With Pride Month well underway, it’s a timely moment to reflect on the state of DEI in finance. Luckily, the findings from PublicRelay’s Q1 2025 Finance Benchmark Report offer a revealing snapshot marked by both progress and pullback.

The Disconnect Between Policy and Perception

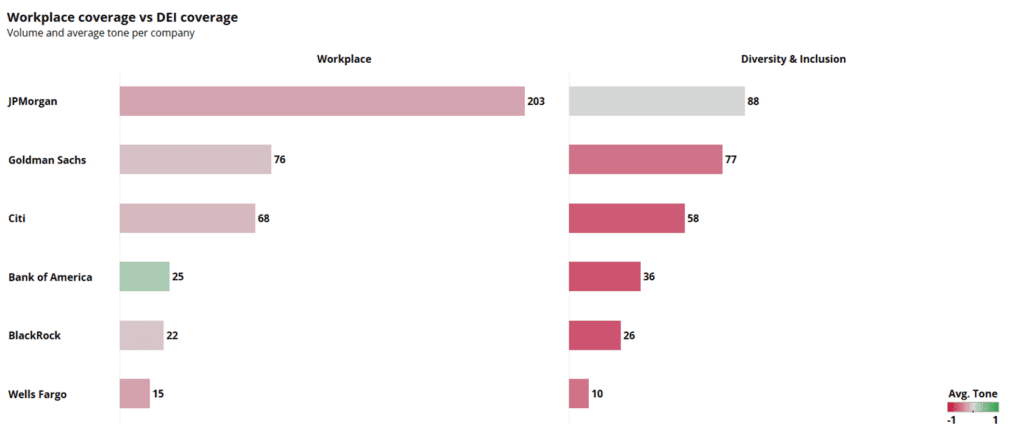

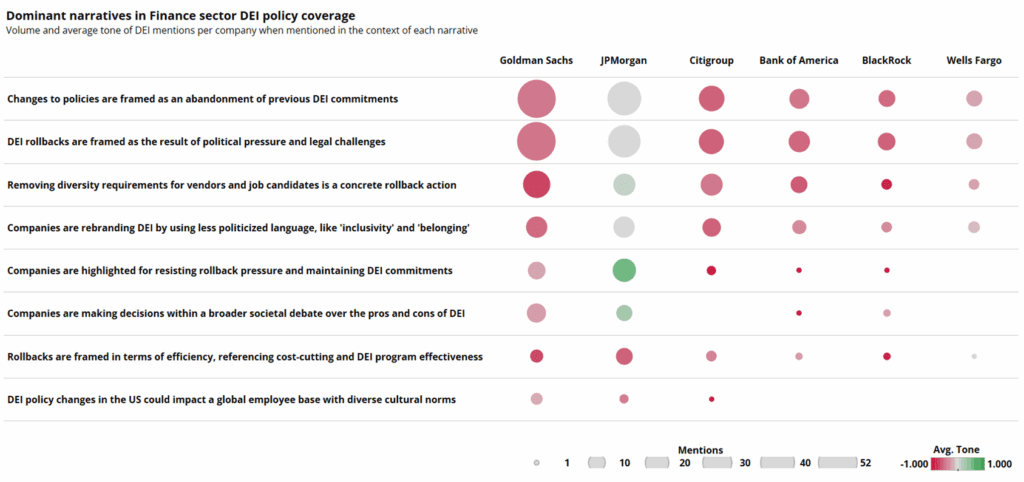

Despite strong earnings and innovation-driven headlines, many financial institutions found themselves under the media microscope for scaling back their commitments to diversity, equity, and inclusion. The report highlights that diversity and inclusion in finance remains a reputational flashpoint, with DEI rollbacks drawing significant scrutiny.

Interestingly, this scrutiny didn’t always translate into internal backlash. In many cases, workplace sentiment remained neutral or even positive, suggesting a disconnect between how DEI decisions are perceived externally versus how they are experienced internally. This gap presents an opportunity for financial institutions to better align their messaging with their values.

