditional, social, and broadcast media outlets and authors. While it can be utilized by countless groups – from political think tanks to PR executives – communications teams can use it to gain a better understanding of the effectiveness of their various strategies and campaigns. Media monitoring is more than simply searching for every single mention of a company over time; it is the compilation of relevant mentions based on personalized and structured search parameters. An effective strategy can highlight the most relevant content on a day-to-day basis, while also providing a structured breakdown of media coverage broken into predetermined categories, such as competitor stories and industry updates.

Why is Media Monitoring Important?

Media monitoring is important because it helps communications teams stay informed of relevant breaking news, the latest industry developments, communications crises, and their company’s representation in the media. Though strategies and objectives vary from company to company, a clearly focused approach can yield a more in-depth analysis. Amidst an abundance of media coverage, an effective monitoring strategy can cut through the noise and help home in on the most significant, most shared, and most widely syndicated pieces.

Its value can be applied to numerous company departments, with the potential to offer teams data-driven insights to guide their individual objectives.

For instance, immediate updates on company mentions can help PR and marketing teams respond to breaking news, while regular alerts and updates can inform crisis management strategies. Teams can also pinpoint widely shared stories and quickly identify the percentage of stories featuring quotes from company representatives. The more information a PR team has on hand, the easier it is it for them to implement an effective crisis response and track its success.

Keeping abreast of media coverage that mentions your company is vital, as is being informed of the latest industry news and updates. Marketing strategies can take advantage of hot industry topics that receive unprecedented levels of coverage and social engagement. By capitalizing on trending industry topics, you can increase your company’s mentions across key industry outlets.

Furthermore, monitoring enables sales teams to understand what has their competitors’ products attracting unrivaled media attention or scrutiny. Sales departments can capitalize on the insights gained from identifying the drivers of both positive and negative competitor media coverage related to products or services to further distinguish their brand from rivals’ in a meaningful way.

The ability to make informed decisions based on contextualized data analytics is the key benefit that links each of these departments. By pairing regular media updates with an understanding of the topics and circumstances that drive mentions, coverage, sentiment, and sharing, a strategic media plan can provide company-wide benefits.

Key Media Monitoring Metrics

The sheer volume of available metrics can make it difficult to distinguish the most significant from the least. While different metrics may appeal to various teams across a company, there are a few key metrics that can build a foundation to inform multiple business strategies.

Reputation Management

Charting the prevalence of specific topics over time yields one of the fundamental metrics that can provide crucial context to weekly, quarterly, or annual media coverage. While spikes in coverage may be caused by specific events, certain subtopics may be gaining more media coverage than others within these spikes. Tracking this data can aid communications teams in understanding the topics that garner the most media pickup and traction with their audiences.

For instance, perhaps articles about CEO comments drove Q2 coverage, or the second half of the year saw workplace-related discussions double. Tracking the volume and tone of reputational drivers can help communications teams to identify what drove company mentions, positive and negative sentiment, and social sharing, and provide useful information to guide their communications strategies going forward.

Competitive Intelligence

Using metrics to track your own campaigns and initiatives can help your communications team to understand both what went well and what they can improve upon. Tracking competitor coverage, on the other hand, can help communications teams to inform strategies to outmaneuver key competitors by distinguishing the good from the bad of their PR efforts.

Studying competitor media coverage will allow you to identify the drivers of competitors’ negative coverage, and to learn from the effectiveness of competitors’ media campaigns and crises response.

Messaging and Campaigns

Armed with media insights, communications teams can plan future media strategies, initiatives, and campaigns to boost their positive media coverage. This information can also highlight why past initiatives may not have succeeded. Media monitoring will also allow you to track and understand rates of press release pickup, and whether recent spokesperson quotes or executive interviews are driving coverage.

Likewise, when combined with sentiment metrics, teams can dive into understanding the specific drivers of both positive and negative coverage for a period relative to previous quarters. The success of new product launches can be tracked with both sentiment statistics and sharing figures. Pinpointing emerging trends and topical engagement can help communications teams plan future campaigns to improve social media engagement. By understanding how topics resonate with readers and influencers, you can develop an informed media campaign.

Influencers

When tracked correctly, influencer metrics are also highly informative to a communications strategy. A good media campaign will know which outlets and authors to target for maximum impact. For the best results, your team must be aware of both the experts in the field and the influencers that can capture your target audience, generate the most relevant coverage, and earn the most social engagement across relevant social platforms.

