Written by Jim Key, VP of Enterprise Solutions

Last week, The Conference Board hosted Corporate Communications: Driving the Business Forward, bringing together top industry leaders to discuss the evolving role of communications in today’s business landscape. Below are some of the most compelling insights that emerged from the event.

The Business-First CCO: What CEOs Expect from Communications

The event’s opening session set the tone with a clear message: “CEOs are looking for CCOs who are business partners first, communications experts second.”

Denise Dahlhoff of The Conference Board bolstered this with data, and the theme was echoed by Thrivent’s CCO Greg McCullough and CEO Terry Rasmussen. Today’s most valued communicators:

- Possess strong business acumen

- Align messaging with corporate goals

- Prioritize outcomes over outputs

- Deliver and measure business impact

Throughout the conference, speakers reinforced this shift from traditional PR roles to strategic advisory positions:

- Jessica Kleiman (Lennar): Communications plays a critical role in talent acquisition, particularly for companies facing large-scale hiring needs.

- Golin: Their analysis found that CEOs with high media visibility in transformation and growth narratives boost corporate reputation, providing a key opportunity for CCOs.

- Katie Hill (NFL): The NFL is broadening its media reach, tracking not just sports media but also diverse outlets and influencers to engage new audiences.

In sum, Communications isn’t just about storytelling; it’s about driving measurable business success.

Reputation as a Business Asset

In a standout session, Allyson Park (Walmart) and Beatriz Perez (Coca-Cola) broke down why reputation should be treated as a business asset:

- 25% of a company’s market capitalization is tied to reputation.

- Reputation is shaped not just by messaging but by corporate actions. What you say yes and no to matters.

- When a new CEO arrives, redefining corporate purpose is a key moment for communicators to add value.

One major shift: Internal audiences—employees and customers—are now the priority over media relationships. Companies are focusing on building credibility internally, knowing that reputation starts from within.

AI’s Growing Role in Communications

Of course, AI was a hot topic throughout the event. Speakers shared real-world AI applications, from generating podcasts and short videos in real-time to monitoring outdated messaging, highlighting its potential but also its limitations. Points included:

- Use AI for efficiencies – fact-checking, summarizing news, and automating repetitive tasks.

- Lean on SMEs (subject matter experts) for nuance, judgment, and context.

- AI accelerates workflows, but it can’t replace human intuition, especially in areas like crisis comms and reputation management.

In sum, general agreement was that, while it can do incredible things on its own, AI should enhance human expertise, not replace it.

Navigating Corporate Engagement in Cultural & Political Issues

Panelists addressed the increasingly complex role of corporations in social issues. Key insights included:

- Companies are rethinking their approach to ESG & DEI messaging. They’re not pulling back entirely, but focusing on alignment between mission and business.

- Paul Dyer (/prompt) & Claudine Patel (Opella) shared that being culturally relevant is now a business imperative. They stated that the best approach was to follow societal trends, not marketing fads.

- Anna Frable (Novo Nordisk): Novo Nordisk’s efforts to elevate the conversation around obesity align with its business goals, making advocacy feel natural rather than forced.

Takeaway: Corporate activism isn’t disappearing, but companies are being more intentional about when, where, and how they engage.

The Communications-Marketing Partnership is Stronger Than Ever

Several sessions explored the increasing convergence of Communications and Marketing.

- Rob Jekielek (The Harris Poll): A unified PESO (Paid-Earned-Shared-Owned) approach is more effective than focusing on SEO.

- Data-driven storytelling is becoming the norm, requiring closer collaboration between comms and marketing teams.

What’s this mean for Communications leaders? You should be embracing cross-functional collaboration to maximize impact.

Final Thoughts

The Conference Board’s event highlighted a fundamental shift in the communications function: CCOs are no longer just storytellers. They are business strategists.

Communications teams that can demonstrate business impact, align with corporate goals, and leverage AI effectively will be best positioned for success. If you’re a communications leader looking to drive real business impact, these takeaways are just the beginning.

Related Resources

For quick-service restaurants (QSRs), the battle for consumer attention has never been more competitive or more price-driven. The past two years have ushered in a new normal in fast food, where value messaging dominates the media narrative and continues to shape brand strategy as we progress into 2025.

