The Olympic Appeal: A Media Opportunity Like No Other

With the 2024 Paris Paralympics set to start soon and focus quickly shifting to the 2026 Winter Games in Milan and the 2028 Games in Los Angeles, many PR and Communications executives are preparing to capitalize on the opportunities the events provide for brands with Olympic media coverage.

The Olympics offer a golden stage for brands to showcase their message to a global audience. As one of the most-watched events globally, the Olympics had 30.6 million viewers in 2024. The sheer number of eyeballs glued to screens worldwide offers an unparalleled platform for brands to showcase their messages.

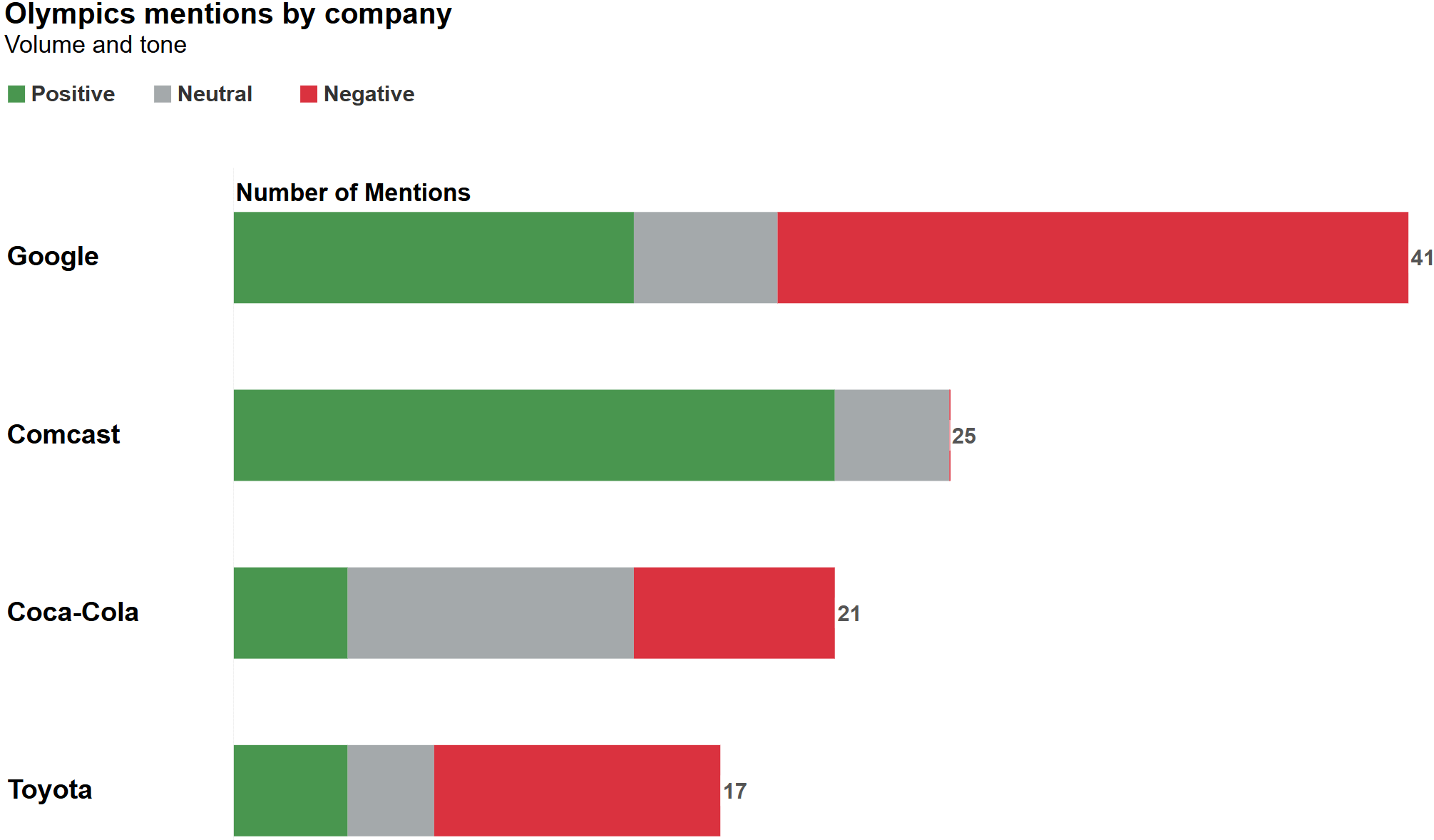

One company that seems to have benefited greatly in media coverage of their Olympic support was Comcast. Every mention we analyzed was either neutral or positive in tone. In fact, there were glowing accounts of Comcast’s Peacock app coverage, their use of shortform content on social media, and more.

For smaller brands as well, the Olympics can be a game-changing opportunity. A well-executed campaign can introduce a brand to millions, creating lasting impressions that can drive business growth.

However, this high visibility can also attract unwanted attention.

Our analysis of corporate media coverage around the Paris games surfaced some insights that could help communicators make the most of these upcoming opportunities and avoid the potential risks involved.

The Dark Side of Olympic Media Coverage

While the Olympics offer immense opportunities, they also come with significant risks. A lot of eyes can be great for a winning campaign – or it can go down in history as an utter failure. Further, controversies that extend beyond sports often surround the games.

