It appears that ESG is retreating from business. Support for ESG-related corporate shareholder resolutions is declining. Finance firms like BlackRock and Vanguard have walked back some of their ESG initiatives in the face of conservative scrutiny.

Do these developments signal the end of ESG? The stakes are high for communicators, who will be responsible for sharing – or downplaying – their organization’s values and initiatives with the marketplace.

PublicRelay sought to answer this question by examining over a year’s worth of ESG media coverage across seven sectors. Here’s what we found:

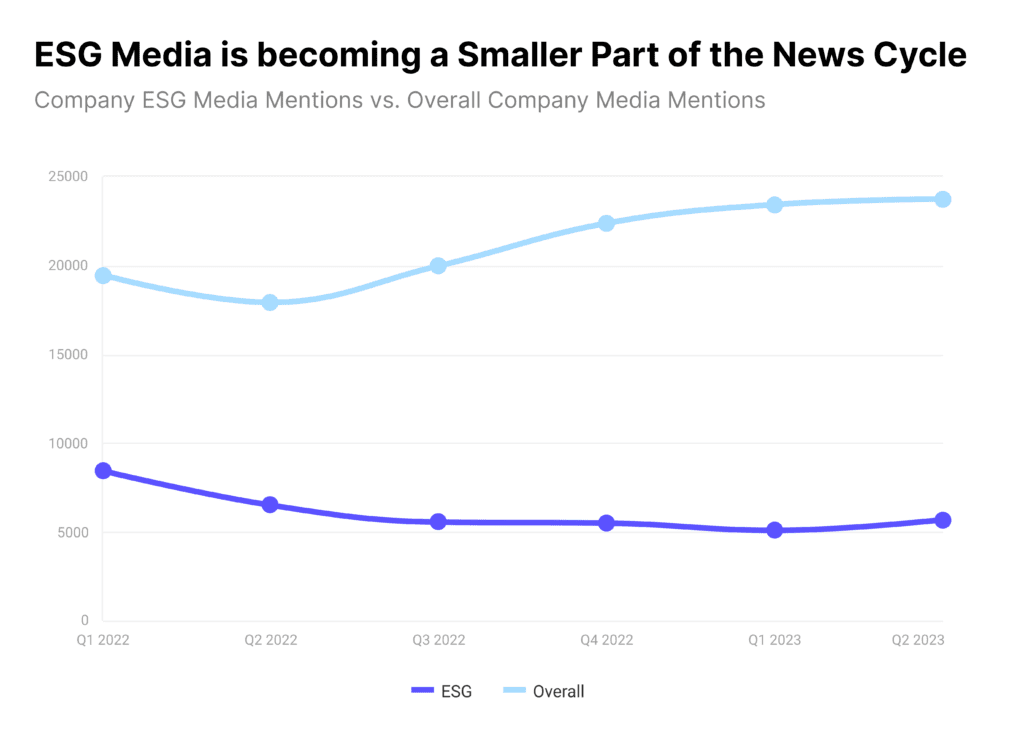

ESG as a concept is on the decline

ESG as an overall concept is becoming a smaller part of the news cycle. Corporate news is increasing around 5% quarter over quarter. But stories mentioning ESG as a singular entity are decreasing 7% each quarter.

Corporate governance is maintaining its importance amid economic uncertainty

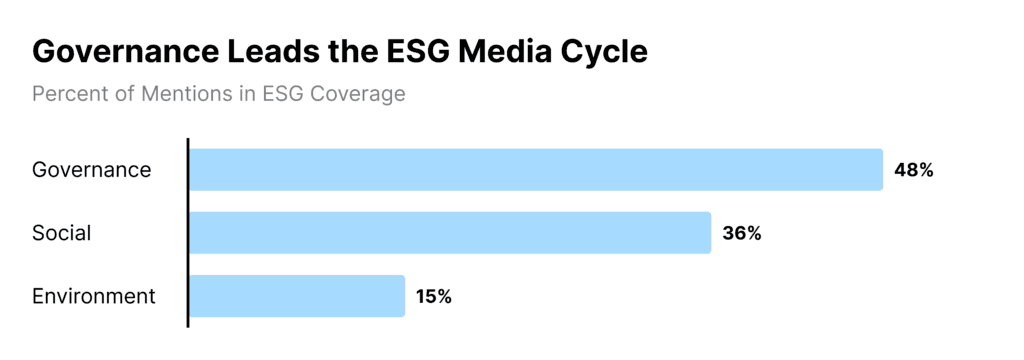

That doesn’t mean that the attributes that make up ESG are becoming any less important. Furthermore, not all components of E, S, and G are performing equally. Much of the decrease in ESG stories is attributed to the decline in social topics. That includes themes like inclusivity and community impact.