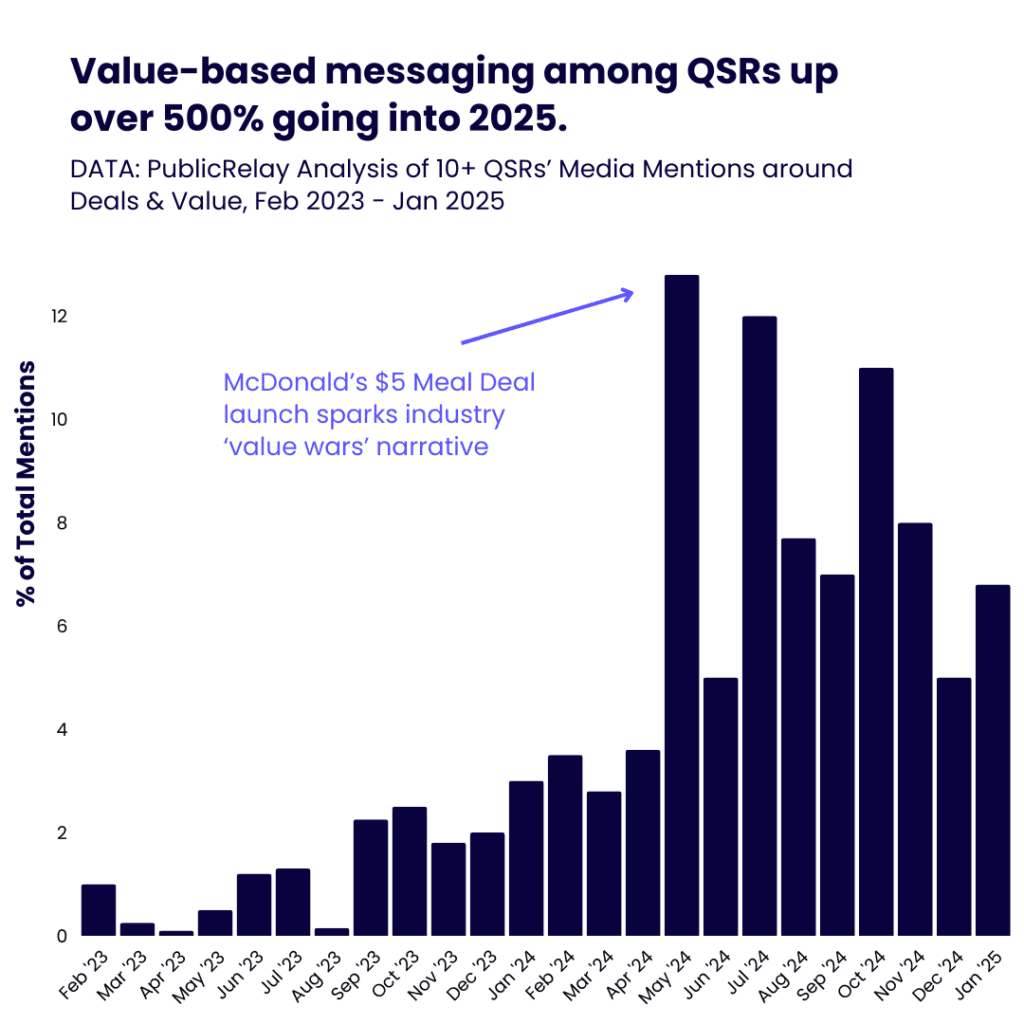

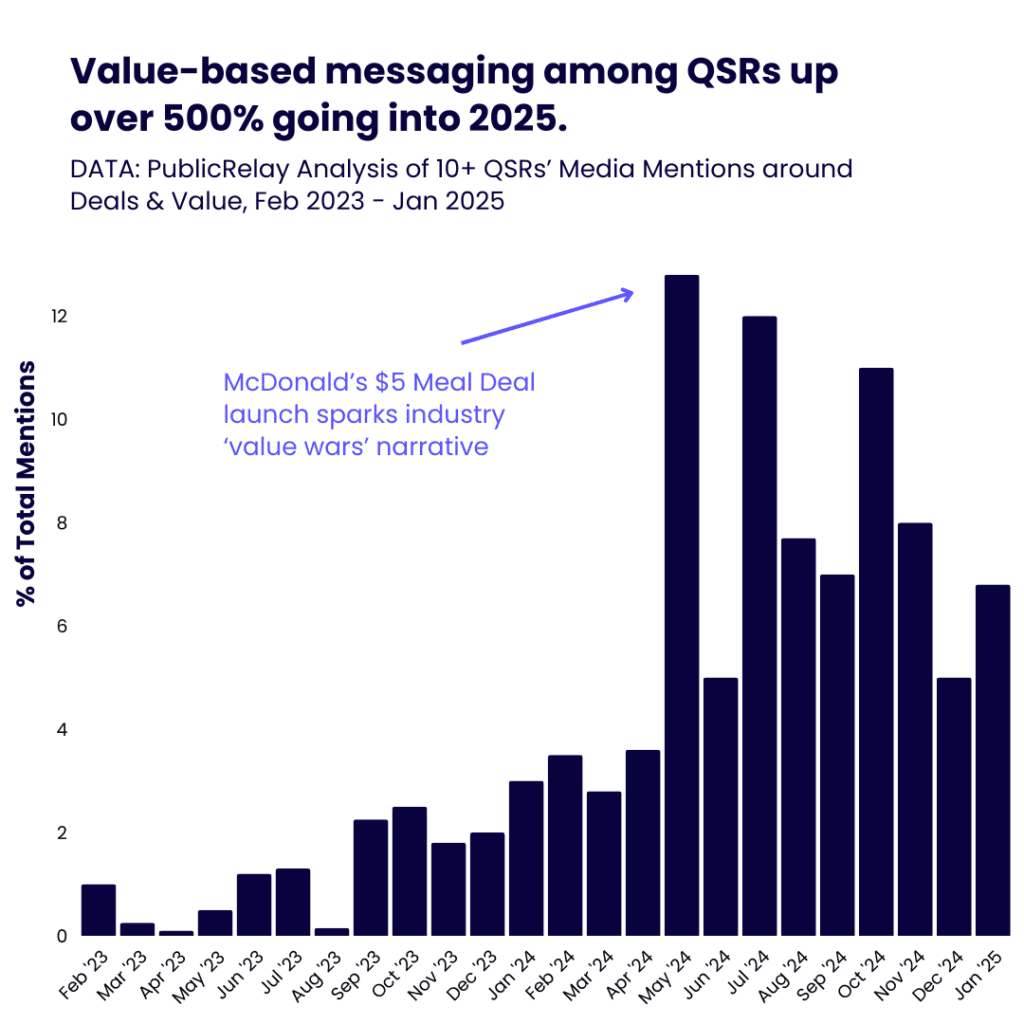

PublicRelay’s analysis of media coverage from 10+ QSRs shows a 500%+ increase in QSR messaging focused on value since early 2023. The trend isn’t just a response to inflation; it’s a fundamental shift in how brands communicate their offerings, defend their market share, and shape consumer expectations.

The Data Behind the Value War

QSRs are locked in an escalating cycle of promotional battles, as seen in recent media trends:

- May 2024 Surge: McDonald’s $5 Meal Deal launch ignited a sustained three-month media spike, forcing competitors like Burger King and Wendy’s to introduce rival promotions.

- Seasonal Fluctuations: Holiday campaigns momentarily pushed deal messaging aside in late 2023, while seasonal events (e.g., Lent specials) caused a brief dip in March 2024.

With each major promotion, competitive ripple effects extend media coverage beyond the initial campaign, proving that in today’s QSR landscape, value is a conversation that brands must continually engage in.

Why Value-Driven QSR Messaging is Non-Negotiable

Beyond media hype, economic pressures are making affordability a top priority for both consumers and brands:

- Inflation & Price Sensitivity: Fast food prices have surged 60% since 2014, far outpacing general inflation. Customers are more price-conscious than ever.

- Margin Squeeze: Labor costs have risen 22% since 2019, making cost-effective promotions essential to maintaining profitability.

- The Grocery Threat: Supermarkets now hold a 310-basis-point price advantage over QSRs, meaning fast food must prove its value beyond just price points.

In this environment, QSR messaging that reinforces value-driven storytelling is essential—not just for sales, but for sustaining brand relevance.

What This Means for Communications Leaders

For PR and communications teams, value messaging is a strategic necessity. Here’s what QSR communicators need to keep in mind:

- Short-Term Wins vs. Long-Term Strategy: Promotions create temporary media spikes, but brands must balance them with broader positioning that reinforces long-term brand equity.

- Echo Effects Drive Media Longevity: Competitive responses extend deal-driven media cycles. Smart brands capitalize on this momentum by keeping value narratives fresh.

- Digital Loyalty Is the New Value Play: App-exclusive deals are becoming a critical tool for reinforcing value perception while strengthening customer retention.

The Future of QSR Messaging

Expect value-driven narratives to peak in summer months and taper off during holiday seasons as brands shift focus to festive campaigns. Ensure value messaging remains compelling and sustainable beyond short-term promotions. For communicators, this is a test of agility. How will brands balance short-term promotional buzz with a long-term value platform that keeps customers engaged?

Connect with us to learn how PublicRelay can help your brand adapt to this value-first landscape.

Related Resources

Held July 25-26 and hosted by PRSA Orlando in partnership with PRSA Sunshine District, SunCon 2024 brought together some of the brightest minds in communications and PR to discuss the importance of strategic storytelling in developing and implementing effective public relations campaigns and beyond.