The Consequences of a Misfired Campaign

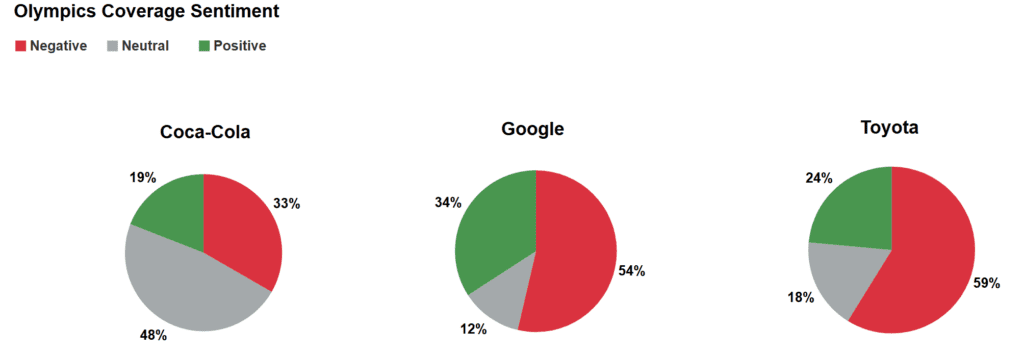

Given the visibility of the Olympics, there are elevated stakes for high media uptake on a brand campaign. A campaign that missteps in tone can have an effect opposite the desired brand impact. This year, one of the more visible misfires was Google’s Gemini advertisement, which Google pulled from the Olympics airwaves after backlash in the media. While it seemed intent to represent a cute interaction between a child and her role model, it was accused of endorsing “automation instead of authenticity” over the use of AI to write a fan letter, something which many could argue goes against the Olympic spirit.

Another example of Olympic sponsorship backlash involves Toyota’s use of hydrogen-powered cars as official transport vehicles during the games. While the initiative intended to showcase Toyota’s commitment to sustainable technology, environmentalists criticized it, arguing that the vehicles were not as green as they appeared. Critics pointed out that hydrogen production often relies on non-renewable energy sources, making the cars less environmentally friendly than their all-electric counterparts. This criticism was covered in major outlets, and serves to highlight the complexities of promoting innovative green technology on a global stage. It also underscores the risk of backlash when a sponsor’s environmental claims do not fully align with public expectations.

We also see this misalignment with Olympics sponsor Coca-Cola. The company was hit with negative coverage on multiple fronts around their support of the Games. At an event deemed “one of the most eco-friendly Games in history”, Coca-Cola, came under fire from environmental groups and athletes alike for its use of plastic, warranting an official response from the company. Then, in another instance, health experts called Coca-Cola’s role as a sponsor in general into question. They claimed the organization was “sportswashing” its generally unhealthy products by aligning with the athletic endeavors of the Olympics.

The Decline of the Olympic Brand

Toyota again made headlines for its decision to end its sponsorship of the Olympics after Paris 2024. The company’s withdrawal from Olympic sponsorship highlights two significant reputational risks associated with sponsoring the games: geopolitics and athlete welfare.

Firstly, the geopolitical landscape surrounding the Olympics has become increasingly fraught. The games are often mired in scandals, corruption, and controversies over host nations’ human rights records. Toyota, like many global brands, found its reputation at risk by being linked to these issues. This was especially true during the Tokyo 2020 games, which faced heavy criticism for proceeding amid the Covid pandemic and local corruption scandals. Increasing geopolitical instability means Olympics sponsors are likely to face more reputational challenges related to these issues in the future.

Secondly, Toyota was concerned about how its sponsorship money was allocated, with reports indicating that funds were not effectively used to support athletes or promote sports. This misalignment with the company’s values led Toyota to conclude that the risks of continuing its sponsorship outweighed the potential benefits.

In Summary: The Complex Landscape of Olympic Branding

The Olympics present a unique media opportunity for corporate branding, but the landscape is fraught with challenges. The Olympics has two main types of PR risks:

- External risks in terms of the controversies the Olympics brand itself attracts, and –

- It is also likely to magnify preexisting reputational issues due to the heightened visibility.

While at face value the Olympics bring about an image of excellence, friendship, and respect – values any company would be proud to associate with – global realities and stakeholder expectations adds more to the picture that communications leaders should be aware of.

To learn more about our research and analysis, contact us here.