Likewise, diving into influencer metrics can provide clarity on coverage that may be receiving more social media momentum than normal, as well as recent coverage that is trending more negatively compared to previous weeks. Knowing which authors or outlets cover industry issues more critically than others, as well as those that do more to promote their work on social media platforms, can provide an important level of context to monitored media.

Insights into Data-Driven Strategies

Media monitoring can provide a wealth of benefits to communications teams, from regular updates of media mentions to in-depth statistical information based on coverage over time. Examining the factors that drive media coverage can help teams to make data-driven communications decisions. When employed correctly, media metrics can provide context to coverage trends, ultimately enabling communications teams to formulate successful strategies.

At PublicRelay, we offer media monitoring and analytics programs that help our clients to identify relevant media mentions and compile thorough metrics-based reports. Click here to turn your media monitoring into media intelligence!

As the communications industry continues to become more sophisticated, it’s vital that your messages reach and resonate with your target audience. While crafting a strong narrative, writing attention-grabbing press releases, and publishing your own content are all important aspects of engaging your audience, these methods are not enough on their own. Today’s public relations leaders must understand how to partner with influencers to effectively deliver their message to the intended audience. In fact, Edelman found that 63% of consumers in a global survey trust what influencers say about a brand more than they trust the brand’s advertisements.

Types of Influencers

Influencers are individuals with established audiences – often in niche areas – that have built trust and authenticity with their audience. By understanding how to engage with each group and how they can impact the reach of your message, you can get the most out of your communications efforts.

There are three common types:

Social Media

Social media influencers are people who engage with your social media content and share your company’s news coverage, ultimately extending your message to their followers.

Reporters

Reporters with established expertise in your industry often have a dedicated following that trusts their endorsements. Further, they have access to publishing platforms which can broadcast your messages to their readers.

Third-Party

Third-party influencers are recognized experts in their field and are frequently cited by the media as an authoritative source. Though they are not affiliated with your company or the media, associating with this type of influencer can lend credibility to your brand messaging.

Why are Influencers Important?

Influencers are important because they increase the reach and impact of your messages by improving their visibility and credibility. By extension, you can improve awareness of and trust in your brand within your industry space.

Visibility

By routing your messages through people with established audiences, their visibility can be significantly increased. You can also target people more directly based on their location, interests, or demographic profile. For example, if Floridians are your target audience, a reporter from a local publication, like the Miami Herald, is more likely to reach that audience than a national publication, such as the Los Angeles Times, despite the latter’s larger readership.

Credibility

Reaching your target audience with your message is only effective if they also trust the source. For this reason, it’s essential to consider the credibility and reputation of the influencer you choose to engage with. For example, if your story is about a scientific discovery, a reporter with National Geographic would lend more credibility than a reporter from ESPN.

How to Find the Right Influencer

Determining the right individual to share your message is dependent on your communications strategy. However, we recommend partnering with those who can best persuade your target audience, rather than reaching out to dozens of people who are not aligned with your goals. In other words, opt for a targeted approach rather than a wide net. To find the right partnership, ask yourself four questions:

Who does your audience hear from and trust?

A thought leader’s visibility and credibility can go a long way in reaching and building trust with your target audience. By researching your target audience and determining their demographic and psychographic profiles, you can more effectively identify their trusted sources of information.

Who generates engagement with media coverage?

Reaching your audience is only the first step. For the best results, they need to engage with your message to build your brand. You can measure metrics, such as social sharing of media coverage, to pinpoint the topics and stories your audience care about most. This method will also allow you to identify the influencers associated with the highest levels of social sharing.

Who covers the right topics?

The most effective way to locate reporters who cover topics relevant to your target audience is to monitor coverage of your company, industry, and competitors. You can also find third-party experts in your field by tracking industry news, as well as making note of individuals or sources who are frequently cited or quoted.

Who portrays your company in a positive light?

Focus your resources on individuals who will act as ambassadors of your brand by portraying it positively, rather than those who will neutrally mention it. You can maximize the return on your outreach by tracking the sentiment of various influencers’ coverage of your company and your industry to identify those who will be supportive of your message.

How to Reach Out to Influencers

Once you’ve found the partnerships you’d like to foster, personalize your outreach to ensure each engagement is unique. There are a host of in-depth resources on engagement to guide personalization, from honing your pitch to authors to working with social content creators.

Avoid the automated, semi-personalized emails that only require swapping out names and key details. Personalizing your strategy starts with ensuring your pitch is aligned with the influencer’s interests and expertise. This method will help your message to resonate with their values and build a strong campaign that meets your communications goals.