Here are the key takeaways from this year’s event:

1. The Line Between Internal and External Communications is Closing

What is Sent Internally Now Shows Up on External Platforms

The boundary between internal and external communications is increasingly blurred. Information shared within a company often finds its way onto public platforms, making transparency and consistency essential.

Employees are Advocates for Your Brand

Employees are not just staff; they are ambassadors for your brand. Their voices and actions can significantly influence public perception. Encouraging and equipping employees to positively represent the company is more crucial than ever.

Companies Need a Modern-Day Employee Communications Plan

To keep pace with the changing dynamics, companies must develop robust internal communications strategies that align seamlessly with their external communications. This includes leveraging modern tools and platforms to engage employees effectively and ensure they are well-informed and motivated advocates.

2. Print and Broadcast are Still Leading Pillars of the Comms & PR Industry

Broadcast and Print Used to Be the Only Key Players

Historically, print and broadcast media dominated the communications landscape. These traditional mediums were the primary channels for reaching large audiences and shaping public opinion.

Digital and Social Have Cemented Their Place at the Table

The rise of digital and social media has transformed the industry, providing new avenues for engagement and content dissemination. These platforms offer immediacy and interactivity, enabling brands to connect with audiences in real-time.

Big Print and Broadcast Still Set the Pace

Despite the growth of digital and social media, traditional print and broadcast outlets often set the agenda. Stories that gain traction in these mediums frequently become viral topics on social platforms, underscoring their enduring influence.

3. Data Drives Everything

Businesses Need to be Numbers-Driven to Succeed

In the modern business environment, data is king. Companies that harness data to inform their strategies and decisions are better positioned to succeed.

Quality Data is Required for Quality Insights

Accurate and comprehensive data is the foundation for meaningful insights. Investing in high-quality data collection and analysis is essential for making informed decisions and identifying opportunities.

Look at Trends and Microtrends to Identify Opportunities and Risks

Staying ahead requires monitoring both macro trends and microtrends. Understanding the nuances of these trends can help businesses anticipate shifts in the market and respond proactively.

Example: Stanley Drinking Cups

Stanley, traditionally a blue-collar brand, experienced a dramatic shift when their drinking cups became a viral sensation on TikTok. This led to a surge in sales from 75,000 to 750,000 units annually. By analyzing big data, Stanley was able to quickly forecast and plan for this drastic increase in demand, showcasing the power of data-driven decision-making.

4. Embracing Change is Critical to Your Career

Change is Happening at a Quicker Pace

The communications and PR industry is evolving rapidly. From the advent of social media to the rise of analytics and now AI, change is constant and accelerating.

Have a 3-Year Plan and Upskill Yourself

To thrive in this dynamic environment, professionals need to be proactive. Developing a three-year plan and continuously upskilling is essential. Staying ahead of the curve requires adaptability and a commitment to lifelong learning.

Related Resources

Once the public relations landscape is understood and your communications objectives are specified, the strategy development process begins. Of fundamental importance, stakeholder segmentation and media prioritization set the stage for strategy development (for both internal and external audiences). Once one understands the audience and the media to which they read, watch, and listen, the next step is to determine the messages to deliver.

Message engineering research helps pinpoint which messages perform best in terms of being compelling to the audience and credible coming from your organization. The result is stakeholder-centric communication that lays the groundwork for purposeful strategy and the tactics that bring the strategy to life. Unlike tactics, strategies remain in place over time and must support a variety of tactical bursts of activity to drive results. As such, research helps to inform the messaging and targeting approaches that are most likely to survive short-term market shifts to deliver positive and sustainable results.

Prioritizing Stakeholders and Targeting Media

Assumptions, intuition, and experience are not enough to make strategic decisions. Research, analysis, and evaluation must be conducted about stakeholders, including the media, to truly understand who they are and what messages will resonate.

It is vital to place significant focus on foundational research to discover which media perform best in terms of target stakeholder reach and penetration. To clarify, “reach” equals “circulation and audience.” “Penetration” means the “percentage of target stakeholders reached through an individual media outlet.” The media targeting process should involve some form of foundational research, which may include the following:

- Demographic/firmographic data available directly through attribution technology or indirectly through third-party data providers of media demographics.

- A survey to uncover the stakeholder’s awareness, attitudes, and behavior toward an individual medium as well as their media consumption preferences. These stakeholder attributes are further validated through a content analysis of news and social media.

- Social media analysis to profile stakeholders by their comments, how they self-identify, and the content they hyperlink through social sharing.

In addition to identifying the media with the highest potential, strategy research also reveals the relative authority and receptivity of journalists and influencers whose content appears in the media (traditional and social).

Using Media Analysis to Inform Your Communications Strategy

Professional communicators must find a balance among the media to identify just those which are:

- Important and engaging to the target stakeholder

- Most likely to cover news about your organization

- Least likely to cover competitors’ news

While an analysis of demographics and firmographics will tell which sources deliver the highest penetration among actual and potential customers, it will not indicate which media are more likely or less likely to cover a particular theme. However, a media analysis will tell which media are more receptive to the themes that matter most to you and your stakeholders. With this, content analysts can quantify the presence of intended and unintended messages, capture any reporting tendencies, and reveal a roadmap toward better results. This combination (the demographic audit and the media analysis) will reveal which media are considered the most credible, which match the often-subtle interests of the stakeholder, and which compel the highest levels of engagement among the targeted stakeholders. Combining media demographics and surveys with media analysis creates a basis for action and a foundation for success.

Message Engineering

Positioning or messaging is not a purely creative endeavor; research-based “message engineering” is an example of how science and creativity come together to result in more effective public relations. The science behind public relations enhances the creative process and helps illuminate the most compelling and credible messages. Message engineering is a data-informed stakeholder-driven process of developing a brand, an issue, or corporate positioning. When developing an optimal messaging strategy, research helps the communicator to:

- Understand what motivates the target to act

- Determine the degree to which the proposition can be made credibly by the organization and match the target stakeholder’s priorities and reality

- Evaluate how the competition or opposition performs against the same criteria

- Consider aspects of the messaging that hold the potential to be misinterpreted, hijacked, or somehow otherwise detrimental from certain perspectives

When one combines message engineering with media optimization, one reaches the intended audience in the best possible way.

Why Develop a Data-Driven Communications Strategy?

There are six reasons for establishing data-driven strategies:

- The data-based strategy development process enables more efficient tactical planning and execution.

- By putting stakeholders first, the strategy focuses resources on the objective rather than conventional wisdom, pure creativity, or vanity.

- It mitigates risk by pre-testing strategy before execution.

- It allows for a sustainable strategy.

- It provides a common language to gain alignment in advance among executives who sponsor or evaluate corporate communications performance.

- It creates alignment with peers across the enterprise and within the function, enabling the communications department to prosper.

Communications Strategy Development Methods

Methods of developing data-driven communications strategies include:

- Quantitative research (surveys) and qualitative research (focus groups) to uncover insights about the media consumption preferences of stakeholders and the messages most likely to resonate.

