When you run the communications department for a pipeline company, every day is a balancing act. You need to push positive messages to key stakeholders while also countering key opposition and general coverage of safety and environmental issues.

Two key metrics for the team are whether or not they are successfully improving their brand’s corporate perception while mitigating the impact of negative coverage. At first glance, it is overwhelming to determine which of the seemingly endless negative coverage is just “loud noise” and which directly impacts their stakeholders. They need to get deep into the context of their coverage to uncover any useful insights.

Key Message Penetration

The team’s top priority is to counter negative information about the pipeline by emphasizing its benefits to local communities. Secondarily, they focus their effort on keeping a positive perception to stockholders and potential acquirers – as mergers are prevalent in this industry. With PublicRelay’s analysis, the company can see what messages are having the most positive mentions whether it is CSR initiatives, investor relations, or community benefits. They can also see if their message penetration is growing or shifting and how the positive coverage of these messages compares over time. This helps put all coverage both positive and negative into context.

PublicRelay was able to notify the team that although they were dealing with legal backlash for one of their pipeline projects in Pennsylvania, their key messages about operational excellence and investor relations were essentially drowning out the negative coverage. They recorded a 12% growth in positive mentions on the topic of investor relations, as the company received praise from a major Wall Street publication for its restructuring arrangement and overall operational superiority. Insight like this allows the communications team to double down on communication strategies that are working and shift resources to other messaging campaigns that are not pulling through.

Gauging the Severity of Issues

In near-real time the team can measure and compare the traditional and social coverage around current and past pipeline projects down to a sub-topic level. This access to past analysis is essential to both identify if negative commentary is in a normal range or if they need to devise a strategy to quickly react to it.

For instance, PublicRelay was quick to alert the company when an issue with protestors affiliated with a religious group started driving the largest portion of negative coverage on the topic of land rights. They helped the company quickly pinpoint which social media users were driving around 60-70% of negative mentions about environmental issues, specifically gas and fracking concerns. Insight like this helps the company quickly create engagement strategies to counteract some of this negative publicity.

Measuring Opposition Coverage

PublicRelay’s media intelligence solution enables the team to break their opposition coverage into three different categories:

- The highest potential reach across traditional media

- Most likely to be shared on social media

- The types of social media mentions shared by influencers (users with high numbers of followers)

They further categorize this coverage into topics such as: safety, environmental, and legal issues so they can pinpoint exactly which topics are of main concern on a regular basis. This two-dimensional look their data enables the team to build out granular strategies for each of the key themes.

Furthermore, this data is analyzed quarter over quarter, to uncover areas where they historically dominated positive coverage and are now losing traction. For example, one quarter, the company’s positive mentions of community benefit and job creation had significantly decreased – particularly in Pennsylvania where their latest pipeline was being constructed. Given history, this outcome was not unexpected. The team used the data to pinpoint authors and outlets in the region and quickly set a plan to turn around positive coverage on those topics.

Maximize Company Value

In volatile and regulated industries, quickly understanding your reputation in the market and how, or if, you need to react is critical. Using accurate and timely data to build and execute their PR strategy has made the communications team much more efficient and agile. They are also able to show their impact on key company goals like maximizing company value to potential buyers, investors, and local communities.

Related Resources

Challenge: Measuring Brand Value and Industry Leadership

We’ve entered the era of Industry 4.0, a confluence of trends and technologies, that promises to reshape the way things are made. For a global leader in materials engineering solutions for the semiconductor, flat panel display and solar photovoltaic industries, maintaining momentum in this ever-evolving landscape is crucial. They are able to achieve this through an emphasis on constant innovation and investment in the emerging trends.

To help their company assert its thought leadership and dedication to cutting-edge products its PR/communications team needs metrics that are accurate and meaningful mirrors of its business goals. The team sought a solution that would go beyond simply tracking how many eyeballs were seeing mentions of their product or company. They want to shed light on both classic brand drivers like financial performance, product performance and the regulatory landscape, but also drivers like leadership and industry innovation. They also need an accurate view into up-and-coming industry trends as well as competitor SOV to be able to boost their brand value and industry stature.