Symbolism vs. Substance in DEI Commitments

One of the most revealing takeaways from the report is how surface-level changes, such as editing DEI language or quietly removing inclusive content, are being interpreted. Rather than being seen as strategic repositioning, these actions are often viewed as capitulating to political pressure. In the eyes of the media and stakeholders, this signals a retreat from core values.

For companies looking to lead during Pride Month, this is a critical lesson. Pride Month corporate responsibility isn’t about rainbow logos or one-time donations. It’s about demonstrating a sustained, authentic commitment to equity and inclusion. Symbolic gestures, while visible, are no substitute for meaningful action.

Leadership Matters: The Case of JPMorgan

Leadership plays a pivotal role in shaping the narrative around DEI in finance. Jamie Dimon, CEO of JPMorgan, offers a compelling example. While the bank did implement significant DEI policy changes, Dimon’s vocal support for diverse communities helped mitigate negative sentiment. His public stance was framed as a refusal to cave to political and legal pressures, reinforcing the importance of executive visibility in maintaining trust.

This underscores a broader truth: in times of reputational risk, leaders who speak clearly and consistently about their values can help steer the conversation in a more positive direction.

The Path Forward: From Compliance to Culture

During Pride Month and beyond, financial institutions have an opportunity to reaffirm and act on past commitment to diversity and inclusion. According to the data, this is the most likely route to avoiding negative coverage in the media and with stakeholders. Companies that remain transparent and consistent in their DEI efforts are more likely to earn the trust of employees, customers, and investors alike, bolstering their reputations in the process. In sum, values-driven leadership is good ethics and good business.

Communications teams rely on precise data to navigate complex stakeholder sentiment. For decades, polling has been a cornerstone of this effort, providing valuable, quantifiable benchmarks of opinion. However, in today’s 24/7 information cycle, relying exclusively on this static and inconsistent methodology to understand how stakeholders view your brand is insufficient.

From a data science perspective, polling presents two core challenges: data latency and potential sampling bias. The insights are inherently retrospective—a snapshot of a moment in time. By the time the data is collected and analyzed, the narrative ground may have already shifted. This is compounded by the high cost of frequent polling and the inherent difficulty in surveying specific, influential stakeholders like policymakers who are often media-driven but survey-averse.

While valuable, surveys should not be your only sentiment collection method. The path to a more robust strategy lies in augmenting polling data with more timely media intelligence.

By applying sophisticated modeling to a daily firehose of traditional and social media, we transform millions of unstructured data points into a structured, continuous signal of stakeholder sentiment. This model is not a replacement for polling, but a vital complement that fills the critical gaps between your surveys.

This dynamic signal helps capture emerging narratives and subtle shifts in public perception—often before they show up in polling data. That’s especially critical in the context of issues or crisis management, where early detection of minor negative turns in sentiment can provide a crucial window to act. Without this visibility, by the time a poll reflects trouble, the situation may already be escalating.

When it comes to media intelligence vs polling, the smartest approach is not choosing one over the other, but combining them. When integrated, these two datasets provide a more complete, contextualized understanding. The poll offers the “what”—a structured measure of opinion. The media data provides the “why”—the daily narrative drivers and sentiment shifts influencing that opinion.

Most importantly, this media signal functions as a leading indicator for your survey data. PublicRelay analysis consistently shows that sustained shifts in media sentiment and narrative are predictive of future polling outcomes. This foresight offers a significant strategic advantage:

- Anticipate Outcomes: By tracking the daily media signal, you can forecast the likely results of your next survey, allowing your team to prepare and manage expectations.

- Enable Proactive Intervention: More powerfully, this early warning allows you to move from a reactive to a proactive posture. Identifying an emerging negative narrative in the media data gives you a crucial window to intervene, launching a targeted communications strategy to reshape the conversation before that sentiment solidifies and is reflected in your polling.

Fusing these two data streams—media intelligence vs polling—provides a more resilient, predictive, and strategically sound foundation for modern communications. It allows you to understand, anticipate, and ultimately shape stakeholder perspectives with greater precision and confidence.