- Analysis of news outlets’ published articles and social media channels to determine what topics they cover and how they cover them.

- Media demographic audit to determine which media deliver the highest penetration among actual and potential customers, employees, and other targets.

- Social listening – in the form of a digital focus group or media analysis — to uncover insight into stakeholder interests, preferences, and behavior.

- Analysis of journalists and influencers to identify target intermediaries to deliver key messages to key audiences.

- Competitor analysis to gauge which strategies appear to be most effective among shared stakeholders.

- PR attribution analysis to identify which digital media and messages are most likely to drive click-through to the website and to track how people engage with the site (e.g., the pages they visit and the information they download).

Example: How a Data-Driven Communications Strategy Leads to the Right Messaging

A company is set to launch a new product to drive revenue for the company’s second-half financials. Thanks to the communications team’s social listening tools and traditional media analysis, the team can see security concerns are being raised around topics related to their new product. These insights are considered and alter how the product is communicated before launch, and a security focus is dialed up as part of the product benefits. Ahead-of-launch messaging is updated, and product benefits are re-ranked to highlight security. The communications team can report its role as part of the business outcome through predictive listening.

# # #

Mark Weiner is the Chief Insights Officer for PublicRelay and the author of “PR Technology, Data and Insights: Igniting a Positive Return on Your Communications Investment.”

Excerpt from “The Communicator’s Guide to Research, Analysis, and Evaluation,” originally published by the Institute for Public Relations in March 2021.

Editor’s Note: Interested in learning how you can demonstrate the value of your work? Read our guide to PR attribution!

Related Resources

In every business case, there is an objective: it might include generating a profit, attracting and retaining top talent, or giving back to a community. In every case, the goal is to build and reinforce relationships, reputation, and organizational performance. To advance an organization, professional communicators must clearly understand its aims to help the organization achieve its business objectives. While each component of the research-based public relations continuum is integral to achieving positive results, the initial stage of objectives-setting research is the most important. Yet, it is also the most frequently overlooked. Setting objectives is the foundation for the entire public relations program on which strategy, execution, and evaluation are formed. Setting and then exceeding objectives that are meaningful, reasonable, and measurable support the communicator’s ability to demonstrate the value of public relations and provide forward-looking insights.

Writing Meaningful, Reasonable, and Measurable Objectives

The difference between a goal and an objective is that goals are relatively vague but represent an overall outcome the public relations professional wants to achieve. They should align with the business goals and reflect the broad aspirations of the organization and often appear in the form of “vision statements” and “statements of purpose.” On the other hand, objectives are measurable and focused, serving as a guide and allowing professionals and others to see how and when they have been met or exceeded. To elevate public relations, one must generate and demonstrate a positive return. While demonstrating the value of public relations is among the profession’s most vexing challenges, the best path is also the most direct: work with executives who control the budget and evaluate performance to set objectives that are meaningful, reasonable, and measurable.

Therefore:

- Meaningful objectives align with organizational goals and the priorities and preferences of executives in charge of evaluating and/or funding public relations.

- Reasonable objectives are openly negotiated with the executives who evaluate and fund public relations programs and confirm what the public relations function can realistically be expected to deliver.

- Measurable objectives ensure that communications performance can be easily quantified regardless of whether the person evaluating performance understands public relations or not. Measurable objectives specify:

- What should be achieved (e.g., “to increase awareness of our socially responsible investment funds”)

- The target stakeholder (e.g., “female millennials”)

- The time frame (e.g., “from June to August”)

- The desired measurable change (e.g., “raise awareness by 7%”)

Objectives should follow the SMART (specific, measurable, attainable, relevant, and time-bound) format, which allows for the creation of strategies and tactics that clearly align with each objective and the ability to later demonstrate a return on expectations.

Unlike indeterminate objectives like “generate buzz,” “break through the media clutter,” and so on, the objective is specific and clear, such as: “to increase awareness of our socially responsible investment funds by 7% among female millennials from June to August.”

Why Set Objectives?

Research takes the emotion out of objective setting. There are six reasons for setting clear, concise, and pre-negotiated public relations objectives:

- Create a structure for prioritizing action among members of the communications team.

- Allow the team to stay focused and circle back to the objectives to ensure the strategies and tactics support achieving (and hopefully exceeding) the objective.

- Reduce the potential for disputes before, during, and after the program.

- Increase efficiency by concentrating resources where they will make a difference, thereby reducing waste.

- Help to form successful programs by focusing attention and action on those criteria by which the program will later be evaluated.

- Set the stage for evaluation by enabling public relations investment decision-makers to determine if the public relations program delivered on its promise.

Objective-Setting Research Methodologies

Research methods to inform objectives may include:

- Data or information gathered from conducting a public relations landscape analysis (i.e., market research, traditional media analysis, social media analysis, web analytics, and digital media attribution) to inform objective setting.

- Primary research (research conducted by the organization, such as surveys or focus groups with internal or external stakeholders) or secondary research (research that has already been conducted by the organization or another entity) that validates the problem or opportunity the objective seeks to address.

- Internal research to ensure that PR objectives align with overall organizational goals as determined through a review of the enterprise’s mission statement and publicly stated priorities.

- Leveraging prior company data as a baseline that objectives will be measured against.

Defining Metrics and Key Performance Indicators

When setting objectives, it is important to define metrics and indicators that communicate success.

For instance, the example objective above seeks to “raise awareness of our socially responsible investment funds.” To one person, raising awareness might mean securing media placements about the investment funds. To another, it might mean surveying the intended target stakeholder (female millennials) to gauge if they are aware of the investment funds. Having a clear definition of the desired key performance indicators and how they will be measured helps to determine later the success of your efforts to meet or beat the objectives. Regardless, the metrics should be valid, meaning that they must actually measure what they are supposed to measure. For example, some may use impressions to measure awareness, which is not a valid metric for measuring awareness.

Differentiating Between Outputs, Outtakes, and Outcomes

When writing measurable objectives, it is important to recognize the difference between measuring outputs, outtakes, and outcomes. Ultimately, all are reflected in your objectives since they are interrelated.

Outputs

The number of communications deliverables the organization produces by using and resulting from a communications process; the number distributed and/or the number reaching a targeted stakeholder.

Example of an Output

How many internal messages did the organization send on a particular issue?

Outputs are a measure of production and distribution. They are focused more on what the organization does rather than how the program affects the attitude or behavior of the intended audience. Other important metrics include outtakes and outcomes, especially behavioral measures as communicators ultimately seek to ignite behavioral change.

Example Metrics Used to Measure Outputs

- Number of tactics, events, and materials produced, sent, or distributed (i.e., newsletters, brochures)

- Traditional and social media coverage, Share of voice Circulation/audience/reach

- Mentions

- Tone of coverage, intended and unintended message pull-through

Outtakes

Measurement and analysis of how stakeholders respond to programs, initiatives, campaigns, and content are foundational for optimizing and highlighting the value of public relations investments. Although many communications KPIs are more perceptual in nature (e.g., brand, reputation), outtakes are a key underpinning as they are clear and tangible (e.g., view, open, read, share, download, etc.). In this way, “outtakes” may be considered “short-term outcomes.” What did they take away from the communications program?