Solution: Metrics that Matter, Data that Captures Industry Movement and Brand Penetration

The team needs to dive deeply into the context of their coverage to uncover the narrative of how well they are or are not performing against their business goals. Most importantly, the materials engineering giant needed to measure its achievement of corporate goals over time in order to build better communications strategies.

The communications group deployed PublicRelay’s media intelligence solution, which combines top technology and human analysis to measure brand driver effectiveness and track industry trends and coverage for key technologies like semiconductor or display articles, for its own brand and its major competitors. This multilayered measurement program includes several deliverables: daily coverage report, a weekly insight summary, a quarterly report, and ad hoc analysis on specific industry trends.

Result: Insights Guiding a Communications Team, its Agency Partner and Corporate Leaders

The client’s PR agency also relies on PublicRelay’s insights to inform their work – they provide the agency an accurate lay of the land which translates into a tactical plan for the week ahead. Reports are modified on a continuous basis to fit the needs of the rapidly changing Industry 4.0 and regulatory landscape and to incorporate breaking stories. In an industry with few players but constant innovation, these reports also serve as the clients’ pulse on the market, and are viewed but both teams and the client’s executive team.

Quarterly, data is compiled into detailed reports that have a competitive analysis, message penetration breakdown and a review of top stories. The SOV analysis data, also toned for sentiment, is parsed into topics so the company can see its SOV across brand drivers, and coverage across trends like IoT, Driverless Cars, Augmented Reality, Connectivity and AI. Competitor coverage is also analyzed for the same context – this view is paramount for the communications team and its agency partner, as they decide where to focus resources to influence positive coverage, revamp competitive campaigns and determine if there is whitespace for message expansion. The company can also enhance its influencer engagement strategy using insight from the top story review – a snap shot of the articles that yielded both the highest impressions and had the highest reach on social media. This interplay between social and traditional media, clearly illuminates which influencer outlets are dominating the conversations.

Lastly, the client can deep dive into any facet of this quarterly analysis which provides them an arsenal of custom data at their fingertips to create new microtargeted, spinoff strategies that highlight highly innovative thought leadership initiatives.

Result: Data that Empowers a Technology Leader by Strengthening its Industry Prominence

The head of communications uses PublicRelay’s analysis during his executive quarterly meetings to plan the earnings reports. Tying all this insight together and comparing it quarter over quarter allows them to focus on outcome-based metrics, such as strategic message pickup, share of voice versus the competition and impact of earned coverage on thought leadership dominance. The communications team can not only prove their impact on bolstering the company’s brand value, but they also provide key competitive insights to leadership as the company pushes to emphasize its innovation across major Industry 4.0 trends and emerging technologies – a strategy central to its profitability.

Related Resources

Challenge: Monitoring Media Coverage for Events

Media events are the bread and butter of communications/PR work in the telecommunications industry. From new spokespeople contracts to influencer collaborations and product launch events, telecommunications is a noisy industry with only a few players and much promotional activity. Events, particularly campaigns, are notoriously difficult to track and measure for success as they are so different from one another and do not directly tie to end-results like they do in marketing. In this fast-moving industry, understanding an event’s success in near-real time can present challenges.

When a new VP of Communications joined a major telecommunications company, he wanted to understand how special events directly impact brand drivers and overall company perception and goals. The executive was looking to answer questions like “Who is talking about us?”, “How are our messages and brand drivers pulling through?”, and “Which areas are our competitors dominating with their events?”

Solution: Reporting on Event Success in Near Real-Time for Just-in-Time Insights

The communications team decided to deploy PublicRelay’s media intelligence solution, which utilizes top technology and human analysis to measure event effectiveness. This approach allows them to cast a wider net of keywords and sub topics both on social media and traditional coverage that would track various events. By combining social media with comprehensive local and national coverage access, they track not only company events but also industry-wide competitor events. This analysis goes beyond merely tracking the media coverage – it also measures the coverage against brand drivers like customer service, customer growth, network performance and partnerships.