PublicRelay’s Media Significance Score (MSS) moves beyond outdated media metrics to give communications leaders a smarter, more actionable way to evaluate earned media.

This powerful, single score combines human analysis and multi-dimensional data to reveal how impactful your coverage really is—across tone, topic depth, outlet quality, social engagement, and reach.

Whether you’re benchmarking performance, reporting to the C-suite, or refining your messaging strategy, MSS helps you focus less on volume and more on value.

Download the guide to learn more about PublicRelay’s Media Significance Score.

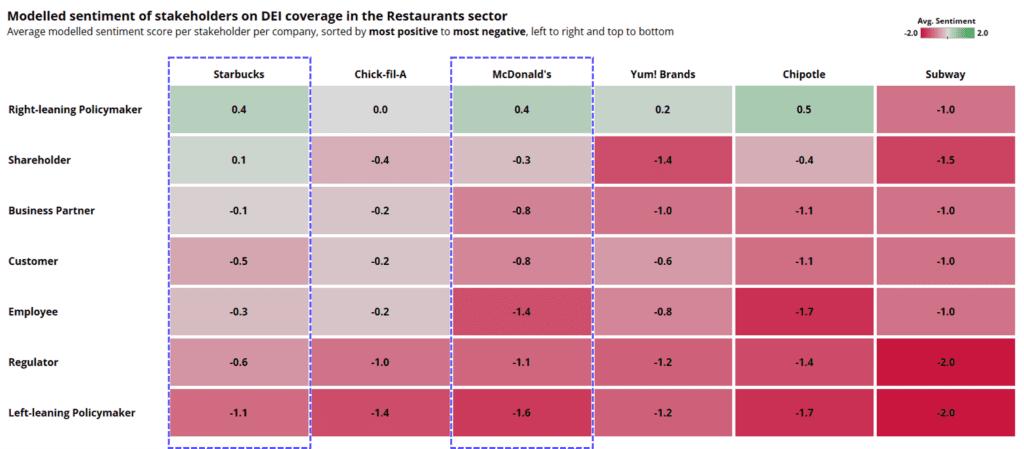

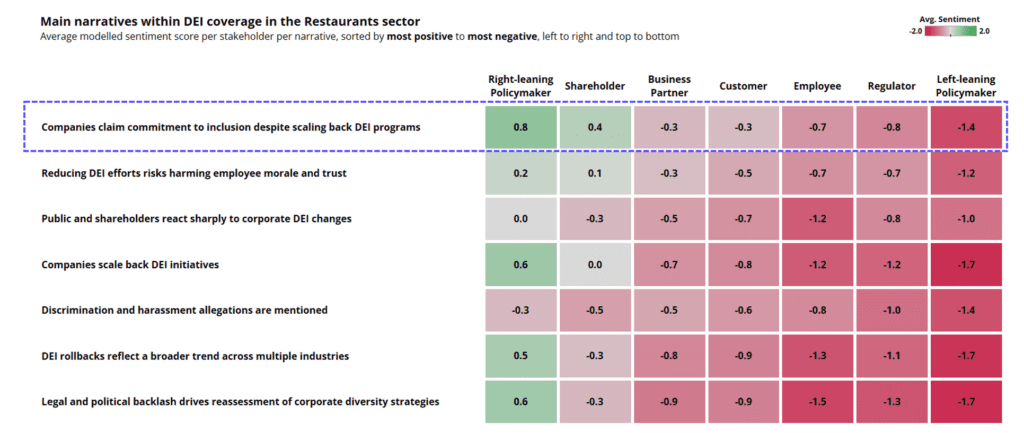

Diversity, Equity, and Inclusion (DEI) remain critical pillars for corporate reputation, especially in industries as public-facing as the restaurant sector. PublicRelay’s Q1 Benchmark 2025 dataset, which analyzed media from 50 companies across nine sectors, shines a spotlight on how DEI initiatives (or the rollback of these initiatives) impact corporate reputation through the eyes of key stakeholders. Using a stakeholder-centric methodology, PublicRelay examined media sentiment across seven key personas: Customers, Shareholders, Employees, Business Partners, Regulators, Left-Leaning Policymakers, and Right-Leaning Policymakers.