Example of an Outtake

The degree to which a stakeholder “received the message” is measured in terms of awareness, recall, understanding, and retention.

Example Metrics Used to Measure Outtakes

- Followers/subscribers

- Click-throughs

- Likes and retweets

- Engagement (i.e., comments, shares)

- Recall, awareness, understanding, and retention

- Web analytics (i.e., unique visitors, bounce rate, downloads, click-throughs)

- Open rate ratings/testimonials

- Viewership/readership

Outcomes

This is the ultimate goal and related KPIs to which leading senior communicators aspire. Outcomes are more macro and often more perceptual in nature. These often include a quantifiable change in awareness, knowledge, attitude, opinion, brand/reputation equity, and/or behavior levels that occur as a result of public relations programs, initiatives, or campaigns. Outcomes result in an effect, consequence, or impact of a set or program of communications activities or products and may be either short-term – even immediate – or long-term.

Example of an Outcome

Outcomes represent what’s on the minds of stakeholders, including awareness, preference, and purchase intention, for example.

Organizations should also think about the impact of a program on business outcomes, such as: How did the PR program affect people’s attitudes toward the company or its product because of public relations actions taken or tactics deployed? To what degree did PR contribute to attracting and retaining talent? How did PR improve the organization’s ESG investment rating?

Example Metrics Used to Measure Outcomes

- Awareness

- Knowledge/understanding

- Attitudes/opinions

- Reputation

- Trust

- Transparency

- Attendance/product/service

- Consideration

- Products/service preference

- Customer purchase/acquisition and retention

- Employee acquisition and retention

- Satisfaction

- Loyalty

- Advocacy (e.g., Net Promoter Score (NPS))

- Brand equity

- Brand valuation

- Behavior/sales

- Other behavioral changes (e.g., donate, vote, partner, policy change)

# # #

Mark Weiner is the Chief Insights Officer for PublicRelay and the author of “PR Technology, Data and Insights: Igniting a Positive Return on Your Communications Investment.”

Excerpt from “The Communicator’s Guide to Research, Analysis, and Evaluation,” originally published by the IPR in March 2021.

Editor’s Note: Interested in learning how you can demonstrate the value of your work? Read our guide to PR attribution!

Related Resources

To succeed in Public Relations, you must apply what you learned in the previous year to improve your odds in the New Year. We recommend a PR Landscape Analysis as the best way to catalog, evaluate, and improve upon your situation. The analysis answers such questions as: What is the current environment? What place do we hold within this environment? Why is this so? Is it likely to continue? What do we need to know now to improve our position? Even if you think you know the answers, the current atmosphere indicates a need for each of us to consider such an analysis to reassess our current communications environment.

What is a PR Landscape Analysis?

The PR “landscape” of which we speak reflects your business landscape. It is comprised of external actors, like your customers, competitors, shareholders, regulators, journalists, social media influencers, and politicians, as well as local community groups in cities where you conduct business. It also incorporates the changing business, cultural, and societal norms that dictate what it takes to be an admired organization and preferred brand now. The “landscape” also includes internal stakeholders such as the senior executives who allocate funding for PR and evaluate PR programs, as well as employees and peers to address in-house factors such as new developments and other marketing communications initiatives within your organization.

A PR landscape analysis enables the communicator to:

- Assess strengths and weaknesses versus existing objectives, competitors, and past performance

- Detect and evaluate the viability of new PR opportunities

- Accurately forecast potential risks and opportunities

- Set objectives that are meaningful, reasonable, and measurable

- Adapt strategies and tactics to markets, trends, and stakeholder priorities

- Identify ways to differentiate your value proposition

- Reaffirm understanding and gain direction among internal stakeholders

- Evaluate competitors, opposition, and aspirational peers

Planning Your PR Landscape Analysis

To begin, you must fully understand your senior executives’ expectations, preferences, and values as they relate to public relations: what do they value most and least? And how do you perform against these priorities? To succeed, you must also uncover the specific metrics by which they choose to measure PR success (and yours). You must also reaffirm the professional attributes they consider most and least important, as well as how well you perform against those preferences. In a way, this may amount to initiating your annual performance evaluation early but, once you uncover their attitudes and preferences towards PR and your ability to deliver on their priorities, your path becomes very clear.

Five Steps for A Successful PR Landscape Analysis

The PR Landscape Analysis involves research and analysis to set the stage for what comes next: objectives setting, planning, activation, and evaluation. To accelerate your PR Landscape Analysis in pursuit of a fresh start, here are five basic steps to achieve your goal:

Set Your Objectives

The first step in the PR Landscape Analysis requires you to clarify your objectives for doing it in the first place. The most essential step in any discovery process is to know the purpose of the endeavor. What do you hope to learn? What questions must you ask and among which stakeholders to achieve your goal?

Define the Scope

The second step reflects your need to specify the scope of your analysis. Once you set your objectives for this endeavor, you must determine the breadth of your research. One meaningful factor to consider is the priorities of your organization. Does the organization aspire for some greater purpose beyond just “sales?” You must also factor in the priorities of your internal and external stakeholders. Internal stakeholders include executives with influence over PR funding and the evaluation of the PR function as well as employees and peers in adjacent departments.

The analysis should reveal the degree to which your messaging aligns with the objectives of your organization as well as the priorities of external stakeholders both domestically and internationally. What’s more, aim to gain new insights into your competitors’ activity and the extent to which they’ve succeeded or fallen short in reference to your objectives.

Understand Your Stakeholders

The third step in the process requires you to identify what you need to know about each stakeholder. For every group, you must seek to learn what’s important and how you’re performing on what’s important. For example, with media coverage and social media activity, assess message frequency, reach, tone, and the degree to which you delivered the intended message (as well as “unintended” and critical coverage). For customers, demographic and firmographic information helps to identify the media your stakeholders favor. Media analysis, social media listening, and surveys reveal the answers to these essential questions.

Start Your Research

Step four involves “digging deeper.” Once you understand the objectives, scope, and data intelligence you need, it’s time to conduct the research and probe the data with a variety of research tools and methods to gather insights and produce the analysis. You must also answer the essential quality-related question of “what’s good enough?” The research methods you employ can vary from free conference room brainstorms and Google searches to the use of secondary research, surveys, and media analysis. With the benefit of tools and research experience, you may conduct the research yourself or, if you have the resources and expect big changes in the upcoming year, you may hire an independent communications research provider who may be more objective and experienced in the process.

Analyze Your Data

Step five involves synthesizing and analyzing the data to uncover insights and explore implications. To generate additional insights, consider engaging colleagues from marketing and human resources before finalizing since they target similar audiences and may be working toward the same business outcomes as you. Only after thoughtful vetting, you should present to senior leadership to discuss findings and recommendations along with implications. Your leadership’s buy-in enables you and your communications team to proceed with minimal risk. Catalog any conclusions drawn from the PR Landscape Analysis meetings with top executives and get final authorization before executing the recommended steps.