Now in a mere matter of hours, the company can determine the impact of their events. Throughout an event the communications team receives fully analyzed reports on an ongoing basis and can view their coverage data live in the PublicRelay system at any point in time. These reports shed light on things like the percentage of coverage for key messages and the breakdown of tonality for each. PublicRelay’s Trending Score also enables the telecommunications giant to see what articles are gaining the most traction on social media.

In addition to adequately tracking their own events, the company also sees how their events compare to their competitors’ events. In almost real-time, the team can answer questions like “Were competitors getting picked up more?”, “Were their events being shared more on social media?”, “What outlets were talking about these competitors and more importantly, were influencers picking them up?”, and lastly, “What exactly are people saying about competitors – are any of the conversations about topics we are trying to own?”

Result: Measuring Impact of Events Over Time

Through quarterly reporting, the communications team has a holistic view of the overall penetration of their messages and can determine things like whether they are increasing key coverage on topics they care about or successfully engaging media influencers. They can also measure how media events stack up over time and how they impact the corporate reputation over the long haul.

The team can also view the same information about their competitors’ events, allowing them to determine areas of coverage that the competition owns, including network reliability, price, or customer service. Each of these pieces of data provides actionable insights for future events; because it shows where the company could enhance its messaging.

Getting to the Big Answers and Driving Event Strategy

Events are costly and time-consuming productions that demand accurate and timely analysis. Distinguishing the positive and negative coverage by authors and outlets helps the company strategize in real-time and, in the long term, set more informed goals. The communications team can now quickly locate favorable and unfavorable reporting from their organization’s point-of-view. Their ability to identify the reach of publications covering them as well as stories going viral on social media, enable them to successfully target key industry influencers.

Meanwhile, drilling down to the messaging of their event news and social coverage helps them track the impact on their overall brand. A dedicated human analyst ensures that even the tiniest detail about their coverage is recognized and categorized correctly – including concepts and topics that do not appear in text.

The communications team is proactively gathering insight about event performance. These high-level answers help the VP measure campaign success, course-correct strategy when messaging is not going as planned, realign resources to focus on specific outcomes, and most importantly, demonstrate to his board that his team is making strategic decisions that drive company goals.

Talk to an analyst about gathering insight into your events.

Related Resources

Who’s Ready for an IPO?

A leading multinational healthcare company spun off a business unit and issued an Initial Public Offering (IPO). The communications team was concerned about their ability to adequately analyze the high volume of coverage expected. At the time of and immediately following the event, they needed around-the-clock monitoring of online, social, and broadcast media coverage. In addition, they required the agility to course correct their monitoring strategy.

A Hybrid Monitoring Approach

The communications team deployed a media intelligence solution that utilized top technology and human analysis. This approach allowed them to cast a wider net of keywords and subtopics. The analysts then categorized the coverage from the outlets based on the criteria set by the communications team. Given the timeliness of the event, updates to the criteria could happen on the fly as needed.

Delivering Just-in-Time Insights

The customer received real-time alerts on hot, breaking news and detailed reports on the news surrounding the IPO. Rapid content selection and reliable analytics enabled the customer to shift focus, adjust strategy, and execute rapid, well-informed responses.

In one case, a hot issue was directed to an analyst who, within seven minutes, had retrieved the content, scored and analyzed it, and consolidated the coverage into an actionable report for the client. Media analysis went beyond print coverage to include online, social and broadcast channels to enable a 360-degree view of the brand.. The client’s PR agency was also engaged and received impact reports regarding social media.

The client effectively managed the IPO and facilitated a successful transition for the newly independent company. Following this critical event, the client engaged PublicRelay as its primary media intelligence provider.

Related Resources

And the survey says…

With the intention of providing better online customer service, the Department of Treasury surveys website visitors about their experience. In addition, they want to know if the visitor chose an online experience first versus another channel like the call center.

The survey is a mix of “closed” (yes/no) and open-ended questions. The agency quickly realized that many answers didn’t directly correspond to the question asked.