Measuring Influencer Impact

As you begin including key thought leaders in your communications strategy, ensure you have a media measurement program in place. Not only will media measurement help you develop outreach targets, but it will also allow you to evaluate the effectiveness of your strategy.

At PublicRelay, we create custom media monitoring and analytics programs to help each client identify the influencers most valuable to their brand. Launch and measure your influencer strategy today!

A crisis communication plan has three phases that consist of planning for, responding to, and assessing methods. It is a strategy for companies’ communications teams to respond to events that attract negative media attention. Media crises that may impact a company’s reputation and require an immediate response from communications teams can range from criticisms of a company’s products or services to executive scandals.

Why is a Crisis Communication Plan Important?

A crisis communication plan is important because it can enable the effective flow of information between a company and its stakeholders. It can also provide direction for the communications team in responding to negative media coverage. The communications department plays an integral role in managing a company’s image when a crisis has occurred and operating from a predetermined plan can improve your team’s response time.

Elements of a Crisis Communication Plan

Each phase has important steps when developing a plan that can promote trust between you and your stakeholders and reduce reputational damage to your company. It also makes it easier for the communications team to remedy any situation that may have a negative impact on the organization’s reputation or brand.

- Build your crisis communications team

- Develop scenario-specific strategies

- Develop and deliver your message

- Monitor the impact of your message

- Evaluate your methods

- Continue to monitor the industry

Pre-Crisis: Planning Phase

The planning phase is an in-depth preparation to consider all the logistics involved in a communications crisis. If the foundation of your plan is not established, the repercussions could be significant. For example, without a plan in place, your communications team’s response could be delayed, thus there may be more negative press accumulating while the team formulates a plan of action. During this phase, building a crisis communications team and developing scenario-specific strategies are important parts to ensure your team is sufficiently prepared.

Build Your Crisis Communications Team

The team should have representatives from various departments across the company. By building a team with representatives from multiple departments – such as finance, sales, legal, and customer service – you can ensure that your plan will address every aspect of company operation that could be impacted. Though some departments may not be affected, their representatives can offer insight to help mitigate damage and develop a response that addresses the full spectrum of stakeholder needs.

When a team is built, a single member acts as the designated spokesperson responsible for disseminating the company’s key messages. The most effective spokesperson is often a high-ranking member of the department who demonstrates likeability and professionalism and is skilled at building trust. The spokesperson should be provided with relevant training during the planning phase to ensure they are prepared to act once a crisis occurs.

Develop Scenario-Specific Strategies

Having multiple responses ready that are specific to a variety of scenarios is crucial during preparation. For instance, an executive scandal would likely require a different communications response from a product recall.

In 2019, McDonald’s responded to the scandal implicating their former CEO, Steve Easterbrook, by severing ties with the executive and issuing public statements that condoned his behavior. However, this response does not apply to all communications crises as some will implicate the company rather than a single individual. For this reason, you will benefit from having alternative, scenario-specific strategies prepared.

One of the most effective methods for developing situation-appropriate responses is to look to the experiences of your competitors. By actively researching and analyzing your competitors’ media coverage and response impact, companies can create data-driven response plans.

During the Crisis: Response Phase

It is not always possible to predict when a communications crisis will occur, but with proper planning your team is always ready to respond. Your team knows their roles and you have strategies for the most likely scenarios; Implementation is the most appropriate plan of action and designing a message to address the issue at hand.

Develop and Deliver Your Message

Developing and disseminating an appropriate message helps responding in a timely manner. Your response should be one of the earliest messages out there, or else you risk losing control of the narrative. Get your team together, evaluate the facts that are available to you at the time, and decide how your company will respond. Deliver a single, unified message, as conflicting messages can lead to doubts about the credibility of your message and spokespeople.

Once you have decided on your message, nominated a spokesperson, and issued a press release, begin reaching out to the authors and media outlets that have positively covered your company in the past. By utilizing media influencers, you can amplify your company’s message and reach a larger audience.

Monitor the Impact of Your Message

Monitoring the performance and impact on the crisis narrative of your message is key. Some metrics to consider measuring are:

- Key message penetration: track the volume of your company’s media coverage related to the situation to evaluate the impact of your messaging.

- Outlets: track to see if your message is being picked up by media outlets or journalists that are important to your brand

- Social media sharing: monitor how far both the initial crisis is being shared and how much your response is being seen.

- Sentiment: assess whether a spike in coverage is positive or negative to determine whether your message is changing minds.