Methodology: Understanding Stakeholder Perceptions

Using PublicRelay’s AI-enabled model, our Insights & Analytics team analyzed high-relevance articles published in the Top 50 English-language outlets, assigning sentiment scores ranging from -2 (very negative) to +2 (very positive). Unlike traditional sentiment analysis, which aggregates public opinion broadly, this model assesses sentiment specifically from each stakeholder perspective, allowing for nuanced insights into how different groups react to DEI narratives.

This multi-dimensional analysis provides companies with a granular understanding of reputation risks and opportunities tied to DEI. For example, while policy rollbacks might receive tepid reactions from shareholders, they can trigger sharp negativity among employees or left-leaning policymakers. This divergence underscores the importance of targeted messaging that considers stakeholder-specific concerns.

Key Findings: Stakeholder Reactions to DEI in the Restaurant Sector

1. Starbucks and McDonald’s: Leaders in DEI Narratives

Despite media coverage of policy changes, Starbucks and McDonald’s maintained some of the most positive DEI sentiment. Starbucks’ rollback of its open-door policy generated surprisingly limited backlash, largely due to messaging around employee safety concerns, transparency around the new guidelines, and reiterating that this policy has long been common among retailers. In contrast, McDonald’s policy adjustments concerning staff and suppliers were met with sharper criticism, particularly from employee-focused narratives. The company tempered this by referencing its progress on prior DEI goals and commitment to inclusion in a widely released note.

2. Silent Players: Flying Under the Radar

Brands like Yum! Brands and Chipotle managed to avoid significant negative coverage despite DEI-related controversies. For example, Yum! Brands appeared on a Trump administration “hit list,” yet received minimal individual media attention. Chipotle removed DEI language from its annual report, but its refusal to comment effectively stunted media momentum.

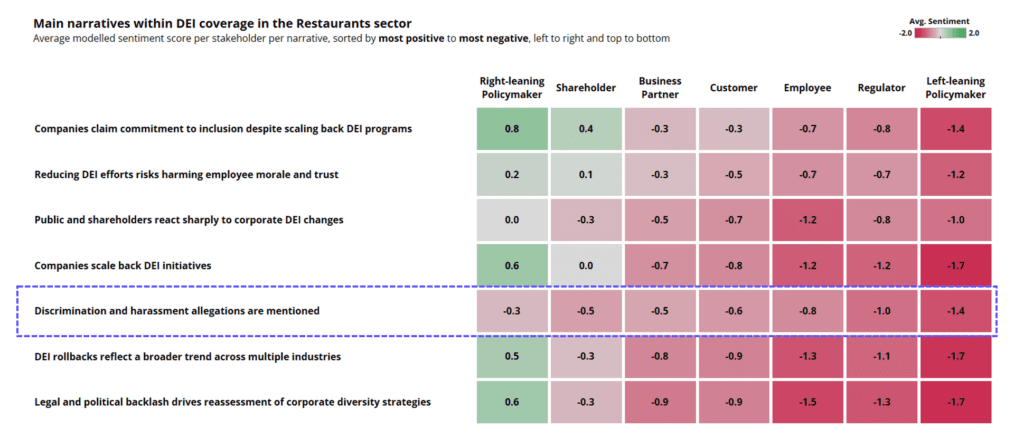

3. Political Influence on DEI Perception

One of the more surprising findings was the consistency of negative sentiment around discrimination allegations even among right-leaning policymakers. This indicates that DEI missteps transcend political alignment, reinforcing that discrimination narratives are broadly reputationally damaging.

4. The Impact of Positive DEI Messaging

Mentions of company commitments to inclusion can moderate reactions to reported DEI rollbacks across nearly all stakeholder groups.

Shifting Narratives: How DEI Messaging Can Mitigate Reputational Risk

The data reveals that not all DEI-related coverage is equal. Companies that preemptively communicate their commitment to diversity and equity—especially during policy shifts—are better positioned to temper backlash. For brands navigating DEI changes, aligning messaging with core values and stakeholder expectations is crucial.