Using text analytics software alone did not work. They needed contextual analysis by someone who could make sense of the responses that did not match the questions. To get this complete picture, the agency deployed PublicRelay’s hybrid solution that combines top technology with expert human analysis.

Creating a Measurement Model

The goal of the survey was three-fold:

- Categorize general visitor concerns by what they were trying to accomplish

- Find product areas on the site needing usability improvements (forms, instructions, data retrieval, etc.)

- Identify all requested improvements submitted

The human analysis provides the ability to:

- Correlate the free text answers with the yes/no answers for a complete view of the submission

- Correctly provide a topic for the open-ended answers that are not tied to the question asked

- Provide analysis of both the quantitative and qualitative survey data

An Action Plan Every Month

The agency reviews the site survey analysis monthly. This allows the team to prioritize efforts on areas that need the most attention.

Whether it’s making changes to the site’s navigation to make it easier to find forms or instructions, or more rigorous testing of data retrieval, the agency now has an action plan each month.

Related Resources

Challenge: Streamlining Communications Monitoring and Analysis

A not-for-profit health organization was having trouble monitoring its coverage in the media. The company owns dozens of hospitals across a large region, making it difficult to separate coverage related to a particular hospital and coverage related to the national organization. Furthermore, several of the hospital names are fairly common amongst hospitals outside of the organization, so keyword searches yielded high volumes of irrelevant information that the team had to spend enormous amounts of time cleaning before the data could inform their strategy.

The regional network of hospitals posed another problem. With local hospitals’ PR teams reporting individually to the corporate communications group, PR measurement was inaccurate. Local teams had differing criteria for reporting, with some including press releases and patent announcements as earned media. The organization needed a third-party source that could create a standard for reporting across all hospitals and the corporate brand to provide accurate analysis that could inform strategy and prove the communications team’s value to the C-suite.

Solution: Standardized Analysis that Accounts for Context

The organization chose PublicRelay’s hybrid media intelligence solution that combines advanced technology with expert human analysis to provide the most efficient and accurate communications analysis. The company began its partnership with PublicRelay by receiving daily clip reports that included information about individual hospitals and the entire organization. The accuracy provided by human analysts that understood the context behind the coverage allowed the company to identify important differences in its local and national media coverage. Now the company receives weekly, monthly, and quarterly reports on its media coverage. They also receive a year-end analysis that goes directly to the C-suite.

With leadership pushing to integrate marketing and communications, the reports help the communications team provide the same level of analysis as their marketing counterparts. In the healthcare industry where brand reputation directly affects a patient’s choice to use their services, the communications team can show executive leadership how they are moving the needle on brand drivers that directly affect the organization’s bottom line. There is a saying within the organization: “marketing helps us get visibility, communications helps us get credibility.”

Result: Standing Out in a Saturated Market

In a market saturated with large organizations and smaller boutiques with specialized care, the company needed to separate itself from the pack. Leadership put forth a company-wide goal to become known as an innovative business, providing non-traditional and cost-effective models of healthcare. The company researched telemedicine and partnered with local healthcare startups to show patients that they were thinking outside of the box and trying to cut patient costs while still providing the highest level of care. The company also partnered with tech companies like Apple and Google Glass for innovative health initiatives. The communications team contributes to the business goal of increasing positive brand reputation as an innovative, tech-based company by highlighting these partnerships in the company’s earned media placements.

The company’s Innovation coverage rose from virtually none at the beginning of the year to the third most mentioned coverage topic of the year, 98% of that coverage being positive.

Understanding Patient Satisfaction

Patient satisfaction directly affects a hospital’s reputation and, therefore, the company’s bottom line. The team needed an understanding of satisfaction around different service lines such as oncology, cardiology, and women’s health care at regional hospitals.

Patient satisfaction can differ drastically between hospitals and even between service lines at the same hospital. But it’s critically important to understand related to each service line at each individual hospital, rather than only related to the overall corporate brand.

