The electric vehicle (EV) race is speeding along, fueled by automakers jockeying for consumers’ minds and wallets. As legacy car companies build their EV reputation, are their news headlines driving EV sales?

To answer this question, PublicRelay compared over a year’s worth of EV media coverage and sales from leading automakers. Here’s what we found:

Legacy car companies are ahead in consumers’ minds

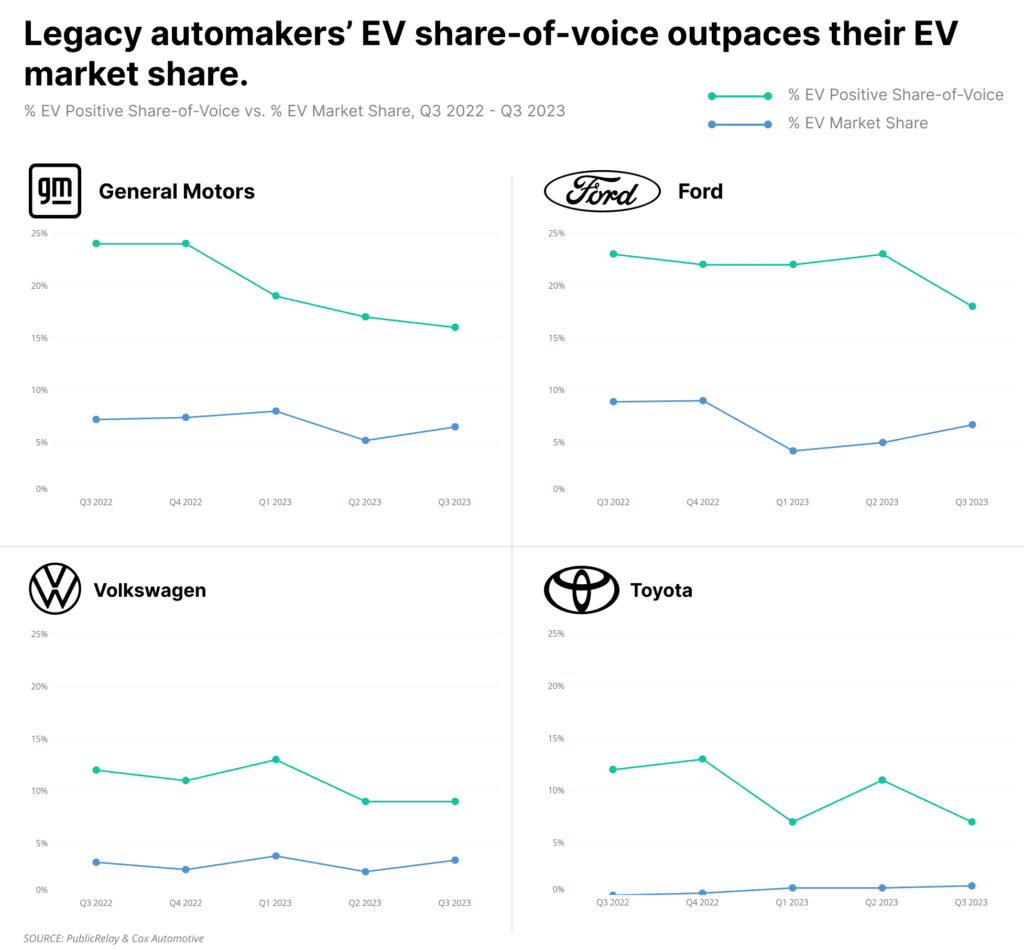

Despite their late entrance to the EV race, legacy car companies have been punching above their weight on EV communications. Over the past year, legacy automakers’ positive share-of-voice on EVs has outpaced their EV market share.

That’s a communications win for legacy car companies, especially for GM and Ford. Those two automakers have branded themselves as leading EV players. GM CEO Mary Barra has vowed to close the EV sales gap with Tesla in 2025 and pledged to end sales of gas-powered cars by 2035. Ford CEO Jim Farley has publicly committed over $50 billion in EV investments alongside partnerships with Chinese and Korean battery firms.