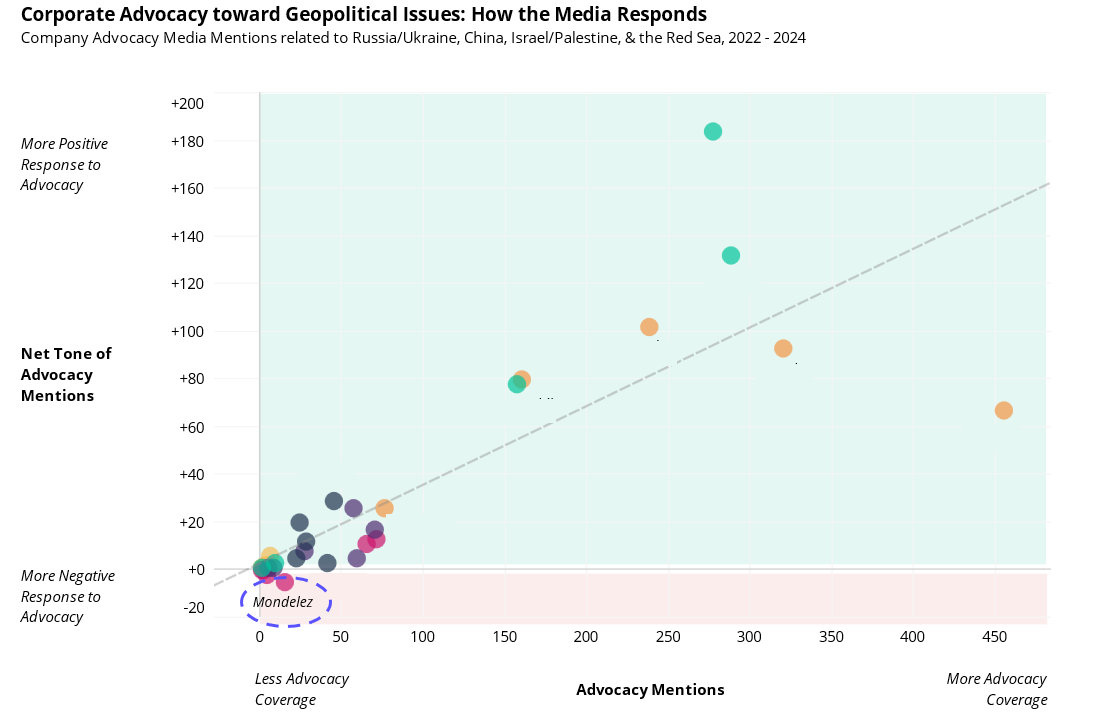

The alignment between a company’s public statements and its actions has never been more crucial. Reputation-reality gaps, i.e., inadequate actions to back up PR statements, are increasingly seen as hypocritical, damaging brand reputation, trust, and loyalty. An example that underscores this is the response to Mondelez following the invasion of Ukraine.

The company publicly announced intention to scale back operations in Russia, aligning with global sentiments against Russia and showcasing solidarity with the Ukrainian cause. However, despite its statements, the company continued to generate revenue and pay taxes in Russia. This discrepancy between its public commitments and ongoing business activities created a significant reputation-reality gap.

Consumers, especially in Europe, took notice. The perceived hypocrisy led to boycotts of Mondelez products across the continent. These boycotts weren’t just a fleeting reaction but a clear message from the public: companies must practice what they preach.

The situation with Mondelez (and Unilever, and Heineken, and more) serves as a stark reminder of the importance of consistency between words and actions. For brands, maintaining credibility requires more than just making the right statements.

The Importance of Alignment

In the age of information, consumers are more informed and empowered than ever before. They have access to a wealth of information at their fingertips and are increasingly holding companies accountable for their actions. Social media platforms amplify their voices, enabling them to share their opinions and mobilize others quickly.

For businesses, this means that the stakes are higher. Public statements are scrutinized, and any discrepancy between what a company says and what it does can quickly become a focal point for criticism.

When Mondelez announced its decision to scale back operations in Russia, they likely intended to align with global sentiments and show support for Ukraine. However, the continued revenue generation and tax payments in Russia told a different story. The gap between words and actions was seen as hypocritical, and the backlash was swift.

The Consequences of a Reputation-Reality Gap

The boycotts of Mondelez products in Europe highlight the tangible consequences of a reputation-reality gap. Boycotts can lead to a significant loss of revenue and market share. More importantly, they can damage the long-term relationship between a brand and its consumers.

When consumers feel that a company has been dishonest, their trust in that brand erodes. Trust is a fundamental component of brand loyalty. Once it’s broken, it’s incredibly challenging to rebuild. This is especially true in today’s competitive market, where consumers have numerous alternatives to choose from.

Moreover, the impact of a damaged reputation extends beyond just consumers. Investors, partners, and employees also take note of these discrepancies. A company that is perceived as hypocritical may struggle to attract and retain top talent. Investors may lose confidence in the company’s leadership and long-term strategy. Partners may reconsider their relationships, fearing that association with a discredited brand could harm their own reputation.

Lessons for Communicators and Business Leaders

The Mondelez case offers several important lessons for communicators and business leaders:

- Ensure Consistency Between Words and Actions: It’s not enough to make the right statements. Statements must align with actions, and communicators should inform other leaders within the organization of the importance of this consistency.

- Be Transparent: If there are challenges or limitations to what a company can do, it’s better to be upfront about them. Transparency builds trust and shows that the company is committed to being honest with its stakeholders.

- Monitor and Respond to Public Sentiment: It’s essential to stay attuned to public sentiment. Companies need to monitor media to understand how their actions and statements are being received. Prompt and appropriate responses can help mitigate potential backlash.

- Prepare for Crises: Despite the best efforts, crises can still occur. Companies need to have a robust crisis management plan in place to respond quickly and effectively. This includes having a clear communication strategy to address any gaps between words and actions.

Moving Forward

The case of Mondelez is a powerful reminder of the importance of aligning public statements with actions. In today’s interconnected world, consumers, investors, and other stakeholders are more vigilant and vocal than ever before. They expect companies to live up to their commitments.

For companies, this means that maintaining credibility requires a concerted effort to ensure that actions consistently align with words. It’s about being genuinely committed to the values and principles that the company espouses.

By doing so, companies can not only avoid the pitfalls of a reputation-reality gap but also build stronger relationships with their stakeholders. This in turn can lead to greater long-term success.

The high cost of a reputation-reality gap underscores the need for companies to act with integrity and consistency. The backlash faced by Mondelez and other companies serves as a cautionary tale for all businesses and a reminder that in today’s world, actions speak louder than words.

To learn more about ways you can measure and manage your reputation, contact us here.

In today’s interconnected world, geopolitical events often create ripple effects that reach far beyond their points of origin. For corporations, this interconnectedness means that events on the global stage can impact stakeholders, influence brand perception, and necessitate a response.

Navigating these waters requires careful consideration and strategic decision-making. For PR and Communications executives, the question becomes: when and how should we engage in corporate advocacy around a geopolitical issue?