The team’s previous media monitoring tool had reported that the company was receiving high amounts of negative patient satisfaction coverage. A closer look at the data by the PublicRelay team revealed that 75% of the negatively toned data was related to controversy over a specific service line at a regional hospital, and 50% of that coverage was driven by just a handful of outlets. The team is now able to follow up on the negative coverage because they know the specific issue and which influencers are driving it.

Increasing Thought Leadership

The communications team works proactively to earn placements for their executives in order to increase their thought leadership coverage. Starting with an accurate baseline and conducting ongoing analysis shows them where their strategies are working and where they need to adjust or refocus their efforts. The team can visualize increases in their Thought Leadership SOV against competitors and if the coverage is positive or negative. Additionally, they can see the tier of the outlet their execs are quoted in, the significance of the mention, and the social sharing behind it.

Analysis revealed that, on average, stories that quoted executives received 6X the social sharing over stories that did not. The team used this insight to drive strategy around executive placements, focusing on fewer quality placements with quotes, rather than a high number of vague mentions. Using this insight, a single placement featuring a key spokesperson can increase the company’s reputation as both a thought leader and an innovator.

Related Resources

Monitoring Media Coverage at the World’s Largest Tradeshow

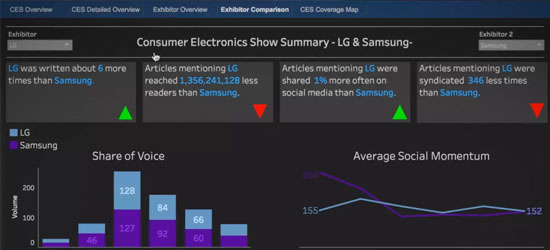

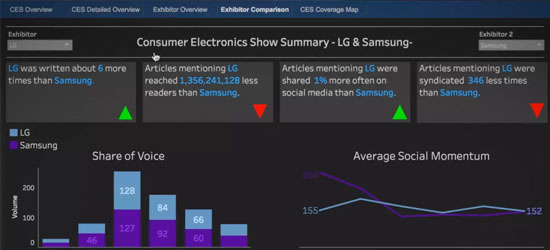

The Consumer Technology Association hosts the largest gathering of innovation and connectivity on the planet – CES in Las Vegas. In advance of the 2017 show, Jeff Joseph (SVP of Communications and Strategic Relationships) and his team constructed a game plan for monitoring, analyzing and responding to media coverage. The media intelligence would focus on event coverage generated by CTA, their exhibitors and keynote speakers. Execution of this plan would require a robust technology paired with a team of people “on” 24 hours a day.

An Innovative Approach at an Innovative Event

A hybrid method of top technology paired with human media analysis allowed CTA to holistically understand the media coverage of CTA and CES as well as their vendor partners.

This approach provided real-time answers to crucial questions such as:

- Are our messages coming through in coverage?

- What negative and positive attention is CES generating – and to what parts of this coverage should we pay immediate attention?

- Which stories are gathering momentum on social media platforms?

- How are topics like “Attendee Perception” and “Innovation” fairing in real-time?

- What do our exhibitors and keynote speakers need to know?

Answering the Questions that Matter

CTA’s media intelligence partner, PublicRelay, created an on-site command center for the event. They utilized interactive dashboards to visualize the answers to all the questions they were asking. Team members could drill down on any of the charts to uncover the coverage that was feeding the statistic. In addition, media analysts provided ad hoc reports throughout the day to keep everyone informed on hot topics. CTA shared the dashboards with their exhibitor partners as a value-add for their support and to visually present how their own messages were being amplified by the event. The same data was analyzed and shared with keynote speakers so they could also see the impact of their participation. Hear Jeff Joseph talk about the coverage CTA monitors at the Consumer Electronics Show.

Related Resources

National Brand Gauging Grassroots Efforts

One of America’s leading energy providers operates in 48 states and Washington, D.C. The Communications teams are tasked with monitoring and reporting on media efforts for national and regional brands.