The automakers’ PR strategies are borne out in PublicRelay’s analysis of the EV media landscape, featuring brands like Tesla, GM, Ford, Toyota, and Volkswagen. GM and Ford each maintain around 20% of the industry’s EV’s share-of-voice despite each having approximately 7% of the US’s EV market share. Even Volkswagen and Toyota have share-of-voices that exceed their shares of the market.

EV media wins are leading to market share gains

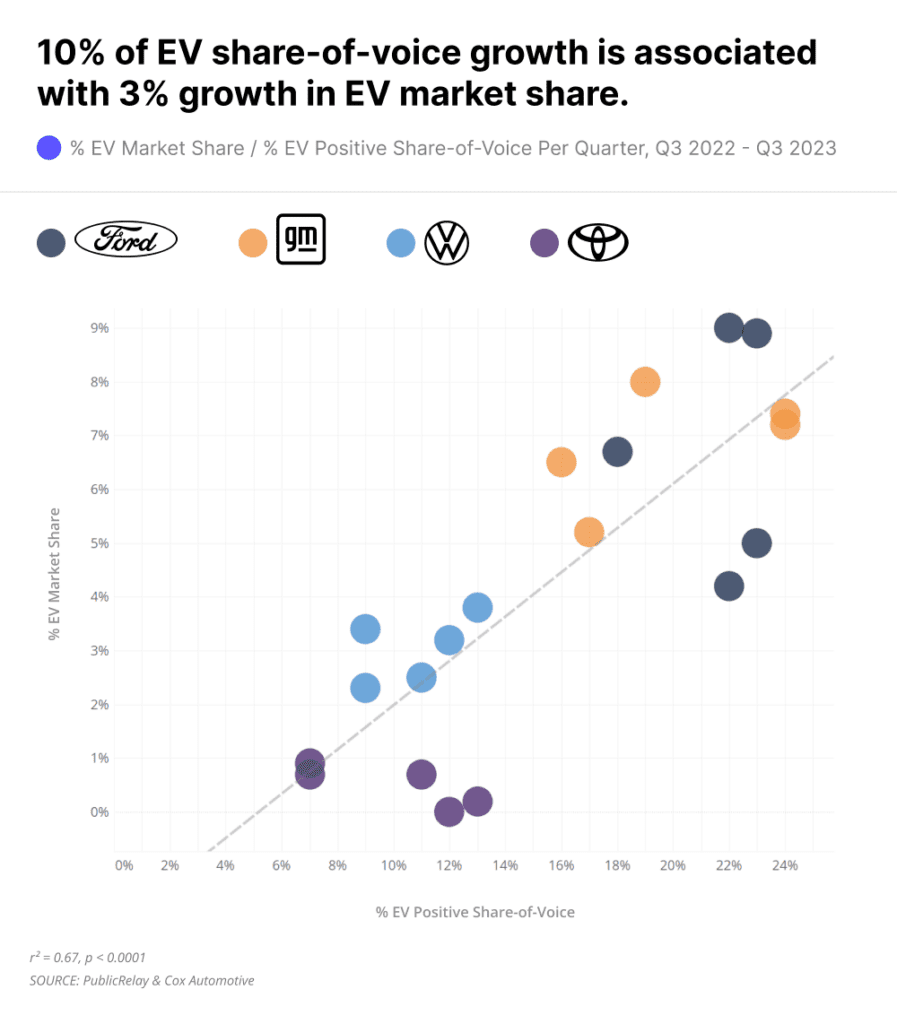

An outsized share-of-voice likely indicates future market share growth in EVs. Advertising firms like Nielsen have long highlighted the value of investing in media share-of-voice early to generate business growth later. That’s especially true when budgets are tight. Companies who build reputational strength early reap the rewards faster when market conditions mature.

That trend is already holding true for legacy automakers in the EV space. 10% more positive EV share-of-voice is generally associated with 3% growth in EV market share, quarter over quarter.