This guide will help you determine the right course of action for your organization.

Download our supplemental worksheet, “Should I Speak Out?”

1. Identify Which Stakeholder(s) This Geopolitical Issue Affects

The first step in addressing a geopolitical event is to identify the stakeholders impacted by the issue. Stakeholders can include employees, customers, investors, partners, and more. Each group may be affected differently, so understanding these nuances is crucial. For example:

- Employees: Consider whether your employees are from or have ties to the region affected by the event. Their safety, well-being, and morale might be at stake.

- Customers: Evaluate if your customer base includes individuals or businesses in the affected region. Consider their potential concerns and sentiments.

- Investors: Assess whether investors are likely to be impacted financially or have ethical concerns about the geopolitical event.

- Partners: Determine if your business partners operate in or are connected to the affected area, influencing supply chains or collaborative ventures.

2. Determine Which Values the Stakeholder Holds Regarding the Geopolitical Issue

Understanding the values and desired outcomes of your stakeholders is essential. This step involves gauging their perspectives and expectations regarding the geopolitical event.

Questions to Consider include:

- Do stakeholder preferences vary by region? For instance, a geopolitical issue might be viewed differently in Europe compared to Asia.

- Does the stakeholder’s values or outcomes overlap with a social or political stance? This could include issues such as human rights, environmental concerns, or economic impacts.

- Has this stakeholder voiced concerns already? This can be through direct communication, social media, or public statements. Listening to these voices can provide valuable insights into their priorities and expectations.

3. Answer Yes or No: Does our organization share any common values with the stakeholder, and does our organization support the stakeholder’s preferred outcomes?

After identifying stakeholder values, the next step is to evaluate your organization’s alignment with these values and outcomes.

- Common Values: Analyze whether your organization’s core values resonate with those of your stakeholders. Shared values form the foundation for credible and authentic advocacy.

- Support for Outcomes: Determine if your organization supports the preferred outcomes of the stakeholder. This alignment is crucial for building trust and ensuring that any corporate advocacy efforts are seen as genuine and not merely performative.

4. Answer Yes or No: Does our organization have a track record of specific actions that are consistent with its shared values with the stakeholder?

Consistency between words and actions is vital for credible corporate advocacy.

- Internal Actions: Review your organization’s internal policies, initiatives, and culture. Have you historically taken actions that align with the values and outcomes of the affected stakeholders?

- External Actions: Consider your organization’s external engagements, such as partnerships, community involvement, and public statements. A track record of external actions that support shared values enhances credibility and demonstrates a genuine commitment.

These are important to understand and align with, because failure to do so can lead to negative media coverage. For example, Meta, has been called out for overreaching with oversized censorship of content related to Palestine, which is out of line with their community guidelines.

5. Answer Yes or No: Does our organization have specific actions it can or will take?

Are those actions:

- Impactful to the Geopolitical Issue: Assess whether your organization can take actions that meaningfully impact the geopolitical issue. This could involve financial contributions, advocacy, or operational changes.

- Consistent with Shared Values: Ensure that these actions are consistent with the shared values between your organization and the stakeholders.

- Able to Satisfy Stakeholder Outcomes: This involves understanding their expectations and aligning your actions accordingly.

For example, mere days after the Russian invasion of Ukraine, Shell announced its exit from approximately $3 Billion worth of stakes in Russian-situated assets, while Netflix suspended service in Russia. Both actions cost the corporations money, but were viewed positively by stakeholders who were against Russia’s actions.

Evaluating the Decision

For steps 3 through 5, if you answered YES to all, your organization has a story to tell that is impactful to the geopolitical conflict and your affected stakeholder. You should engage in corporate advocacy.

If you answered NO to 1 or 2 questions: Assess the areas where your organization is falling short or disagrees with the affected stakeholder. Those are areas of potential risk to engaging in corporate advocacy that communicators should prepare for.

If you answered NO to ALL: It’s likely best that you don’t speak out. The risk of backlash from the stakeholder is greater than the reward.

Assessing Broader Implications

After completing steps 3 through 5 for each stakeholder group, ask yourself whether engaging in geopolitical advocacy will alienate or threaten your standing among other stakeholders. This is to ensure your stakeholders are aligned. This is relatively straightforward – if the answer is YES, it will alienate other stakeholders, then there’s high risk of backlash that you should prepare for. If the answer is NO, and your stakeholders are aligned, you should have a low chance of negative reactions and can feel comfortable speaking out.

Other Questions to Consider When it Comes to Corporate Advocacy:

- Is this the first time you are speaking out? Consider the precedent you are setting. If this is the first time your organization is engaging in corporate advocacy, ensure that you have a robust strategy and clear communication plan.

- Will speaking out now land with your stakeholders? Are you too late to the conversation? Timing is critical. Engage early to avoid being perceived as reactive rather than proactive.

- Are you backing up your advocacy with specific actions? Advocacy without actions creates a risk of backlash. Where possible, ensure that your statements are supported by concrete actions to avoid being seen as insincere or opportunistic.

Planning Your Response

Prepare to communicate your shared values and your track record of actions to address concerns brought by disaffected stakeholders. This involves crafting clear, transparent, and empathetic messages that acknowledge their perspectives and outline your commitment to addressing the issues. At certain times, company values might dictate a response regardless of the outcomes of the above process, so your best course of action will be to prepare. Consider how you’ll respond to reactions, whatever they may be.