To tie back their efforts to the objectives of the business, they needed to analyze media coverage that included specific topics in local markets. A media intelligence partner must provide analysis on their grassroots efforts around topics such as Rates, Energy Efficiency/Conservation, Customer Service, Reliability and Community/Philanthropy – even if the actual words aren’t present in the articles.

Comprehensive Media Strategy

By combining comprehensive coverage access with human analysis, PublicRelay would deliver the media intelligence the client needed for all topics and geographies.

The brands could now report on the impact of community programs to increase STEM education at local schools, economic benefits provided by local nuclear plants, state-level legislative efforts impacting business, reaction to outages, restoration projects and more.

This flexible, hybrid media intelligence approach enabled all brands to receive analysis on the metrics they found most impactful – on a daily, weekly, monthly and/or quarterly basis. Each team could also do quick turnaround, deep dives on events such as storms or industry mergers. Moreover, the company gained comprehensive insight into message Share of Voice (SOV), tone of coverage over time, and the probability of specific topical coverage being shared across social media platforms.

Accurately Informing Strategy

With more accurate and comprehensive intelligence, the energy company could answer several important questions:

- Which local influencers are significantly impacting our brand reputation?

- How effective are our spokespeople at driving positive community messages?

- How do our territory-specific grassroots campaigns compare to each other?

- What are suggestions for improvements from our customers directly?

- Are articles more likely to be shared if they feature a quote from a spokesperson?

The context and visualizations provided by human analysis, gave the client insight into areas where they were excelling or needed improvement. The more accurate data also enabled a level of predictability around items including:

- What the social media sharing impact would be on an article based on topic, spokesperson, tonality, author, etc.

- Best days to share certain topics in each region for more positive coverage.

This created trust with the C-suite and enabled them to make more strategic and targeted plans moving forward.

Related Resources

Challenge: Understanding the Success of Complex Communications Strategies

A complex and decentralized organizational structure, featuring an in-house team and multiple PR agencies, was making PR measurement nearly impossible for a leading financial insurance company. Local teams and individuals reported PR metrics from offices across the country and multiple PR agencies were creating reports based on different data. Their measurement process was fragmented and ineffectual, which made it near impossible to prove their contribution toward company-wide business goals let alone prove their value to leadership.

Solution: Standardizing Data and Sharing Accurate Results

The company needed to centralize the collection and analysis of their media coverage. They also had to agree on a set of metrics that they would consistently measure. Those metrics would be tied to business goals and used not only to measure team performance but also inform ongoing strategy.

To put more structure around the process, they chose PublicRelay for their hybrid media intelligence solution that utilizes both cutting edge technology and human analysis. Since the various agencies had been tasked with reporting for each of their topic areas, the communications teams were used to working with outside resources. This solution enabled both the in-house teams and PR agencies to get back to executing on campaign plans instead of reporting on inaccurate data.

Once the measurement strategy was set, PublicRelay began collecting data to set baseline results for each of the categories. Each team would be able to understand how well their thought leadership messages were pulling through, if traditional articles were being shared and on which social platforms, SOV by brand and reputation drivers for both traditional and social media, and the effectiveness of their spokespeople. These results would then be comparable over time and used to determine if they needed to redirect resources or stay on course.

This enables the team to make strategic, data-driven decisions, benchmark their efforts, and confidently report their numbers to the executive team.

Result: Exceeding Thought Leadership Goals

The company as a whole places an emphasis on being a thought leader in their industry and a successful spokesperson strategy is important in establishing that expertise. The communications team measures coverage of their spokespeople to understand not only each person’s share of voice in the industry, but about which key messages they are most often quoted. The team found one spokesperson’s coverage all stemmed from quotes about innovation, an insight that informed not only where spokesperson strategy was successful, but provided understanding of other key message pull through. The team not only benchmarks to understand if each of their own spokespeople receives more coverage quarter over quarter, but also measures against competitors.

The company began tracking their top market commentator against the most highly quoted spokespeople in the financial services industry. Since measuring this spokesperson head to head with competitors, the team has found that he is now the third most highly quoted spokesperson in the industry, climbing from number five. Insights like these are taken straight to executive leadership to show the success of the team’s execution and the impact on the brand.