Tracking all these together will give you a holistic view of how your message is performing, allowing you to assess and adjust accordingly.

After the Crisis: Assessment Phase

By evaluating and continuously monitoring your industry, you can better prepare for the future and improve your company response.

Evaluate Your Methods

Review your response and its impact. Identifying what worked as well as areas for improvement will pay dividends for the future. For example, Chipotle was the center of a major E. coli outbreak in 2015. They responded defensively, by outlining the company’s improvements to food safety protocol and explaining that the real number of E. coli cases was marginally lower than the number reported. However, this did not stop their reputation and stock price from falling significantly.

Since their response was poorly received, they examined their internal process and adjusted their approach to a later crisis. In 2018, one Chipotle location was reported for selling contaminated food. This time, however, the company closed the offending location, extended a promotion to all other locations world-wide, and announced a number of new menu items. As a result, Chipotle’s stock prices rose, and the E. coli incident flew under the radar for many consumers.

Continue to Monitor the Industry

Continuing to track your industry and cultural changes over time can impact the effectiveness of your response. Crisis communication planning is a cycle, and should be routinely reassessed, evaluated, and modified according to the industry and social climate.

Develop a Data-Driven Strategy

A crisis communication plan should be part of your wider communications strategy to safeguard your company’s reputation in the face of public relations crises. By monitoring industry trends, measuring your campaigns, and tracking competitors, you can develop a data-driven strategy that will prepare you for any communications crisis.

At PublicRelay, we use a combination of artificial intelligence and human analysis to draw actionable insights from your media coverage. Click here to elevate your media monitoring into media intelligence today!

The editorial team at PublicRelay contributed to writing this blog.

Every communicator knows when a big story is published, every minute matters. Yet many earned media articles leave little impact – while a few pieces drive the entire conversation. But what if you could know in advance which stories will catch fire?

With PublicRelay’s Predictive Alerts, you can. This feature gives your team an email alert that a particular story is likely to take off over social media – hours before it actually does. You and your team gain valuable time with which to craft the perfect response or engage key advocates to amplify the coverage.

The Details

Predictive Alerts uses industry-leading AI to predict whether an article will go viral on social media. If an article is likely to be widely shared, we deliver an email alert straight to your inbox. This gives you time to craft the appropriate media strategy.

The alert operates within a set of search terms defined by you and your analyst, depending on the topic of interest. The scope is completely up to you – search terms are not limited to tracked themes and brand drivers. Your team can keep an eye on important company announcements, key influencers, or monitor major articles on industry topics more broadly.

Strategic Value

Social sharing is a crucial gauge on which topics, outlets, authors, and stories garner the most attention. Knowing about these news hits in advance, your team can:

- Enhance positive news by engaging company advocates and employees to share the story.

- Get ahead of negative coverage with a clear, compelling media response.

- Calm worried executives by demonstrating a disagreeable piece is unlikely to receive much attention.

- Keep track of what’s generating real buzz for competitors or peer companies.

Earned Media in the Social Age

Social media has become a cornerstone of the brand landscape. In a surprising twist, however, this shift to social has only increased the importance of viral earned media. Only half of consumers say they trust paid advertisements – but 92% trust earned media. This trust, coupled with the fact that a majority of social sharing is generated by only a few earned articles, makes identifying viral earned media paramount to staying ahead in brand awareness. Predictive Alerts are the best way to glimpse into your media future – what will you do with the extra time?

An Era of Change is Upon Us

Most people have heard the saying “the only constant in life is change.” Change comes at us from all directions, and it is relentlessly driven by the many events and factors that swirl around and impact us every day.

The communications profession certainly is not immune to the forces of change.

In fact, because of the coronavirus pandemic, many organizations are seeing unprecedented levels of change to their business models. Every department is being asked to adjust and innovate to weather the next 12-24 months until the world (we hope) passes through the pandemic. As a communicator, if you already have not been asked, it is likely you soon will be challenged to find a way to do business smarter, faster, and more efficiently. Unfortunately, efficiency is often sought out by trying to do the same work with fewer people who end up working longer hours.

But such a challenge also creates the perfect opportunity and motivation to rethink what you do and how you do it.

Times of transition are strenuous, but I love them. They are an opportunity to purge, rethink priorities, and be intentional about new habits. We can make our new normal any way we want.

– Kristin Armstrong, Three-Time Olympic Gold Medalist

Taking what some call a “zero-base approach” to your work can be a lifesaver. Zero-base planning means rethinking from scratch how you do your job, where you invest your resources, and how you make your team more focused and effective together. And frequently zero-base changes deliver a cathartic moment that pays huge dividends.