Conclusion

Engaging in corporate advocacy around geopolitical events is a complex and nuanced decision. By following this structured approach, PR and Communications executives can make informed choices that align with stakeholder values, support meaningful outcomes, and enhance organizational reputation. Remember, the key is to ensure that your advocacy is authentic, backed by action, and considerate of the diverse perspectives within your stakeholder community. Be prepared for potentially negative responses if your company values are at odds with what certain stakeholders may be looking for.

As you navigate this process, stay attuned to the evolving geopolitical landscape and be prepared to adapt your strategies. Effective corporate advocacy not only addresses immediate concerns but also builds long-term trust and credibility with your stakeholders.

To learn more about the research that supported the creation of this blog, contact us here.

The recent CrowdStrike outage has generated significant media coverage. We examined how various sectors and companies were mentioned to gain insight into the media’s priorities and their brand impact.

In short – and rather unexpectedly – the event had minimal negative impact on most companies’ media coverage, while for some, coverage was actually brand-positive.

Essential Services and Media Focus

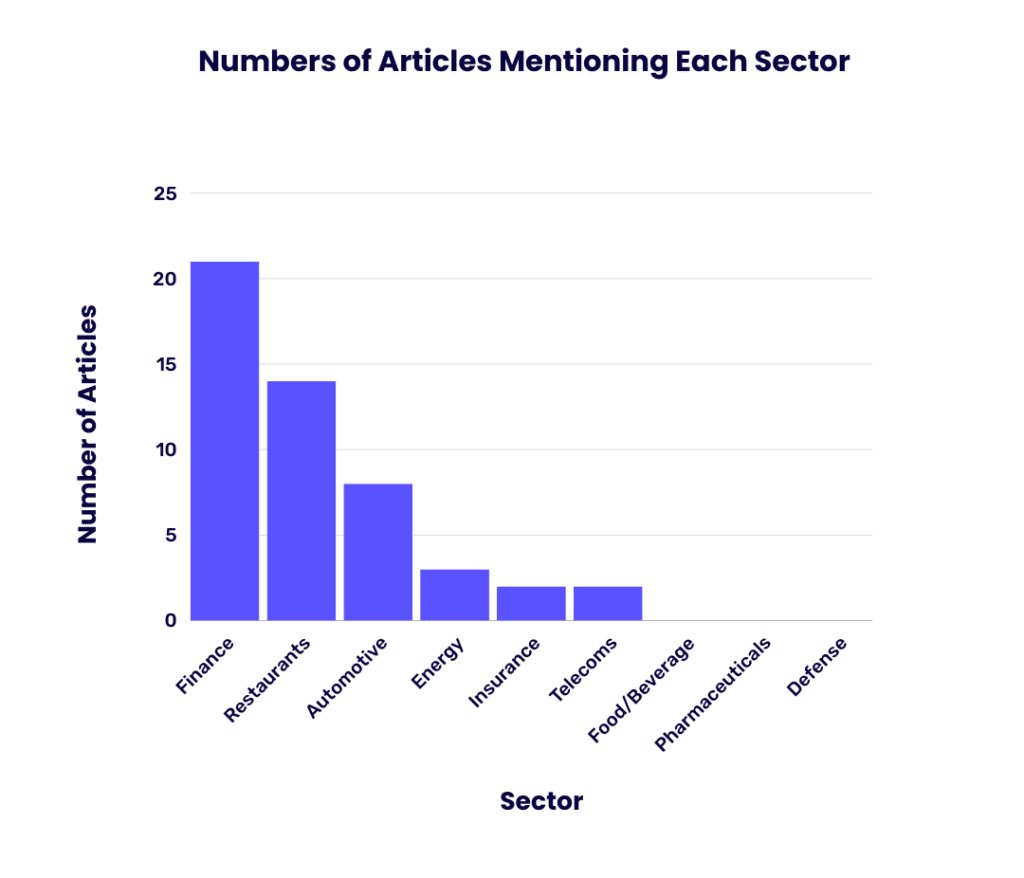

We analyzed coverage of the CrowdStrike story across all the sectors in our Benchmark dataset, which tracks 49 global organizations across 9 industries, and found surprisingly low volumes across all of our non-Tech sectors.

However, our data shows the Finance sector was mentioned most out of our tracked industries, following a broader pattern where coverage gravitated toward sectors where disruption was most palpable to the public, such as everyday banking services.

Most coverage about the CrowdStrike outage focused on disruptions to time-sensitive essential public services like transport, healthcare and emergency services. A prominent example in transportation is Delta, who even 5 days after the incident is still having to cancel flights due to the issue, generating sustained media coverage as a result. Nonessential businesses, on the other hand, were generally spared scrutiny.