PR Landscape Analysis for Better Communications

We operate in challenging times, but research and evaluation equip us to make better decisions under difficult circumstances.

# # #

Mark Weiner is Chief Insights Officer for PublicRelay and the author of “PR Technology, Data and Insights: Igniting a Positive Return on Your Communications Investment.”

Originally published in PRNEWS January 2021 issue.

Editor’s Note: At PublicRelay, our quarterly Benchmark report conducts an in-depth analysis of the communications of some of the world’s leading brands. Check out our Communications in Context series for insights into the PR landscape and a sample of the key insights from our latest Benchmark report!

Related Resources

Editor’s Note: As our Chief Insights Officer, Mark Weiner, explains below, no PR measurement program is complete without benchmarking. But for truly relevant insights, you need a benchmark built around communicators. That’s why we launched the PublicRelay Benchmark so you can evaluate your PR performance against the world’s best communications. Preview a few of the media trends and insights from our Q1 Benchmark report now!

Media content analysis continues to be one of the most popular forms of PR research and evaluation. This approach involves the deconstruction of traditional and social media content to convert text, video, and audio content into actionable data representing individual messages as well as the names of spokespeople, opinion leaders, and influencers. Once converted to data, the researcher seeks to detect trends, uncover insights, and propose future action.

Thorough media analysis includes each of the following: quantitative analysis (frequency and reach); qualitative analysis (tone/sentiment and message delivery); comparative analysis (your performance versus other measures); and business impact (PR’s effect on revenue generation, efficiency, and cost avoidance). In this column, we focus on comparative analysis, commonly known as “benchmarking.”

Why Benchmarking Matters

Smart communicators use benchmarking to assess their environment, gain perspective, and refine for better results. Without the context of comparative analysis, one can pursue what seems like a proper PR plan by setting measurable objectives, developing data-informed strategy and tactics, and evaluating performance… and get everything absolutely wrong.

Imagine this scenario: a communicator sets an objective to improve by 20% over the previous period by generating 500 positive stories per month, 80% of which contain one or more key messages, and 20% of which appear in top-tier media. Sounds good. Even if they achieve all their objectives, they may hit their numbers and fail miserably. Why? Because their competitors aren’t idle: they may have generated 1000 positive stories per month, 90% of which contain three key messages and 40% of which appear in top-tier media. In the absence of competitive benchmarks, your program can only be partially informed and your advice to leadership will be inaccurate or irrelevant.

The Best Benchmarking Metrics

Benchmarking adds insights when done right. The best comparisons to include are:

- Performance versus objectives: Assuming you set measurable objectives at the start, good objectives answer “the what” (what are you measuring), “the when” (the period of activation), the “among whom” (the intended audience), and the “by how much” (the level of improvement). If among your objectives you see, “generate significant buzz,” “break through the media clutter,” or “raise media awareness,” you’re in trouble because they aren’t measurable.

- Performance versus competitors: One of the most compelling measures to management is whether (and the degree to which) you beat competitors. Even if you have many competitors, focus on those that matter most: the market-share leader, the most innovative, and the one that keeps the CEO up at night.

- Performance versus aspirational peers: There are times when your traditional competitive set may not provide the insights you need. Being the best performer among losers is no great distinction. In such cases, you may choose to add an “aspirational peer.” For example, nowadays almost every company competes for talent. Many companies compete for ESG investors regardless of sector. So even if you’re in financial services, you may want to benchmark against Salesforce; widely recognized as a top ESG company and innovator. Benchmarking against aspirational peers enables you to pursue “the best of the best.”

- Performance over time: If you set measurable objectives in the prior period, you can measure the degree to which you improved performance since then. Senior executives may not understand PR or the media, but they recognize continuous improvement. One wrinkle: the state of the media business portends great difficulty if you focus solely on quantitative measures: circulations are down and the emergence of “news deserts,” content sharing through common ownership, and bottom-line struggles for media around the world reveal fewer opportunities for media placements.

Even if your senior leadership knows little to nothing about public relations, all you may need to show is that you beat the competition, exceeded your objectives, and improved over last year to prove that you spent the organization’s PR investment wisely.

Improve Your Communications with Benchmarking

Benchmarking provides context and learning opportunities that enable you to be – or beat – the best. Like all communications research and evaluation, benchmarking takes place throughout the public relations cycle rather than at the end of a sequence. Benchmark early and often to guide your progress towards continuous improvement every step of the way.

# # #

Mark Weiner is Chief Insights Officer at PublicRelay. He is the author of “Public Relations Technology, Data and Insights” which is available for preorder now.

Originally published in PRNEWS March 2021 issue.

Related Resources

Editor’s Note: Chief Insights Officer Mark Weiner’s commitment to inspiring PR teams of every size to begin measuring their communications work led to his partnership with PublicRelay. Like Mark, we strive to support communications teams at every stage of PR Measurement – from simple, entry-level evaluation to more advanced PR attribution programs. And what better way than to join forces?

One of the biggest and most pervasive myths in public relations is that good measurement must be expensive and complicated. Years ago, speaking at a public relations conference, I shared stories from a variety of Fortune 500 clients. This seemed like the best way to make an impact on the importance of communications research, after all, if the biggest PR departments invested in research, everyone should. Then, a member of the audience commented, “I know what you’re saying is right, but I don’t have a Fortune 500 budget. So, rather than doing it wrong, I choose not to measure at all.” At that moment, I realized that in promoting my position, I perpetuated the myth I’m committed to dispelling.

In fact, research is more accessible now to more professional communicators than ever before. The Institute for Public Relations and AMEC offer all the guidance you’ll need including case studies, methodology, and instructional frameworks. What’s more, communications technology platforms are now ubiquitous and at many price points.

Start With Simple PR Measurement

Even if management isn’t demanding PR measurement, you should consider what can be done and the positive effects of simple measurement. As you’ll certainly see on the IPR and AMEC websites, the measurati speak of four types of measures:

- Inputs

- Outputs

- Outcomes

- Business Results

Inputs track your expenditure in terms of time and money. By monitoring the levels of your investment, you can show how wisely you spent your budget and the efficiency of your actions. When combined with output, outcome, and business measures, your efficiency equation will show your “Cost per ‘X’” where “X” may mean “cost-per-thousand circulation” or “cost-per-positive story” or “cost-per-percentage point of increased awareness.” It’s a good and easy way to begin.

Outputs measures what you put out, such as news coverage and social media activity. In addition to simple quantitative tabulations, you can look at qualitative measures like the tone of coverage and the presence of key messages. Keep in mind that technology alone has trouble accurately assessing quality, so be prepared to review the computer’s calculations. Finally, the technology enables competitive analysis to track share-of-voice as well as other comparative measures.