Tesla is losing market share, but its media share-of-voice is rebounding

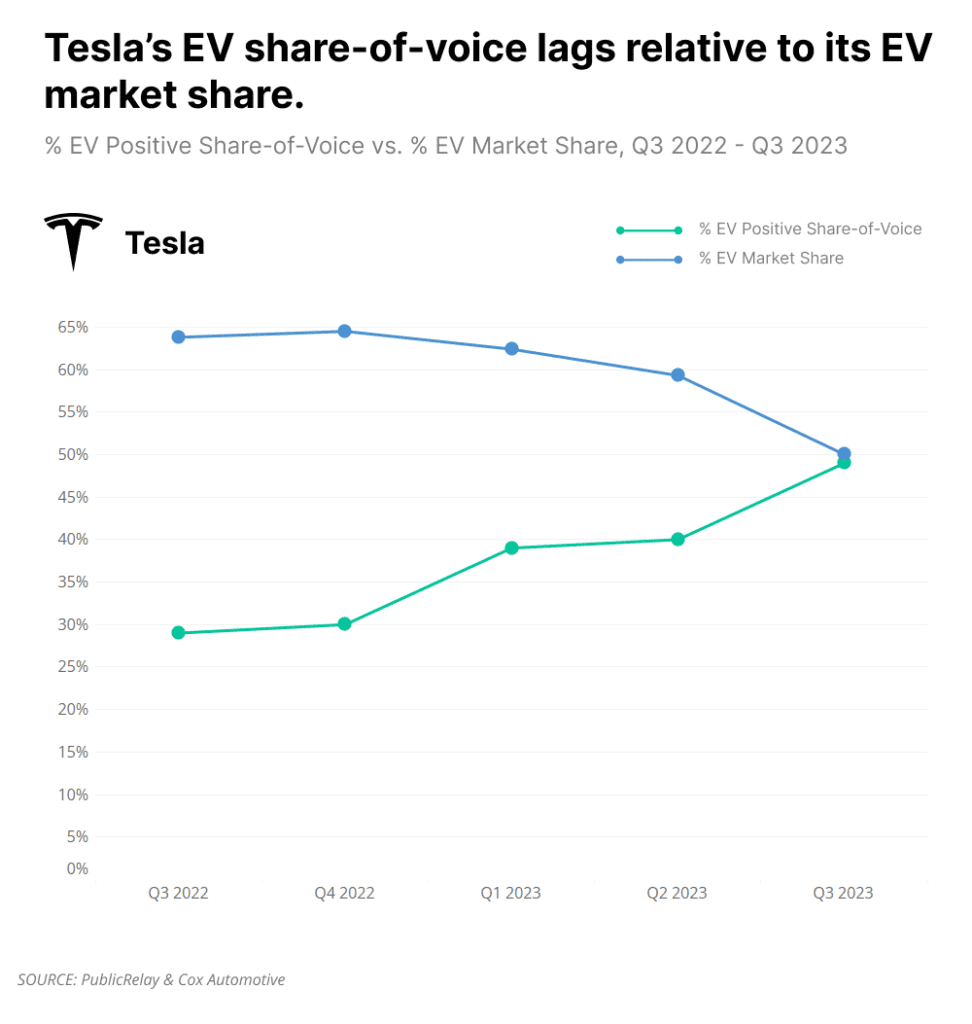

Tesla’s trajectory is also consistent with this trend. Elon Musk’s company is the clear EV market leader. But unlike legacy automakers, Tesla’s PR efforts have significantly lagged its market power. At the end of 2022, Tesla’s share-of-voice was less than half its market share.

Combined with growing competition in the EV space, Tesla’s reputation deficit has predictably led to a decrease in its market share. Tesla’s share of the EV market has decreased from 64% to 50% in the past year.

Numerous controversies surrounding Elon Musk’s takeover of Twitter have alienated potential Tesla customers. Tesla also faces ongoing product reliability issues. Without sufficient reputational capital in place, EV buyers may be more willing to look beyond Tesla towards other brands.

Tesla is far from doomed, however. The company has been rapidly increasing its EV share-of-voice in 2023. Its market leader status has enabled it to capture headlines about lowering prices and the launch of the Cybertruck. The brand has been quick to point out its insulation from chip supply constraints and UAW strikes affecting Ford and GM.