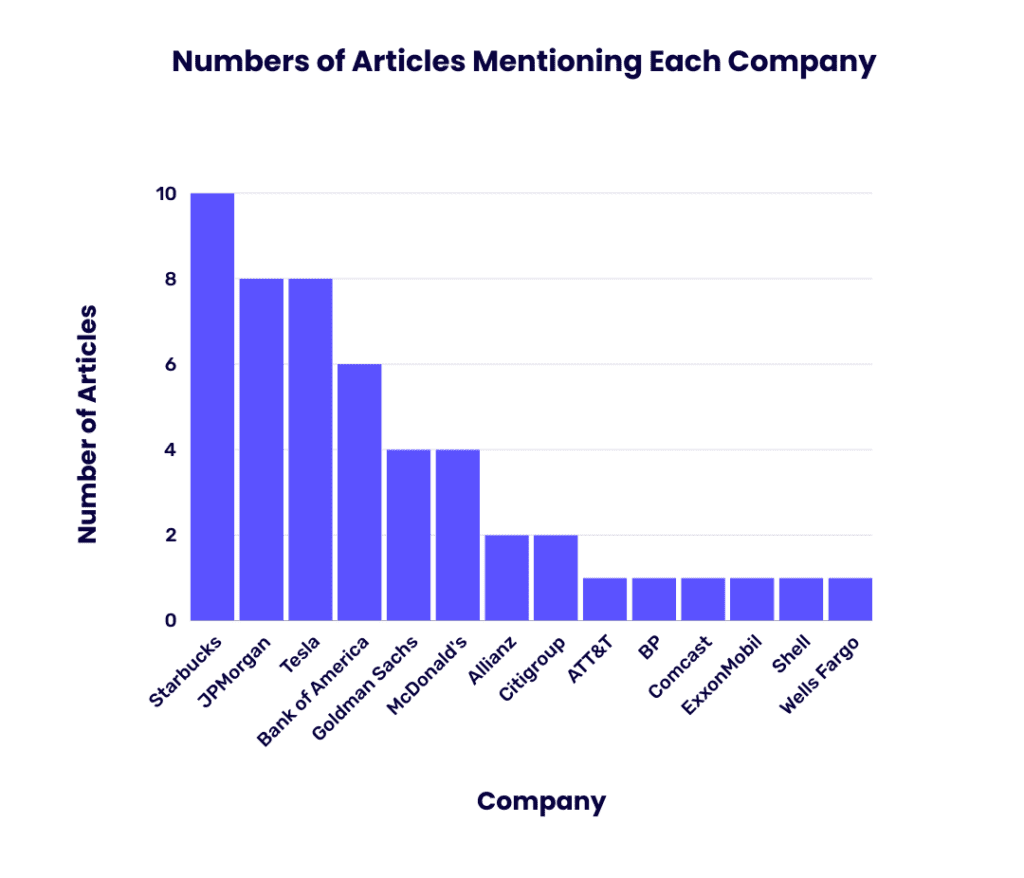

Starbucks: The Unexpected Essential Service

A deeper dive into the data by company surfaced Starbucks as the most mentioned brand, with 10 articles covering the impact of the outage on its services. This is striking given that Starbucks is a coffee retailer, not typically associated with critical infrastructure or essential services. The high media attention highlights an interesting perspective: Starbucks has become a significant part of many people’s daily lives, to the extent that disruptions to its service are considered noteworthy.

The media focus and portrayal of Starbucks as an essential service highlights how deeply the brand is embedded in daily life. Articles often included quotes from social media users that suggested that, for many, a day without their Starbucks coffee is a significant inconvenience, akin to disruptions in banking or transportation. In fact, in some instances, Starbucks closures were mentioned in the very same headline as these more essential services.

Mentions such as these were largely lighthearted in nature, with social media commentary from customers more so lamenting that their typical coffee routine was disrupted rather than placing any sort of blame on Starbucks itself. This spotlight on Starbucks generated a narrative that the brand is crucial for daily functioning, a testament to its strong market presence. For Starbucks, therefore, the CrowdStrike outage turned out to be brand-positive.

Preparing for the Next Outage

Communicators can expect that if a similarly widespread outage occurs in the future, it is unlikely to affect the majority of brands’ media reputation. Disruptions to time-sensitive essential services will draw most of the negative media attention, while businesses offering non-essential or non-time-sensitive products and services can fly under the radar.

For some lucky companies, a short disruption to services could even remind the public how beloved and essential their brand has become. This phenomenon underscores the importance of building a strong brand presence and fostering deep customer connections which can act as a buffer during crises such as this one.

To learn more about our research, contact us here.

How do geopolitics impact corporate reputation?

In this report, we uncover the vital insights PR and communications leaders need to understand and navigate the complex interplay between geopolitics and corporate reputation.

You’ll learn where you’re most likely to face pressure to speak out about a geopolitical issue, which coverage themes capture the most attention, and much more.

Read the full report for further insights.

Data analysis and authorship credits: Azhar Unwala, VP of Analytics at PublicRelay & Kay Kavanagh, Director of Research at PublicRelay

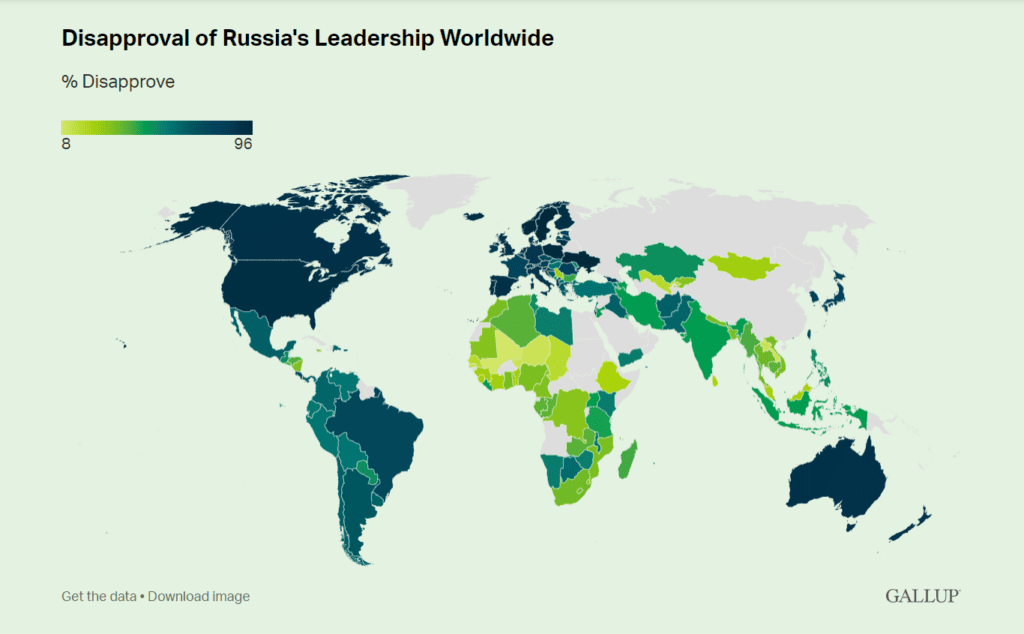

As the Israel-Hamas war has unfolded, stakeholders are re-evaluating companies based on their ties to the conflict.