Outcomes measure the effects of your communications on the awareness, understanding, preferences, and attitudes of your target audience. These answers reside in people’s minds. There are two ways to measure inexpensively: survey technology and social media. Low-cost survey technology allows you to ask respondents the questions that reveal the extent to which – or even if – their positions changed because of your work. Social media enables you to gauge awareness, attitudes, and behavior as evident in posts where people share their opinions about and experiences with your product or service. Social media listening is like a giant unmoderated focus group, and you can learn a lot by simply listening.

The purpose of connecting public relations activity to business results is to demonstrate PR’s ability to affect sales, cost efficiency, and risk mitigation. While certain methods are complicated and expensive, making the “PR-to-sales connection” can happen during times when PR operates in isolation (so there’s no other way to explain the result). You can also study social media results to uncover references to purchase behavior (“I just bought the new improved detergent, and it really works!”). While linking PR with sales is sexy, the most accessible approach to PR’s effect on business outcomes is efficiency. This requires linking PR Inputs with Outcomes to show that you’re doing more with less and for less. By lowering the cost on each positive story (budget divided by positive stories), you’re improving the return of the organization’s investment in PR. Finally, avoiding catastrophic costs is a measure of your good counsel. Compare your crisis averted with a competitor’s crisis and see what it cost them by doing it wrong. Measure their stock performance, their market share, or other data, much of which is publicly available through trade associations and trade media.

Low-Cost Best Practice PR Measurement

One of the best examples of PR research I’ve seen was entered in the PRSA Silver Anvil Awards. A small town submitted an entry that quantified inputs, outputs, and behavioral results – and the campaign cost nothing! The town sought to reduce the number of stolen cars by reminding trusting citizens to remove their keys from the ignition while running routine errands. The program began by tabulating the number of car thefts in the town and comparing their town data with neighboring communities. Once the behavioral benchmark was sent, the town began a media campaign in the local newspaper. Within a few months, car thefts were eliminated.

Communicate Your PR Performance with Data

Over the past few years, I’ve adopted a new measurement motto: “Begin simply. Simply begin.” By committing fully to PR measurement, even in simple ways, you communicate PR performance in the language of the boardroom. Data transcends language barriers to demonstrate the effect of your good work. What’s more, fundamental measures create an appetite among senior executives for more PR programs, more good results, and more measurement. You, in turn, position yourself for more: bigger budgets, more resources, and greater acclaim.

Ready to show your impact? Download our PR attribution whitepaper to learn how you can connect your communications work to business results now!

# # #

Mark Weiner is Chief Insights Officer for PublicRelay and the author of “PR Technology, Data and Insights: Igniting a Positive Return on Your Communications Investment.”

Originally published in PRNEWS April 2021 issue.

Related Resources

Editor’s Note: Our Chief Insights Officer, Mark Weiner, wrote this column for PRNEWS November 2021 issue. The findings cited are based on PRNEWS’s survey of 150 communicators conducted in October 2021. Interestingly, his forecast for predictive analytics became a reality when PublicRelay launched its Predictive Suite in January 2022.

The results are in: The 2021 PR Measurement, Tech, and Talent Survey reveals where we are as a profession and where we’re headed, at least in terms of communications research and evaluation. In this column for Measurement Month, I’m focused on one question, specifically, “What’s the next big thing for communications research and evaluation?”

The Advantage of Predictive Analytics for PR

Everyone answered this question to share their predictions, but, in an ironic twist, only 12% consider predictive analytics as a “big thing.” How odd that everyone felt comfortable aligning on the future, but only 17-out-of-150 respondents believe that research-based predictive analytics will play an important role.

Perhaps that’s why few PR people work in meteorology.

Significant resources are being applied to predictive analytics by savvy research providers who recognize its power to reveal important aspects for planning and activation. Imagine predicting the virality of a news item or a post. How would you like to know where your competitors are headed so you can preempt their position or mitigate any advantage? Consider the advantage of knowing which stories will—and will not – gain traction. How many times have you had to calm a client or an executive over your tepid response to their desire for a vanity press release, or their response to a negative story or a competitor’s announcement?

Why PR Measurement Needs Both Technology and Talent

The pendulum of “what’s important now and in the future” continues to swing. Of course, “near term” and “long term” are important distinctions when contemplating the future, but let’s look at each response to this survey question.

For one, consider the gap between the 5.1% of respondents who believe that what’s most important is “An emphasis on automation, AI and DIY,” versus the 21.7% who chose “A balanced mix of technology and talent.” Could it be that everyone already owns a PR platform? And now that they own it, perhaps they realize that technology in isolation is not the answer (it never was, and it never will be). The question evolves from “which technology?” to “who manages the technology?” and “how do we think about the data?”

Surprise! Current technology is not a panacea: operators need training – the technology needs training, too. As someone who believes in our uniquely human contribution, I’m encouraged by this phenomenon, and you should be too: it underscores the paucity of talent in PR hiring situations – in the absence of viable candidates, talent trumps technology and you command greater remuneration.

I am encouraged by the lower scores attributed to “Automation, AI, and DIY.” While there’s much more that technology can do, we may have reached the stage where technology development for PR evolves towards iterative refinement. There aren’t many pure breakthroughs left to unleash upon the mass PR market beyond contact databases, media monitoring, and simple media analytics (although I believe that predictive holds great potential). When you consider how the activities most vulnerable to automation and AI are those which are rote and routine, we can see how PR is insulated. How many PR days are so mundane? Given our creative endeavors which require innovative thinking to address chaotic, unpredictable situations, you should have nothing to fear. And, based on the responses, you don’t.

That’s good news: we in public relations are safe from robot replacements and we may look forward to enhancements that make our work easier and faster so we can focus on what we’re singularly capable of achieving.

Communicators Still Want to Quantify PR’s Value

The least surprising responses are two sides of the same coin: “A fully integrated analysis across the marketing and communications mix” and “A solution for quantifying PR’s impact on business outcomes like sales and revenue generation.” A combined 46% of respondents envision this as PR’s next big thing. The two ideas are interrelated because to isolate PR’s impact on business outcomes, we also need to know our relative contribution across the marketing and communications mix. As such, the second is predicated on the first.

But it’s been PR’s next big thing for 30 years.

The difference is that marketing and communications analytics have evolved dramatically. And here’s where technology shows great potential to boost integrated marketing communications. With cascades of data, business in general and PR specifically can ascend beyond what anyone would have imagined in the past. And these technologies continue to evolve. Now, we have access to lower-cost multi-touch attribution and marketing mix modeling. Multi-touch attribution collects specific user-level data to quickly isolate specific events and assess their impact on conversion (“the customer journey”). Marketing Mix Modeling was first used in the late 1990s. Applying advanced regression analysis, these statistical models quantify the success of marketing and communications activities over time. Unlike attribution modeling, it is much slower, favoring annual or semi-annual analysis and heavily dependent on historical data but it reveals a much bigger picture.