But governance stories have maintained their lead in the ESG media mix. They’re even increasing in 2023. This is in large part due to growing economic uncertainty. As the news cycle focuses on business performance, issues like corporate ethics, overhead, and board decisions are in the spotlight.

Environmental stories are rare but can pose risks for several sectors

Stories about company environmental initiatives are rare compared to those about corporate governance. Environment mentions tend to be 15-20% of overall corporate ESG coverage, quarter over quarter.

But companies’ impact on the environment shouldn’t be ignored. The energy sector is receiving backlash to their doubling down on fossil fuel investments. Finance firms face criticism from climate advocates for walking back sustainable investing pledges. In the future, the energy required to power new AI technologies could put Big Tech in the crosshairs of the environment media discussion.

A healthy workplace will matter for business competitiveness

Promoting an engaged and inclusive workplace is still paramount, even with the decline in news about social-related topics. 2023 saw companies face layoffs, return-to-office policies, demands from organized labor, and a new wave of AI tools that may affect the future of work.

Navigating these challenges will require precise communications strategies, both internally and externally. Retaining top talent may have added significance in a news cycle focused on business performance.

ESG isn’t dead, but it’s branding might be

The environmental, social, and governance reputations of a company are still important. Yet how does that square with the growing scrutiny towards ESG?

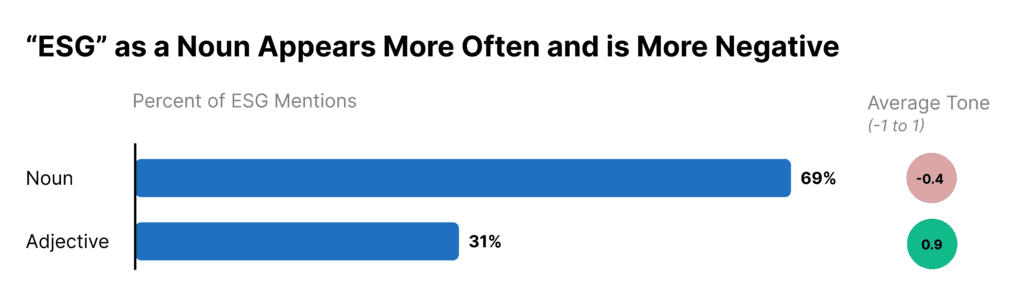

Our analysis revealed that companies face the most criticism when they play up ESG as an end in itself. Backlash tends to occur when company ESG efforts feel overly political or unrelated to their bottom-line.

In fact, coverage that used “ESG” as a noun generated more criticism than when the media used “ESG” as an adjective. Noun uses of ESG seemed vague. They invited suspicion from anti-ESG advocates that companies were becoming overly political.

Companies that used the ESG term to describe specific actions received more positivity. The best results occurred when they referred to the constituent parts of ESG, like ‘environmental efforts’ or ‘governance initiatives’.

Dropping ESG as a term is also a no-cost option. In response to the prior year’s backlash, BlackRock CEO Larry Fink avoided the ESG term in his 2023 annual shareholder letter. Fink maintained BlackRock’s commitment to sustainable investing. But the media sentiment towards BlackRock became positive after dropping the term.

Navigating ESG’s future

The core issues that fall into the ESG category are still relevant for corporate communicators. Companies will need to showcase their good governance values and sound environmental footprint. They will need to demonstrate engaged employees and happy customers.

Yet the way those issues are communicated will likely change. With growing attention to corporate governance, companies will benefit by tying ESG-related efforts to their performance and bottom-lines. Communicators might consider avoiding the ‘ESG’ term entirely and instead emphasize specific environmental, social, or governance initiatives. That can help them reach their core audiences while avoiding the media storm around ESG.