PublicRelay examined how public opinion and media reporting on major brands has evolved since the start of the conflict. We found that ties to the Israeli government are a looming corporate reputational risk. And that threat is set to grow as Americans become increasingly sympathetic to the humanitarian crisis in Gaza.

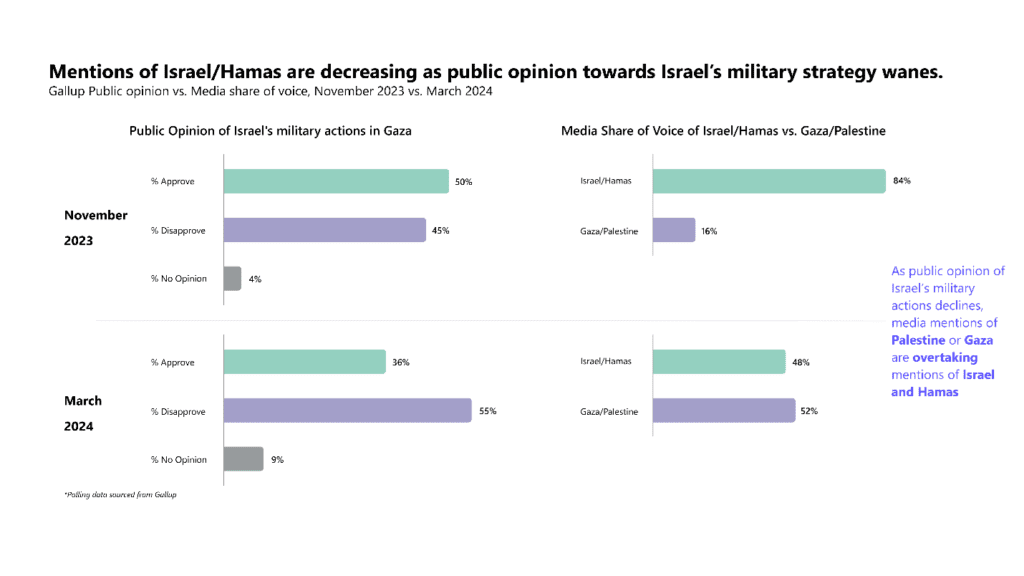

There’s been a remarkable shift in public opinion in the last six months

Polling data from Gallup reveals that early opinion towards Israel’s military strategy was in the country’s favor. At this point, Israel was still reeling from Hamas’ October 7th attacks.

The Israeli government’s reaction was at the center of news coverage in November. The media commended corporate leaders for backing Israeli citizens in need. This included Google’s Sundar Pichai and JPMorgan’s Jamie Dimon, who expressed steadfast support for the country.

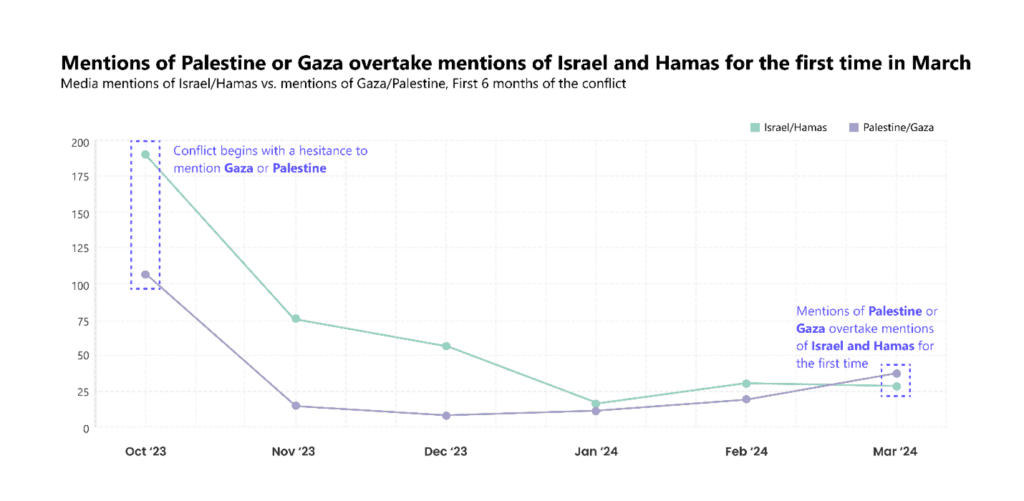

But as time marched on, Americans became more aware about the humanitarian crisis in Gaza. By March, public opinion had largely turned against the Israeli military strategy. Media reporting reflected this, as coverage of Palestine and Gaza overtook mentions of military conflict between Israel military and Hamas for the first time.

As the attention on Gaza has grown, so has the backlash on brands’ ties to the Israeli military. The mainstream media that once praised businesses for showing support now spotlight accusations of bias against Palestine.