Fortunately, in the past few years things have changed in the world of media monitoring and analytics that make this approach to planning particularly effective right now.

Things Have Changed

In recent years, many of the world’s most sophisticated brands and their communications teams have chosen to embrace a new approach to communications analytics. Instead of relying on the approach from the early 2000’s – throwing technology blindly at the problem – they have moved forward to a new, proven method that utilizes the best that technology has to offer while respecting the unique abilities that humans have to interpret complex human communications.

Companies like Merck, Berkshire Hathaway, Exelon Energy, and many others – all with reputations for using the world’s best talent and technologies – have embraced this new approach. They have found through robust testing that it consistently generates more reliable analytics and much richer insights that make them smarter, more effective, and more efficient.

In short, people paired with technology delivered the exact improvements they were seeking.

The Evolution

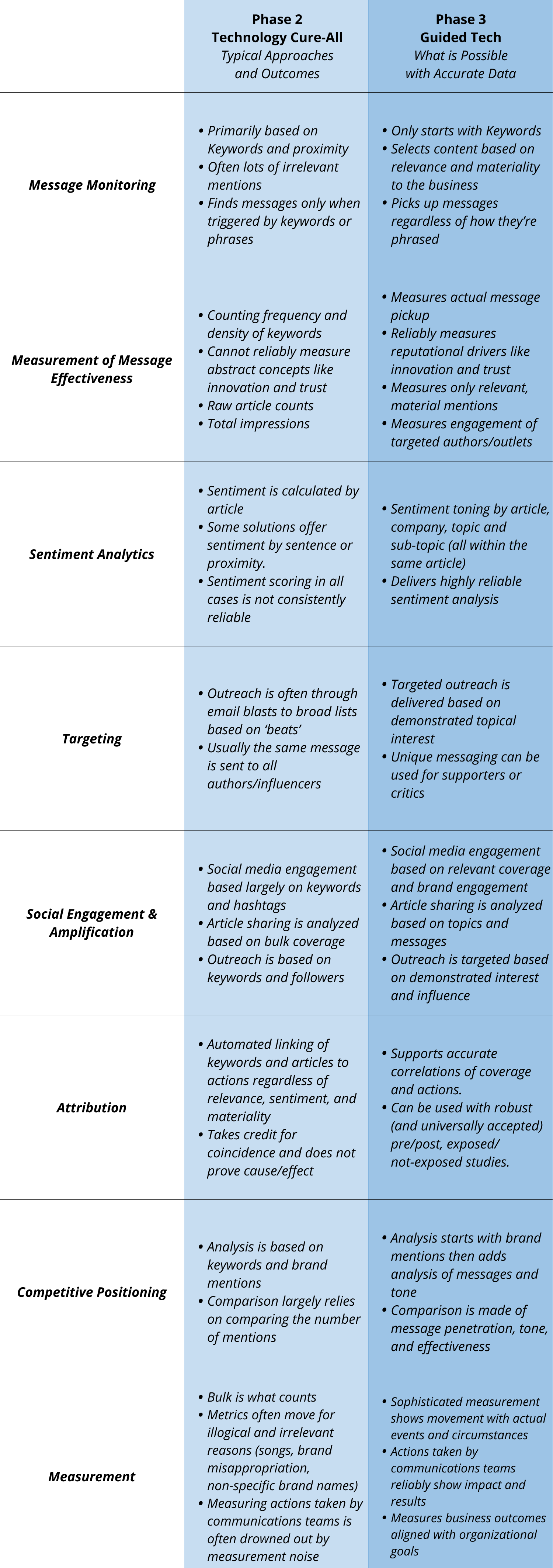

So how did we get here? The evolution of media monitoring and analytics has moved through three distinct phases over the past decades:

Phase 1: Big Books (1950-2000)

The world moved slower in these times, and so did communications. Monitoring was done manually, usually with thick clip books filled with physical copies of media coverage. It was not uncommon to wait weeks or months for metrics, and communications impact often was measured simply as the thickness of the clip book.

Often communications teams claimed success simply by talking about the stories that were written about the company and its executives. While that approach created great presentation theatrics, it rarely reflected the overall success of the communications effort accurately.

Some organizations also relied on (the now-discredited) Ad Value Equivalent, or AVE, a misguided attempt to equate news coverage with the value of ads that ran on those same pages or in the same broadcast segment.

But technology marched on, and scissors and tape no longer did the job.