The road ahead

At the same time, legacy automakers have begun to pull back from their bold EV stances amid high interest rates, fears about inadequate EV charging infrastructure, and a surge in hybrid vehicle sales. The result has been a decline in share-of-voice among legacy car companies at the end of 2023.

Whether or not legacy automakers renew their focus on their EV businesses through 2024 remains to be seen. If they do, building their EV share-of-voice will be a necessary place to start.

Read Next: Improve Your ESG Communications Strategy

Related Resources

As companies and shareholders increasingly prioritize diversity and inclusion efforts, many are turning to diversity audits to evaluate their progress.

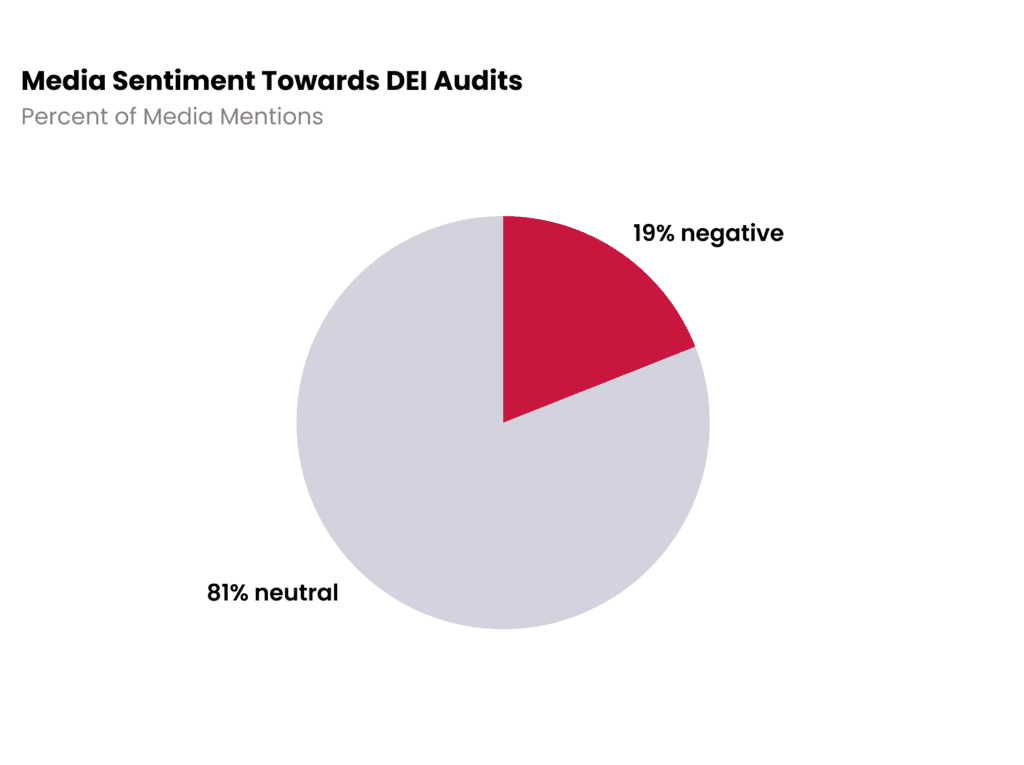

However, our recent research suggests that these audits may not have the positive media impact that communicators might hope for.

Independent reviews of diversity and inclusion efforts have led to zero media reputation gains for the companies we track in our media Benchmark. In fact, controversy and skepticism surrounding the process of conducting such audits has meant coverage is neutral at best, and sometimes even negative.