Exposure to the conflict is both an external and internal communications issue

We found that some of the largest companies in the world have been unprepared to respond to consumer backlash. Both McDonalds and Coca-Cola have already reported declining sales linked directly to boycotts. This is especially a risk for companies with younger audiences, who have been the driving force behind protests.

But the consequences go beyond your customer base. Protests by activist employees have steered the media cycle in recent months. This creates an internal communications issue that could put all companies with ties to the Israeli government at risk.

Google, for example, has been traditionally known for their open work culture. In recent months, the company faced internal backlash over their Israeli military contracts. The tech giant has limited company message boards and fired protesters, acting out-of-line with their cultivated brand image. High profile outlets have called out Google’s ambiguous public statements on their actions. Their response has fueled a narrative of unpreparedness around internal dissent.

Plan your response today

As American opinion continues to turn against Israel’s military actions, it’s clear that organizations with ties to Israel’s military have unavoidable exposure to the public discourse. Smart leaders should assess their risk profile relative to their customer and employee bases and plan responses now. Communicators need to prepare targeted response strategies ahead of time to effectively address concerns from external and internal stakeholders alike.

To learn more about our research contact us here.

Employer brand – your company’s reputation as a place to work – goes beyond impacting recruitment efforts. It’s an essential facet of your overall corporate reputation and can even influence consumers’ purchasing decisions.

You may think a satisfied workforce translates into a strong workplace reputation, but employee experience and employer brand aren’t always aligned. And that disconnect can come down to your communications.

However, employee brand ambassadors can help bridge the gap.

Engaging your employees as brand ambassadors can be one of the most powerful methods for improving public perceptions of your company’s workplace culture and managing your reputation.

What is an Employee Brand Ambassador?

A brand ambassador is an employee who promotes a company’s employer brand to their personal networks, usually via social media. As a prerequisite, they often have substantial social followings and online conduct that aligns with the brand’s values.

Traditionally, brand ambassadors were “influencers” – usually celebrities or individuals with significant name recognition – unaffiliated with the company they were paid to endorse (think Kiera Knightley and Chanel).

But rather than using prominent figures as they do for product endorsements, companies often turn to employees to advocate on behalf of their workplace culture.

Why Recruit Employees as Advocates?

Communications teams should recruit employees as advocates because audiences view employees as authentic and trustworthy sources of insight into their company’s mission, values, and ethics.

Stephanie Genin, Global Vice President of Enterprise Marketing at Hootsuite, explains that “brands are seeing value in influencer marketing because consumers are more influenced by an authentic, human communication than by corporate jargon.”

Not only does the public have more trust in perceived “normal” people, but the 2019 Edelman Trust Barometer found that 53% of all global audiences view employees as the most credible source of information when forming an opinion of a company. Another 78% agreed that “how a company treats its employees is one of the best indicators of its level of trustworthiness.”

In other words, employees are one of your most valuable resources for managing your workplace reputation.

Create an Employee Brand Ambassador Program

Consider engaging employees as brand ambassadors an element of your internal communications strategy.

And by launching an employee brand ambassador program, you can more effectively mobilize employee advocates to deliver the key messages that support your communications objectives.

Here are three ways to build a program optimized for impact:

Assess Your Employer Brand

Implementing an employee brand ambassador program is an opportunity to evaluate and understand your existing employer brand.

You must assess two aspects of your employer brand: employee experience and workplace reputation.

Employee Experience

Research your company’s employee experience on employee review sites like Glassdoor and social media platforms. For real-time feedback and suggestions for improvement, you can hold focus groups or conduct an employee feedback survey to assess your existing workplace culture.

Suppose it becomes evident your employees are unsatisfied with your company as an employer. This may be the place to start – by fostering a positive workplace environment and recognizing employee achievements – before recruiting ambassadors.

Alternatively, if your research indicates your company has successfully established a positive workplace culture, you can utilize this data to pinpoint your company’s strengths and identify themes for your ambassadors to highlight.

Workplace Reputation

To evaluate your external workplace reputation, you can use reputation polls or corporate reputation rankings to gain insight into public perceptions of your company as a place to work.

You can also use media analytics for a nuanced understanding of how the media covers your brand on various workplace reputational drivers that shape public opinions of your company culture.

Analyzing the data on your company’s workplace reputation against its employee experience will reveal any misalignment between the two and the workplace topics that could benefit most from your employee endorsements.

Recruit Volunteers

The value of employee endorsements resides in their personal experiences with the company and their willingness to advocate on behalf of the brand. Accordingly, enlisting brand ambassadors on a volunteer basis is crucial to the authenticity at the crux of their support.

Not only do audiences view employees as more trustworthy sources of information on a brand, but an authentic employee endorsement of your company as a workplace is one of the most impactful methods of verifying and reinforcing your desired employer reputation.

Encourage Ownership

Ramp up your internal communications and provide your team with frequent updates on company news and employee achievements, along with tools to simplify social sharing.

Encourage employees to take ownership of personal and company accomplishments by highlighting their role in successes and output. When employees are invested in their work and recognized for their performance, they will be more inclined to share positive company news with their social networks.

Take Control of Your Workplace Reputation

Engaging your employees as a part of your communications strategy will make your workplace messages more credible and ultimately improve public perceptions of your company culture.

At PublicRelay, we measure your workplace reputation as it’s represented in media coverage and on employee review sites, including Glassdoor and Indeed. With this insight, you can better understand your current reputation and benchmark your performance and the impact of your employee ambassador program in influencing your public perceptions of your brand. Start improving your workplace reputation now!