Result: Demonstrating Return on Investment

As a part of their thought leadership strategy, the company made significant investments in conducting research studies. They performed a white space analysis to determine which topics in the industry were congested and in which topics they could lead a new conversation. Since the company had already been tracking key topics in the industry and their competitors’ coverage in addition to their own, the analysis was easily accomplished using their backlog of data.

The analysis made apparent that Financial Planning was a topic that was talked about in the industry, but none of their competitors owned the conversation around. They began conducting robust research studies around the topic and became a thought leader in this area. Accurate media analysis allowed the company to invest in innovative content creation that earns them positive, high-profile placements.

Continued measurement and analysis of these studies supports the communications team’s initiative. Mentions of the studies, along with mentions of their top spokesperson, dominate the company’s coverage every quarter, proving the return on investment and demonstrating the success of the team’s thought leadership strategy to executive leadership.

Result: Enhancing PR Agency Work

One of the biggest priorities for the company’s PR agencies is to place the thought leadership studies in publications. The agencies work closely with the company’s PublicRelay analyst to understand syndication and impression data of authors and outlets to inform pitches and placements. Having accurate analysis at hand ensures the agencies spend more time on strategy and execution, rather than data clean up.

The various agencies incorporate PublicRelay analysis into their own reports for the company, assuring a single source of truth regardless of the team reporting on measurement. The analysis can now be shared with the C-suite with confidence because it is rooted in accurate data.

This ability to demonstrate the success of communications strategies and how they positively effect corporate goals proves the value of the team to the C-suite in a way that they could not previously. Making data-driven decisions earns the team a seat at the table as a strategic partner to the business.

Related Resources

Challenge: Creating a Media Measurement Strategy from Scratch

When a new CCO came aboard a leading financial insurance company, he was tasked with improving media measurement. The team believed they had solid communications strategies in place, but they had no way of concretely proving the success of their efforts (or the value they added to the business).

Much of the team’s time was spent on a very manual monitoring process that was not rooted in measurement and could not show the success of their strategies. Even with all the time they devoted to monitoring they still missed coverage because of the wide array of local and industry publications in which their brand and subsidiaries get mentioned. The team chose PublicRelay’s human-assisted artificial intelligence solution that yields fully analyzed, accurate results in near real-time so that they never have to worry about missing a story or spending their valuable time collecting and organizing coverage. Instead, they focus on the strategy behind receiving those placements.

Solution: Tracking Brand Drivers and Competitors

The company’s team discussed brand and reputation measurement best practices with the PublicRelay team and together they established brand themes based on both PublicRelay’s experience in the financial services industry and their company-specific goals. Beginning measurement with company-wide goals in mind enabled them to tie back results to goals the organization was familiar with, like becoming known as a more socially responsible company. Confident in the measurement strategy they put in place, the company began tracking key brand drivers for their own brand as well as their competitors. They also measure how social sharing amplifies their traditional coverage and that of their competitors, as well as the prominence of each company and brand driver mention within an article, and the outlet credibility. The team doesn’t just have a pulse on the coverage they receive, but also measures their efforts quarter over quarter and compares how they stack up to their competitors on key messages.

Result: Using Insights to Guide Strategy

By consistently reviewing the analysis that demonstrates how their strategies perform over time, the team can see if they are making improvements in areas where they are actively executing campaigns and where they need to adjust. They no longer rely on a gut feeling that their campaigns are generally performing well but, instead, use concrete metrics to clearly understand areas of success and where there is room for improvement. In fact, one quarter the team believed they were gaining significant share of voice as Thought Leaders in the industry. However, the analysis revealed that while they made gains from last quarter, their Thought Leadership SOV was still solidly in the middle of the pack when compared to their competitors. The team realized that they needed to continue to actively execute Thought Leadership campaigns and allocate the appropriate time and resources to move the needle on this brand driver and contribute to the company-wide goal.