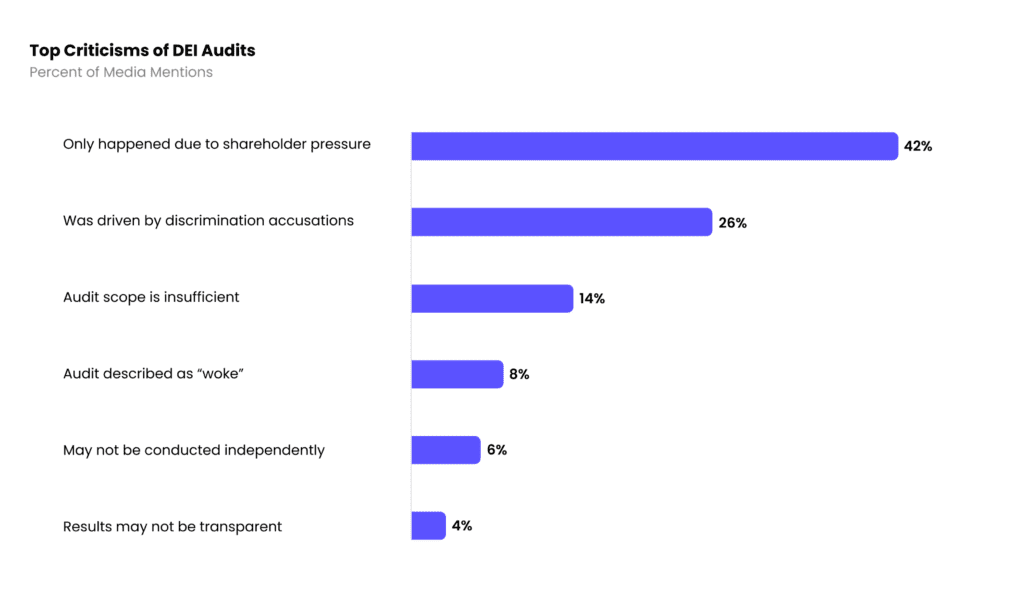

The main contributor to negative sentiment was coverage of how the decision to conduct an audit was reached. Voluntary diversity audits were often framed as a reluctant reaction to pressure from shareholders, with plenty of commentary around companies’ initial pushback to the idea. Also, coverage often mentioned existing allegations of discrimination to explain shareholder demands for audits. This context undercut the potential reputational gains for diversity audit stories.

Another reason for the lukewarm coverage is that the auditing process is vulnerable to being portrayed as performative or insufficient. For example, the qualifications or independence of external auditors were often questioned in media coverage. Alternatively, if a company conducted an internal audit, media coverage suggested that the audit was biased or lacking in transparency. Issues related to the sufficiency, independence and transparency of audits together accounted for 24% of negative messages.

The recent politicization of corporate DEI initiatives also plays a role. The media will publish the ‘anti-woke’ rhetoric of shareholders who take issue with companies choosing to perform a diversity audit. This results in unwanted controversy – whether the articles in question are written in support of such views or not.

When diversity audits materialize, communicators should be prepared for the media to broadcast shareholder views. Whether these shareholders are for or against diversity audits, their comments are likely to be critical of the company, undermining any potential reputational gains.

In theory, showcasing the progress of diversity audits should be a great PR tool to demonstrate action and commitment to an important issue. However, in practice, results are neutral at best. While the media continues to frame these stories from the viewpoint of critical shareholders, communicators should minimize proactive messaging about audits, and look elsewhere for stories that can more effectively communicate their brands’ DEI values.

Related Resources

It appears that ESG is retreating from business. Support for ESG-related corporate shareholder resolutions is declining. Finance firms like BlackRock and Vanguard have walked back some of their ESG initiatives in the face of conservative scrutiny.

Do these developments signal the end of ESG? The stakes are high for communicators, who will be responsible for sharing – or downplaying – their organization’s values and initiatives with the marketplace.

PublicRelay sought to answer this question by examining over a year’s worth of ESG media coverage across seven sectors. Here’s what we found:

ESG as a concept is on the decline

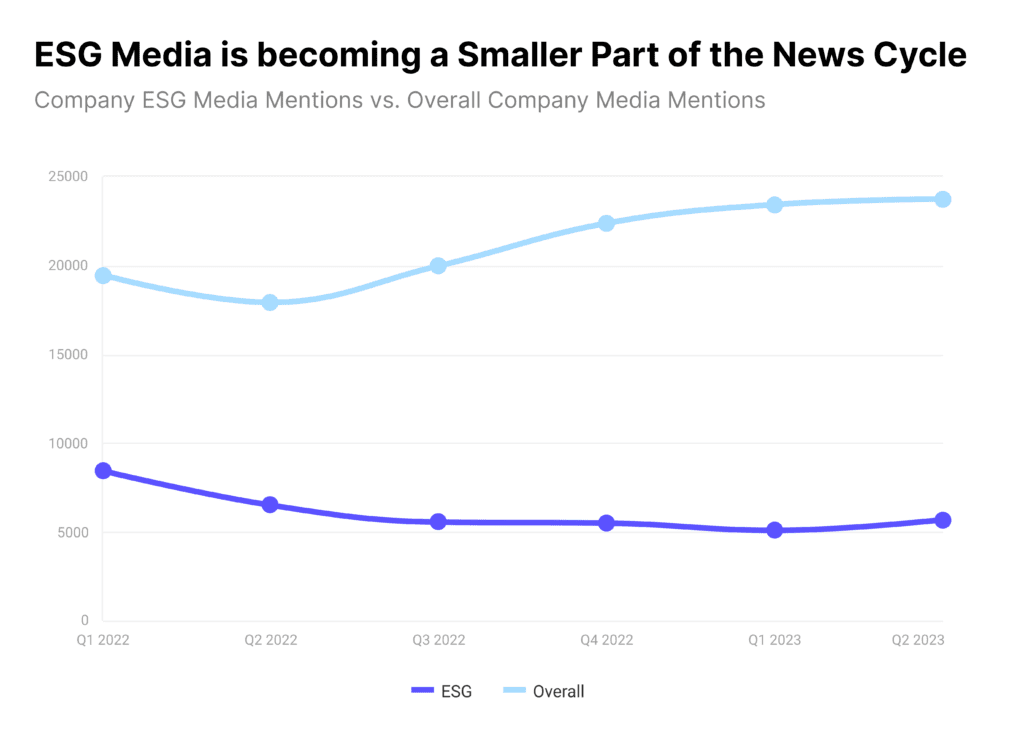

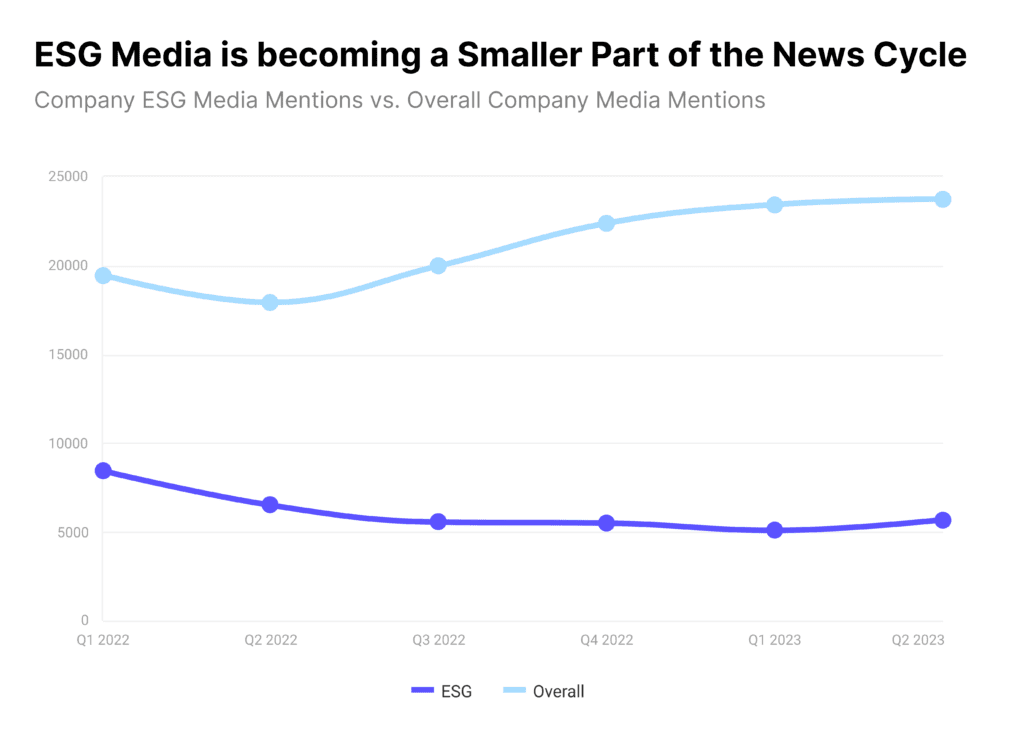

ESG as an overall concept is becoming a smaller part of the news cycle. Corporate news is increasing around 5% quarter over quarter. But stories mentioning ESG as a singular entity are decreasing 7% each quarter.

Corporate governance is maintaining its importance amid economic uncertainty

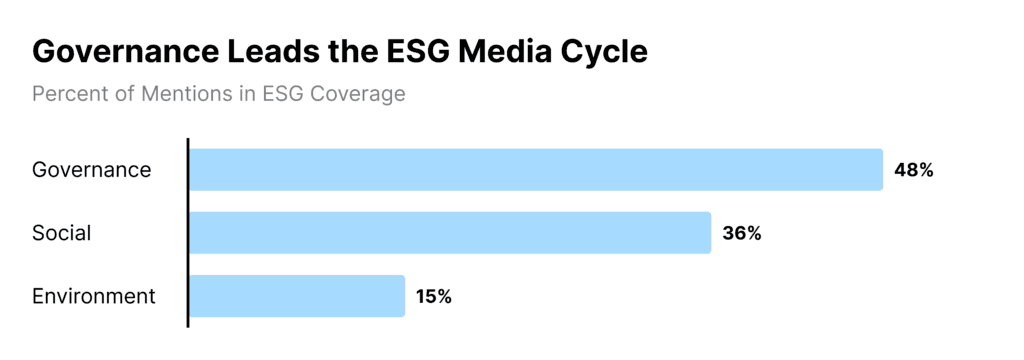

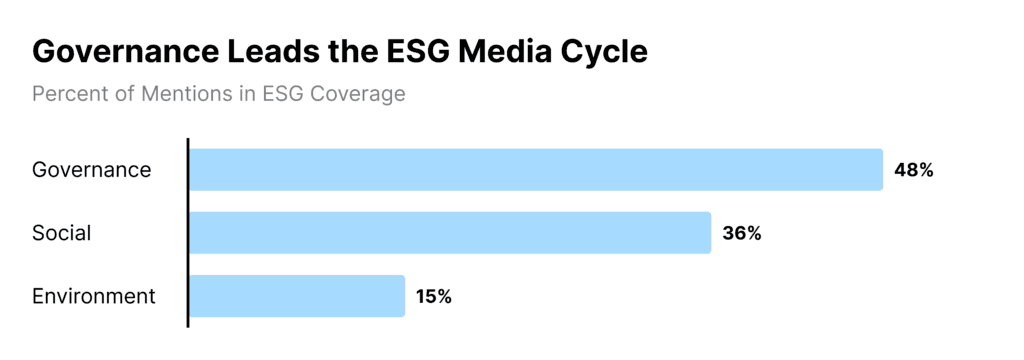

That doesn’t mean that the attributes that make up ESG are becoming any less important. Furthermore, not all components of E, S, and G are performing equally. Much of the decrease in ESG stories is attributed to the decline in social topics. That includes themes like inclusivity and community impact.

But governance stories have maintained their lead in the ESG media mix. They’re even increasing in 2023. This is in large part due to growing economic uncertainty. As the news cycle focuses on business performance, issues like corporate ethics, overhead, and board decisions are in the spotlight.

Environmental stories are rare but can pose risks for several sectors

Stories about company environmental initiatives are rare compared to those about corporate governance. Environment mentions tend to be 15-20% of overall corporate ESG coverage, quarter over quarter.

But companies’ impact on the environment shouldn’t be ignored. The energy sector is receiving backlash to their doubling down on fossil fuel investments. Finance firms face criticism from climate advocates for walking back sustainable investing pledges. In the future, the energy required to power new AI technologies could put Big Tech in the crosshairs of the environment media discussion.