Communicate Continuity, Not Just Change

When companies announce DEI rollbacks or adjustments, framing the conversation around ongoing commitments can mitigate negative reactions. As we’ve seen, McDonald’s was able to somewhat cushion backlash by referencing prior DEI achievements and its long-term inclusion goals. This contextualizes the change as part of a broader, evolving strategy rather than an abandonment of principles.

Leverage Leadership Voices

Adding authentic statements from CEOs or other executives can lend credibility to inclusion commitments. Media coverage that included executive-level assertions of company values saw more balanced stakeholder reactions, as it provided a counter-narrative to headlines focused solely on policy changes.

Anticipate Stakeholder Reactions

Understanding the specific concerns of different stakeholders allows companies to craft more resonant messages. Shareholders, for example, leaned more neutral to rollback announcements, contradicting media assumptions that these moves would be positively received. Meanwhile, employees and policymakers were notably more reactive to discrimination-related coverage.

Avoiding the Media Frenzy

Brands like Chipotle demonstrated that strategic silence can sometimes be effective. By declining to comment on DEI language removal, Chipotle prevented the story from gaining traction. While not always a viable strategy, selective engagement with the media can minimize narrative escalation.

Conclusion: Prioritizing Perception

For companies in the restaurant sector, DEI narratives carry significant reputational weight. Proactive communication, stakeholder-centric messaging, and strategic leadership involvement can help mitigate backlash and maintain positive sentiment across key personas. In an era where DEI is both a corporate expectation and a media focal point, mastering the narrative is essential for brand resilience.

Learn more about how PublicRelay’s Benchmark insights can guide your stakeholder strategy. Connect with us.

Opportunities are emerging as companies commit record capital towards powering data centers. The media has been highly receptive to communications around co-location deals as AI continues to command the news cycle. But, utilities also face reputational risks as reporters call attention to rising rates amid growing consumer anxiety.

This report aims to uncover emerging trends, opportunities, risks across the utility industry media landscape.

To generate data for this analysis, PublicRelay analyzed the earned media of over 30 utilities across the portfolios of 13 holding corporations. The companies chosen as a part of the analysis service residential customers spanning the Continental United States.

By reading this resource, you’ll learn why:

1) Utilities succeed when communicating on innovation, grid resiliency, and community impact.

2) You should pitch alternative energy projects as an investment into energy security and diversification.

3) You should center your AI messaging strategy around American leadership and local support.

4) Showing support for vulnerable populations and small businesses impacted by high bills is a winner for reputation.

5) Direct bill relief efforts set up communications opportunities.

Download the report

A company’s reputation is influenced by a diverse set of stakeholders, including employees, investors, customers, regulators, business partners, and policymakers. How does media coverage impact each of these groups? Join us for an exclusive 20-min webinar where we’ll unveil key findings from PublicRelay’s latest research on stakeholder sentiment.

Using data-driven insights from our Benchmark, we’ll explore:

- How different stakeholder groups perceive companies in the media and how their sentiment varies.

- Which stakeholders are most sensitive to media narratives and why their reactions are the most volatile.

- Why customers often remain undecided and what this means for corporate messaging.

- How sentiment shifts over time and what it reveals about reputation management strategies.

This report walkthrough will provide PR and communications leaders with actionable insights to navigate stakeholder sentiment effectively. Take this opportunity to sharpen your media strategy and better understand the audiences shaping your corporate reputation.

Host: Haley Wilson, Strategic Partnerships Lead at PublicRelay

Watch On-Demand Here

Watch On-Demand

This 25-minute webinar discussed the complex intersection of geopolitics and corporate reputation.

Using data-driven insights from PublicRelay’s benchmark, we explored when and how companies should engage in geopolitical discourse, balancing risk, reputation, and stakeholder expectations.

Watch on-demand to:

- Learn data-backed strategies for managing corporate reputation in a volatile geopolitical landscape.

- Hear insights on balancing stakeholder pressures while minimizing reputational risk.

- Gain a framework to assess whether your company should engage on a given issue.