Each in their own way contributes to understanding PR’s impact on business outcomes and explains the ways by which PR interrelates with other marketing agents. When combined, attribution and modeling create an even more formidable platform to accurately quantify PR’s contribution and to inform near and long-term planning and evaluation.

Why ESG is the Next Big Thing in PR

Now for my prediction: Often the contrarian, I believe that ESG will be the next big thing because it answers so much of what communicators envision for the future. Investment advisory services like Morningstar quantify ESG as a predicate for investment, and they estimate that one-third of all investors factor ESG into their buy and sell decisions. ESG is a function of two elements: a company’s behavior and the reputation it creates for doing good. To a high degree, PR owns reputation. Until now, investors considered reputation to be a “soft asset” that couldn’t be quantified. With the advent of ESG investing, that’s changed. What’s more, compared to attribution and marketing mix models which reveal PR’s ability to generate a few million dollars in revenue, reputation affects billions of dollars in market capitalization. ESG introduces PR to the big money.

PR’s Continuous Evolution

Only time will tell. As is so often true in the evolution of public relations, business, and humankind: the predicate isn’t so much about technology or methodology; it’s about people’s willingness to change. One thing about which we can be certain: our profession continues to evolve and elevate, and these changes will profoundly affect public relations as we know it.

# # #

Mark Weiner is a Trustee of the Institute for Public Relations and the author of “PR Technology, Data and Insights: Igniting a Positive Return on Your Communications Investment.”

Originally published in PRNEWS November 2021 issue.

Related Resources

Many communications and PR professionals take advantage of media monitoring and analysis to gain insight into their strategies and boost the effectiveness of PR campaigns. With all the data generated by media monitoring at your disposal, using data visualizations to illustrate insights can maximize the return on your efforts.

What is Data Visualization?

Data visualization is the communication of data and information using charts, graphs, diagrams, and other infographics. Visuals make data and text easier to digest by taking different learning styles and approaches into consideration and helping to convey content as efficiently and effectively as possible.

Exasol head of business intelligence Eva Murray shared her experience with how visuals have helped to avoid confusion on her team by quickly creating a shared understanding. Many times in her career, she’d found herself in a situation whereby her team talked around the same subject but failed to establish shared definitions, processes, and priorities. Murray said, “I learned early on that simply drawing a diagram on a whiteboard can prevent these long-lasting discussions and achieve a consensus quickly.”

By establishing a shared understanding, graphics allow everyone to participate in the discussion where misinterpretations of data have been known to derail key conversations about media strategy.

Why is Data Visualization Important?

Data visualization is important because it simplifies the task of communicating many small data points as well as large, abstract concepts.

The Harvard Business Review explains that the old mindset of data visualization, or ‘DataViz,’ as a “nice-to-have skill” is outdated. Now, “visual communication is a must-have skill for all managers, because more and more often, it’s the only way to make sense of the work they do.”

As public relations and communications become increasingly data-reliant fields, the importance of being able to visualize information is immense.

Data visualizations allow your team to look at a data set of thousands of media mentions and quickly identify trends, outliers, and patterns. According to Tableau, “data visualization tools and technologies are essential to analyze massive amounts of information and make data-driven decisions.”

Tableau further stresses the value of colorful, visually attractive graphics and their role in helping communicators to internalize data narratives: “If you’ve ever stared at a massive spreadsheet of data and couldn’t see a trend, you know how much more effective a visualization can be.”

When using visualizations, you can use the principles of design to convey information more clearly and effectively.

How Does Visualizing Data Improve Decision-Making?

Data visualization can improve decision-making by making sense of large data sets in a format that humans can better comprehend. The Harvard Business Review explains, “decision-making increasingly relies on data, which comes at us with such overwhelming velocity, and in such volume, that we can’t comprehend it without some layer of abstraction, such as a visual one.”

Turning large data sets into different forms of digestible material also helps to isolate and highlight important information for communicators. Graphics can make trends and outliers stand out, so it is easier to identify patterns, top influencers, champion outlets, key regions, etc. than if you were looking at a spreadsheet. This is the information that creates actionable insights and provides clear direction to your media strategy.

But the value does not end there.

Data Visualization and Reporting

Once you have identified valuable media opportunities, you can leverage graphics to present your work to company executives. When demonstrating the value of your team’s work (and justifying your department’s budget), conveying information clearly is essential.

Similar to how visuals can help you understand key data, they can also help you to explain the narrative. Forbes reminds us that a picture is worth a thousand words and data visualizations are no exception.

For example, check out this chart of news coverage by volume, sharing, and tone and imagine trying to succinctly explain this information to a room full of executives without the supporting visuals. Most communicators would find this task to be quite challenging.

Given the level of detail included, this chart is the best format for the job. It shows both the nitty-gritty details and the big picture, enabling viewers to draw the same conclusions and engage in further discussion about the data.

Forbes advises starting all discussions with shared understanding to remove barriers to participation. A data visualization that gets everybody onto the same page, “provides an opportunity to find agreement, discuss changes, and create solutions and improvements.” This offers a significant advantage when making decisions as a team or reporting to executives and demonstrating your value.

How to Use Data Visualization in Your Media Analytics Strategy

At PublicRelay, we utilize dozens of different visuals to convey media data effectively. Using Tableau, we create custom charts, maps, and graphs that highlight trends and outliers, making the information easier to consume.

Volume and Tone of Coverage

Coverage volume and tone form the backbone of any good media monitoring program. As a result, these metrics appear repeatedly in media analysis. Rather than opting for a basic bar graph to communicate this data, these metrics can be reimagined as the size and color of a bubble on a plot chart and can include additional information like sharing data. There are a multitude of engaging ways to manipulate and visualize volume and tone.

Outlet and Author Coverage

After volume and tone, outlet and author information can be some of the most helpful metrics for providing actionable insights. This data can help your team pivot your strategy to ensure that you’re pitching your key messages to the right people. In this instance, bar or line graphs can extend off the page or include dozens of overlapping trend lines that make it impossible to glean any insight from the data. To illustrate this information, we often create charts in which the outlet or author is a bubble or point on a scatter plot. Bubbles can also display more detailed information in the form of their color, size, gradient, and placement.

Social sharing

Social sharing can be demonstrated using bar charts, bubbles, lines – you name it! Often, we like to compare sharing data to article volume because this can tell you which topics generate natural interest among your target audience. It is also helpful to pair sharing data with outlet and author metrics, so you can identify the influencers that generate the most social engagement.

Geographic Coverage

Geographic data allows us to share information about where news coverage is coming from, typically based on the locations of the outlets that originally published each article. Using infographics, we can show an article’s origin by country, region, state, or city, both on accurate cartographical maps and other, more abstract representations like bubble maps.

Increase Comprehension of Your Media Coverage

Data visualization can help you to make the most of your media monitoring and analytics programs. The value it provides to communicators lies in the shared understanding of complex concepts it enables, and the increased ability to identify trends and meaning from your data.

To learn more about how we use data visualization to turn media monitoring into media intelligence, click here.