A healthy workplace will matter for business competitiveness

Promoting an engaged and inclusive workplace is still paramount, even with the decline in news about social-related topics. 2023 saw companies face layoffs, return-to-office policies, demands from organized labor, and a new wave of AI tools that may affect the future of work.

Navigating these challenges will require precise communications strategies, both internally and externally. Retaining top talent may have added significance in a news cycle focused on business performance.

ESG isn’t dead, but it’s branding might be

The environmental, social, and governance reputations of a company are still important. Yet how does that square with the growing scrutiny towards ESG?

Our analysis revealed that companies face the most criticism when they play up ESG as an end in itself. Backlash tends to occur when company ESG efforts feel overly political or unrelated to their bottom-line.

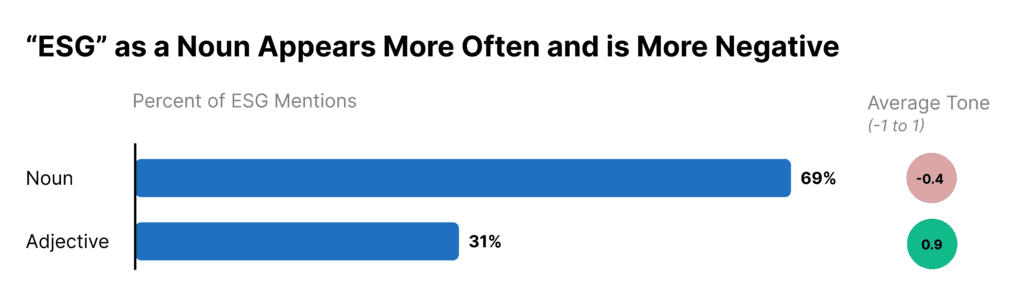

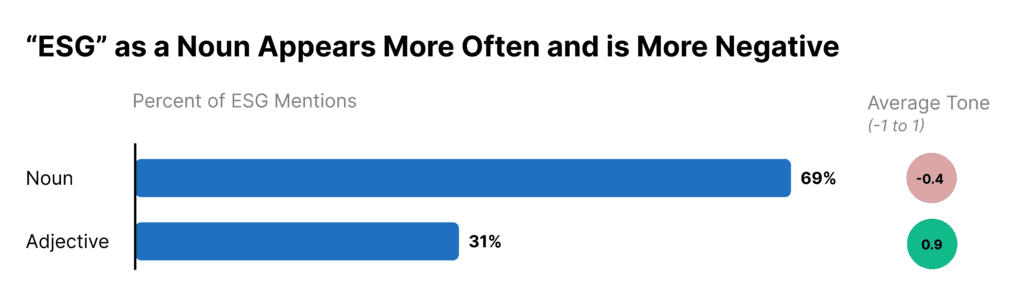

In fact, coverage that used “ESG” as a noun generated more criticism than when the media used “ESG” as an adjective. Noun uses of ESG seemed vague. They invited suspicion from anti-ESG advocates that companies were becoming overly political.

Companies that used the ESG term to describe specific actions received more positivity. The best results occurred when they referred to the constituent parts of ESG, like ‘environmental efforts’ or ‘governance initiatives’.

Dropping ESG as a term is also a no-cost option. In response to the prior year’s backlash, BlackRock CEO Larry Fink avoided the ESG term in his 2023 annual shareholder letter. Fink maintained BlackRock’s commitment to sustainable investing. But the media sentiment towards BlackRock became positive after dropping the term.

Navigating ESG’s future

The core issues that fall into the ESG category are still relevant for corporate communicators. Companies will need to showcase their good governance values and sound environmental footprint. They will need to demonstrate engaged employees and happy customers.

Yet the way those issues are communicated will likely change. With growing attention to corporate governance, companies will benefit by tying ESG-related efforts to their performance and bottom-lines. Communicators might consider avoiding the ‘ESG’ term entirely and instead emphasize specific environmental, social, or governance initiatives. That can help them reach their core audiences while avoiding the media storm around ESG.