Phase 2: Technology Cure-All (2000-2018)

This is the era that gave us the exponential growth of digital communications; during these years, email, text, and social media all came of age. Communications teams gained access to digital streams of any news content they desired, all delivered in an instant via the Internet.

Communicators jumped on the idea of instant analytics, and metrics became (sometimes obsessively) focused on counting mentions and impressions, regardless of the quality, context, or sentiment. Often with this model a headline story in the Wall Street Journal was counted the same as an irrelevant mention by a hobby blogger with 30 followers, and a keyword mention was considered equivalent to a complex message pickup by an influential writer.

On top of that, the endless pursuit of increasing impressions created a “hamster wheel” environment in communications teams, where the obsession to generate clips of any kind dominated what should have been a focus on strategic messaging and guiding public opinion. Compensation plans sometimes included counts of mentions as a key component for bonuses, leading communicators to push for stories of any kind regardless of messaging strategy and business impact.

Another approach favored by this automated model is so-called Attribution analytics. The problems with this automated attribution approach have been well-documented. In a nutshell, these attribution models use technology to connect dots in ways that do not hold up to the scrutiny of even a high school statistics class.

Over time there became an increasing awareness and acknowledgement of the severe limits of this all-tech approach. Technology was not delivering on its promise to reliably understand complex concepts and sentiment – both of which were (and are) absolutely critical to the communications function. Irrelevant articles were picked up, sentiment was frequently wrong, and complex concepts (like Innovation and Trust) were often completely missed, so the resultant data was bad.

“I don’t know what circle of hell bad data may be, perhaps it’s the third or fourth, but no matter what, who wants to live like that? No one.”

Steve Molis, Renowned Development Guru, Salesforce.com

In fact, multiple disciplines came to the same conclusion at the same time as corporate communicators, including software companies, self-driving trucks, delivery robots, medical diagnostics, and investment services. The conclusion was simple yet powerful: augmenting great technology with talented human resources was a killer application that consistently delivered the best balance of fast data and valuable, reliable insights.

Phase 3: Expert-Guided Tech (2018- )

We are now in the third generation of media monitoring and analytics – one that has moved to recognize the limitations of technology and that has embraced the value of human-technology collaboration. Industry after industry has embraced the marriage of fast technology paired with the unique creative, analytical, and introspective nature of human experts.

With this hybrid approach and the resultant quality data and deep insights, these professionals are able to make much better decisions, focus their resources, and achieve consistently better results. With this now proven superior capability and insight, Expert-Guided Tech has become the fastest-growing segment in the media monitoring and analytics sector.

As an aside, technologists still look to software to reduce human effort and cost whenever possible. Will technology ever replace humans in these roles and understand relevance, context, sarcasm, and underlying sentiment? These challenges may well be solved someday, but despite the claims of some bold marketers, the consensus among experts is that the General Artificial Intelligence to achieve this is at best decades away.

How far are we from general A.I.? I don’t think we even know enough to estimate. We would need dozens of big breakthroughs to get there, when the field of A.I. has seen only one true breakthrough in 60 years.

Kai-Fu Lee, Former President, Google China and Author of ‘AI Superpowers’

Going Forward

So what have we learned? Fundamentally, the model of the past 15 years – fully-automated, human-free measurement – did not deliver on its promise. And like in many other industries, the approach is being tossed aside by many of the smartest minds in corporate communications. These experts have also realized that chasing mentions, keywords, and impressions is not the best use of their time and talent: every year the team was tasked to lift these (largely meaningless) counts even higher; no matter how hard they ran, they were just going nowhere fast.

Now is the time to turn over a new leaf. Things have changed, and you need to make the choice to evaluate moving to Expert-Guided Tech and seeking higher-quality data and analytics.

Quality data is cited regularly by its proponents as being more focused, less stressful, and more efficient with limited resources. They also regularly brag about newfound strength in measuring their impact, being more competitive, and proving their worth in the organization. The approach gives Communications an equal seat at the table with more data-driven disciplines like Marketing, Sales, and Technology.

As an added bonus, this approach, when all resources are measured, is frequently less expensive than the Technology Cure-All approach. In short, reliable tech-human analytics has provided a more effective communications strategy, better measurement of impact, and a leaner, higher-performing team.

Do something today that your future self will thank you for.

Anonymous

How Does Expert-Guided Tech Change My World?

Many aspects of the communications function take on new characteristics of precision and focus when the power of technology is paired with the ability of humans to understand and interpret communications.